Please Follow us on Gab, Minds, Telegram, Rumble, Gab TV, GETTR, Truth Social

Tl;dr: The Fed hiked rates by a stunning (but expected) 75bps - the biggest hike since 1994. Esther George dissented (preferring 50bps). Fed expresses that is "strongly committed" to fighting inflation.

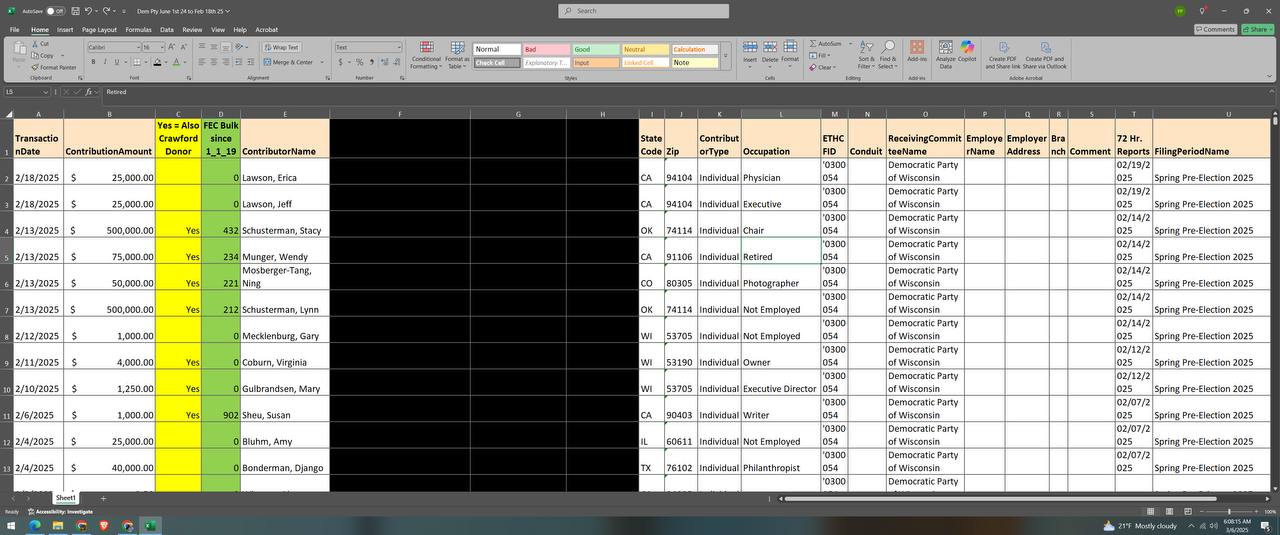

The Fed sharply raised its rates outlook (to meet market expectations) and sharply lowered its growth and employment outlooks.

The last time the Fed hiked 75bps, we got the 'Tequila Crisis' and The IMF had to bail out Mexico.

* * *

Since the last FOMC statement on May 4th, all hell has broken loose in global capital markets (and economies).

US equities have collapsed (Nasdaq -15%) and US Treasury yields have exploded higher. Gold is down around 3% since the last FOMC, mirroring the 3% or so gain the USDollar Index...(NOTE everything shifted after last Friday's CPI)...

To read more visit Zero Hedge.