Please Follow us on Gab, Minds, Telegram, Rumble, GETTR, Truth Social, Twitter

The Chinese property market is a house of cards, even worse than in the U.S. in 2008, as many assets are used as collateral in multiple real estate deals, adding mountains of counterparty risk to each transaction.

China's property market may end up mirroring US real estate in the summer 2008, when a downturn was underway but Wall Street didn't see a collapse.

"In this scenario, the next big step for China is a full-blown financial crisis," wrote Ruchir Sharma wrote in the Financial Times.

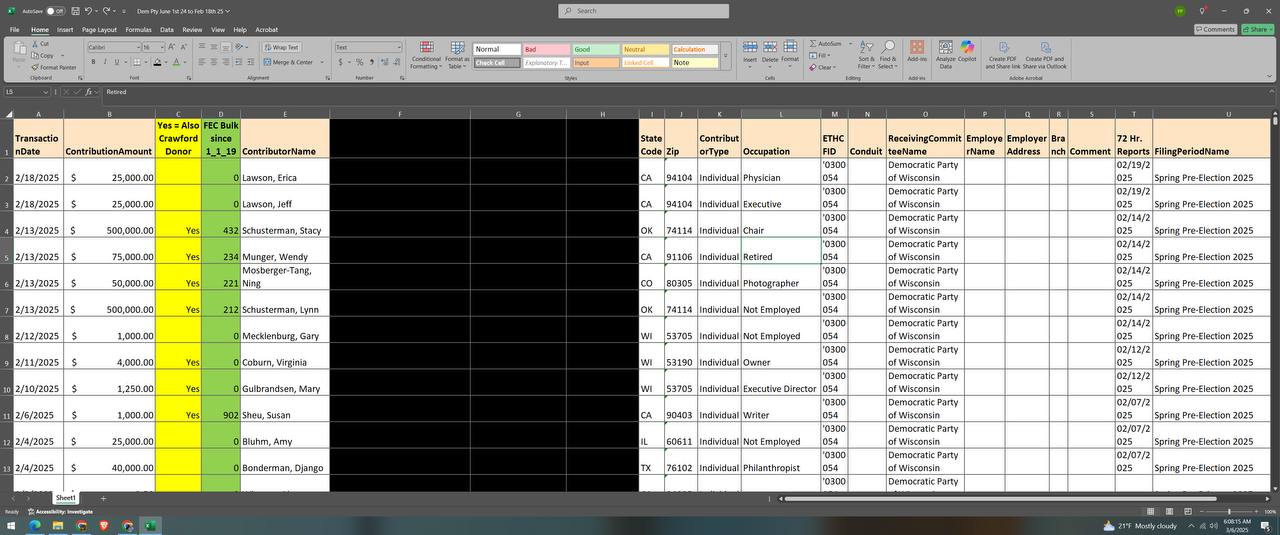

According to Sharma, land and home prices have annually fallen around 5%, while the funding vehicles used by local governments to purchase property now make up almost half of China's government debt. Defaults have been common in the sector, with even its most stable developers at risk, reports Insider.

As China, and its partners in BRICs, look to destroy the U.S. dollar as a reserve/trading currency, hesitancy about trusting the CCP with the global means of exchange may dampen any chance Beijing has to use a new gold-affiliated currency to dampen the coming crisis.

However, the Chinese Communist Party has long shown that profit, financial soundness, is not a priority. It is all about power.

The next two years will be interesting indeed.