Please Follow us on Gab, Minds, Telegram, Rumble, Gab TV, GETTR

As an former bond trader, there is an old Wall Street saying, "Interest rates are low until they are not..."

Imagine you are a family making $100k a year, and your credit card debt level has passed your annual income. Then imagine you are borrowing up to 50% of your income every year just to pay the bills. And, also imagine the interest rates on your credit cards are at zero.

You would be considered a 'high risk' borrower at any bank.

Now imagine the bank gets new management, and decides to charge you an interest rate based on your actual risk, let's say 20%.

Now you have $20,000 a year of interest on top of your principle repayment.

How long before the bank would cut you off?

Immediately, you say?

Well, this is the situation America now finds herself in. Our GDP is our 'national income', somewhere between $20-30 trillion, depending on your metrics used.

Our national debt is now larger than our income, and we are borrowing a huge percentage of our income every year just to pay the bills.

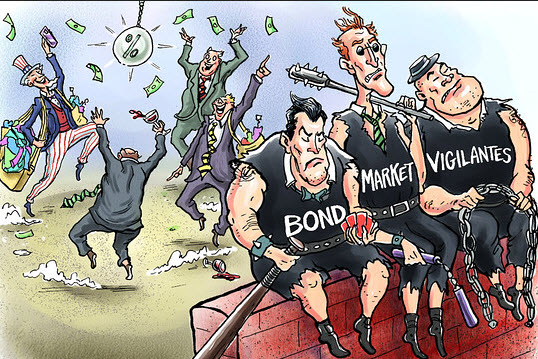

At some point, the bond market, who is our bank, will cut us off, or charge a 'market interest rate'.

The historical rate of the U.S. 10-year bond is 5% approximately. At the moment we are less than 2% on the 10-year. Just to get back to historically average interest rates would cost us hundreds of billions in debt service cost that we cannot afford.

Hyperinflation is the first warning sign of this scenario.

Our Federal Reserve has caused this problem by being an active buyer in the bond market, pushing down rates. This began under Obama and continued under Trump, and now President* Biden.

The Fed is also printing money like a bat out of coronavirus Hell.

In banana republics they call this printing money; here we call it 'quantitative easing'.

There is another old Wall Street saying - "reserve currency status doesn't last forever" either.

When we lose global demand for the dollar, we will have to raise interest rates more to attract capital at a market rate.

Watch interest rates, not just the horrific Biden inflation.

Today inflation hit a 40 year high.

Financial markets keep going higher and higher. This won't last.

Consumer Price Index (MoM) (Dec) printed at 0.5% vs 0.4% consensus estimate.

Consumer Price Index (YoY) (Dec) printed at the 7% estimate.

Consumer Price Index Core s.a. (Dec) printed at 284.76.

Consumer Price Index ex food & energy (MoM) (Dec) printed at 0.6% vs 0.5% estimate.

Consumer Price Index ex food & energy (YoY) (Dec) printed at 5.5% vs 5.4% estimate.

Consumer Price Index n.s.a. (MoM) (Dec) printed at 278.802 vs 278.738 consensus estimate.

EIA Consumer Stockpile Change (Jan 7) printed at -4.553M vs -1.904M estimate.

Subscribe to our evening newsletter to stay informed during these challenging times!!