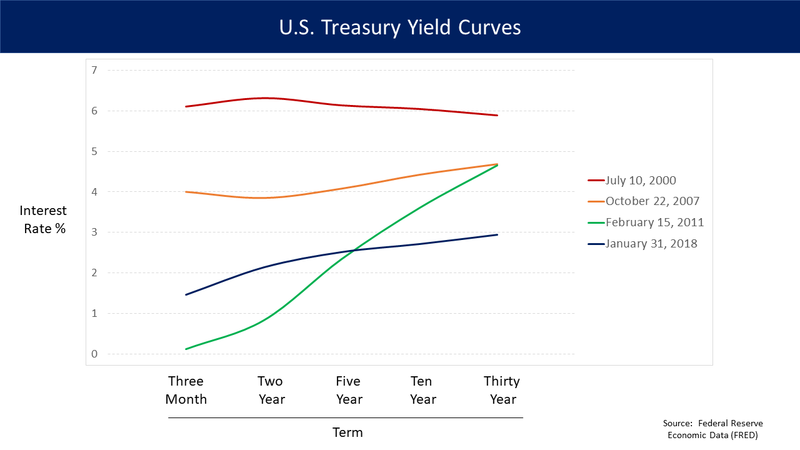

The yield on the benchmark 10-year Treasury note on Wednesday broke below that of the 2-year U.S. note as investors rushed toward safe-haven assets amid global growth concerns.

The traditionally watched 2-year and 10-year Treasury curve moved into inversion — with the 2-year yield topping the benchmark 10-year rate — a phenomenon heralded by many as a recession indicator. Investors are now demanding higher interest rates on short-term debt than they are longer term debt, a phenomena known as an “inverted yield curve...”

To read more visit CNBC.

Subscribe to our evening newsletter to stay informed during these challenging times!!