The talking heads in anti-Trump business media were scratching their heads today as economic data was released for the month of April showing a massive, unexpected (really?) increase in new home sales. It seems when interest rates are at record lows, people buy new houses. Who would have thought?

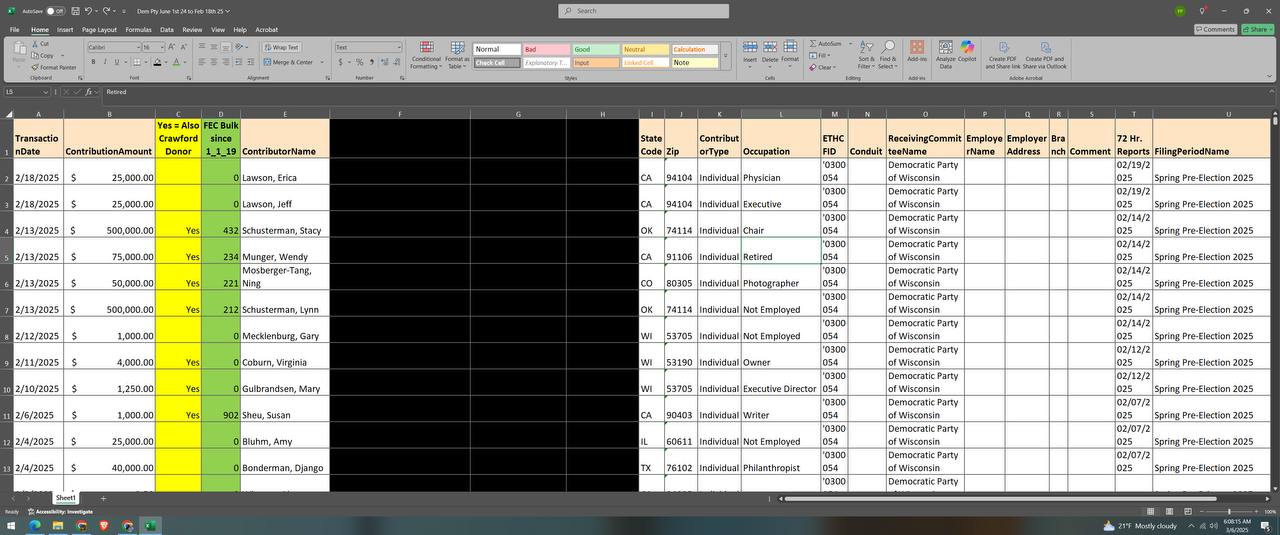

Following the collapse in existing home sales in April, new home sales were also expected to plummet 23.4% MoM but through the magic of seasonal adjustments, new home sales rose 0.6% MoM (following an upwardly revised 13.7% drop in March), wrote Zero Hedge.

In addition, consumer confidence ROSE higher than expected as the nationwide lockdown eased.

“Following two months of rapid decline, the free-fall in Confidence stopped in May,” said Lynn Franco, senior director of economic indicators at The Conference Board, in a statement. “Short-term expectations moderately increased as the gradual re-opening of the economy helped improve consumers’ spirits.”

New Home Sales (MoM) (Apr) printed at 0.623M vs .49M consensus estimate.

New Home Sales Change (MoM) (Apr) printed at 0.6% vs 21.9% estimate.

Dallas Fed Manufacturing Business Index (May) printed at -49.2.

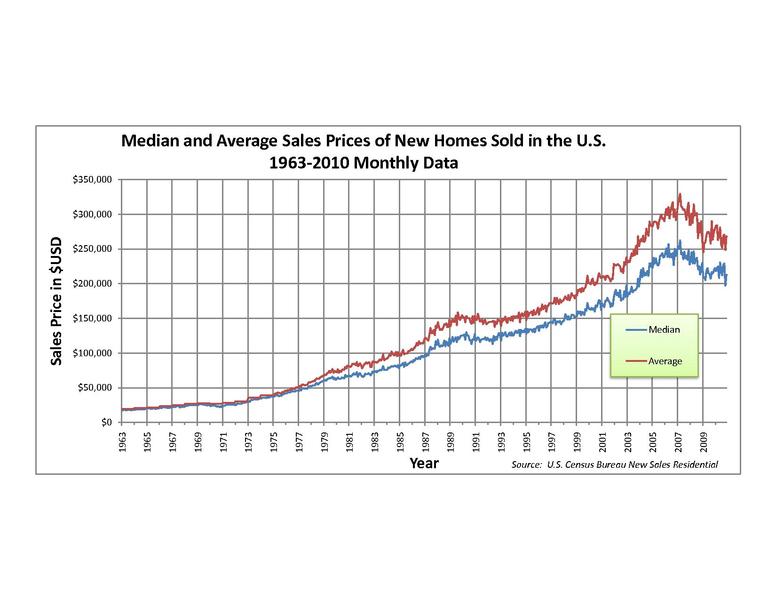

Housing Price Index (MoM) (Mar) printed at 0.1% vs 0.3% estimate.

S&P/Case-Shiller Home Price Indices (YoY) (Mar) printed at 3.9% vs 3.4% estimate.

Chicago Fed National Activity Index (Apr) printed at -16.74.

Consumer Confidence printed at 86.6 vs 82.3 estimate.

[…] post Guess What? Record Low Interest Rates = Americans Buying Homes appeared first on CD […]

[…] Guess What? Record Low Interest Rates = Americans Buying Homes […]

People, as a market, don't buy homes due to low interest rates. Sad to see another false news article on this subject. As one example, I participated in as a developer in the 1970's people buying homes like crazy even when rates hit 13%. It is the economic growth, the money they have, the future they expect, the monthly payment amount where most of it depends on the home price which spurs sales. Interest rates are on the list, but way down the list.