A group of oil producing countries known as OPEC+ agreed to reduce production by 9.7 million barrels per day (bpd) for May-June. The + stands for Russia and Mexico who needed to be part of the overall agreement for it to have any stabilizing effect on the world energy market. After four days of marathon talks the combined OPEC+ and G-20 cuts should set in place a bottoming process for oil prices and stop the deflationary spiral that was threatening jobs, businesses and entire industries around the world.

Oil prices collapsed by more than 50% from their January highs as the Chinavirus pandemic shut down the global economy and suppressed fuel demand. The 10 million (bpd) reduction in output is roughly a 10% cut in production which will have significant impact on oil exporting nations who rely on oil revenue for a growing GDP. Mexican President Andrés Manuel López Obrador had balked at participating because the promise of increased oil revenue was a critical component of his election victory.

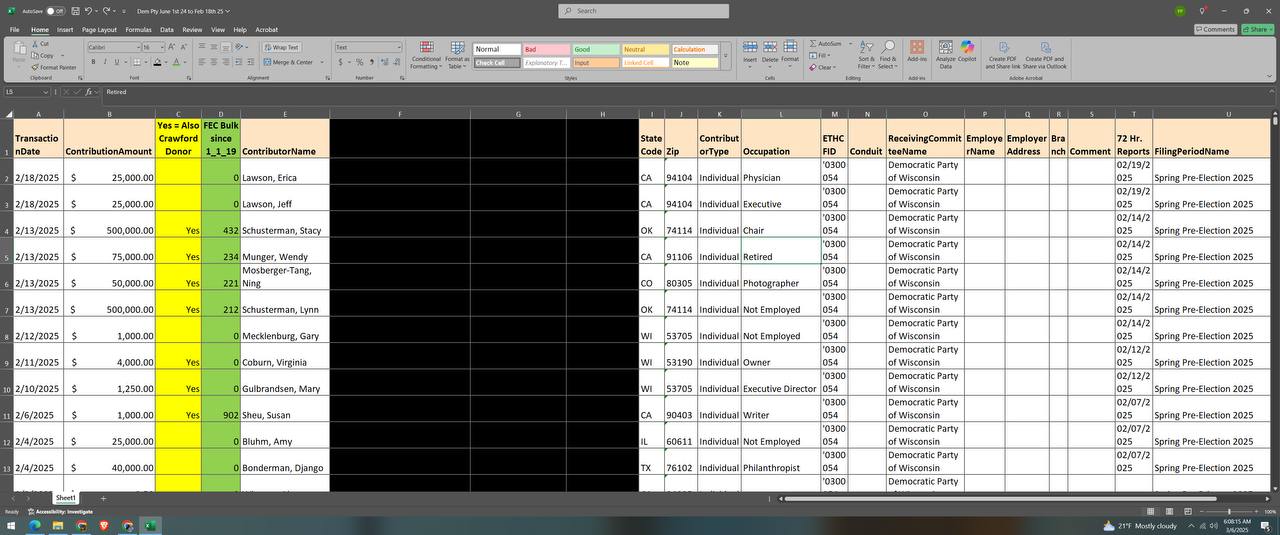

Enter Donald J Trump and the art of the deal. Trump said the U.S. would cut production levels by 250,000 to 300,000 in order to assist Mexico in meeting the parameters outlined by OPEC+, and this promise gave Obrador cover to agree to the deal . The President had long negotiations with leaders from Saudi Arabia and Russia who increasing production as the Chinavirus pushed demand for oil to drop by 30 percent.

The administration's plan to alleviate oil oversupply issues is built around an effort to fill the nation’s Strategic Petroleum Reserve with 77 million barrels of U.S. crude. The $3 billion in funding required to purchase the oil was not included in the CARES Act stimulus package approved by Congress. The President will probably find a way to get the $3B out of a $2.2T slush fund but it is amazing that the Representatives on Capitol Hill could not work that required money into the language of the Coronavirus Aid, Relief, and Economic Security Act.

Companies are just starting to adjust their behaviour to deal with the oncoming global recession. The International Monetary Fund (IMF) has projected a dismal growth forecast claiming the impact of the Chinavirus pandemic will be worse than the global financial crisis a decade ago. A first step to revoery is stabilizing the price of oil on the world market.

- Report: Saudi Arabia And Russia Have Reached Oil Production Cut Deal…Oil Moves Higher 7%

- Oil Is Near Record Lows And California Residents Still Paying Through The Nose For Gas

,