Please Follow us on Gab, Minds, Telegram, Rumble, GETTR, Truth Social, X

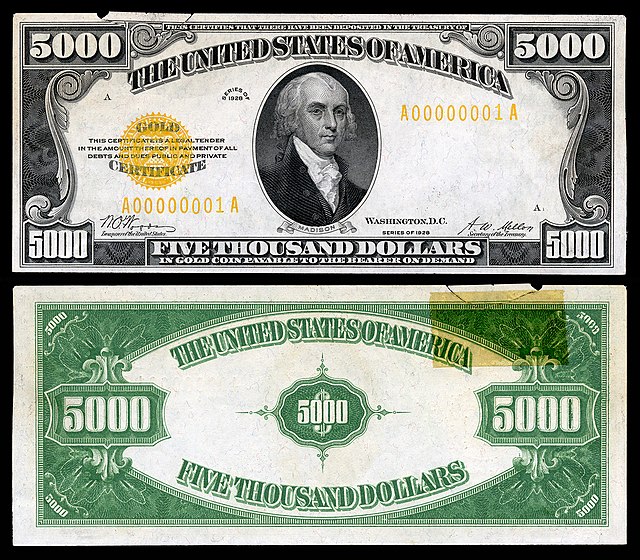

Coins

Bullion coins are minted by sovereign (government) mints and some include The United States Mint, the Royal Canadian Mint, The South African Mint, and The Royal Mint (United Kingdom).

Advantages

In times of great uncertainty, coins from sovereign mints may have a higher perceived value than a bar. They have a face value though the value of the metal is worth more than the face value.

Disadvantages

There is a higher premium to purchase sovereign minted coins due to the higher perceived value as mentioned above and the higher minting cost than a bar. If the coin is a proof (limited mintage) coin there will be a much higher premium afforded the coin. This premium will fluctuate based on supply and demand and adds another variable to the coin’s worth. Collectors usually purchase proof coins.

Bars

Bullion bars are minted by private mints.

Advantages

Bars are minted to the same quality standards as sovereign coins, have a lower minting cost, and have a lower premium than sovereign coins. They usually come with an assay card for authenticity and the mint and purity are on the bar itself and the bar can come with different designs.

Disadvantages

May not be as recognizable or as marketable as a sovereign coin though I do not believe this to be much of an issue.

Summary

Are coins or bars right for you? Or both? That depends on your goals and aspirations, cost effectiveness, and holding period to name a few.

Only purchase physical gold and silver from reputable dealers like us, Advisor Metals. Our Managing Member, Ira Bershatsky, is the only person in the retail physical precious metals industry who is Federally-registered with the Commodity Futures Trading Commission (CFTC) assuring that your purchase will be with integrity and transparency.