As the partners in the Blue Whale Project near a final investment decision (FID), reportedly to be reached next year, some are asking if Beijing will also pressure Hanoi to cancel the Exxon-Mobil led project. On the other hand, given that the Vietnamese consortium is in partnership with an American oil major, it seems plausible that Beijing would not interfere with the project since it could provoke backlash from Washington.

Carl Thayer, an emeritus professor at the University of New South Wales in Australia, and a Vietnam and South China Sea expert, sees the Repsol issue differently than that of the Blue Whale project.

“China claims that it reached agreement with Vietnam to maintain the status quo in the Vanguard Bank area. When Vietnam resumed oil exploration in this area last year China put enormous pressure on Vietnam reportedly even threating armed force. Vietnam backed down,” he told me.

“Exxon Mobil is operating in a block that comes close to but does not cross China’s ambiguous nine-dash line,” he added. “Vietnamese sources intimate that both sides have reached an informal understanding that they will not interfere in activities by the other party if it falls on their side of a hypothetical median line. Both sides are free to make public protest, but the understanding is that both sides will exercise restraint and not interfere. This understanding should reduce the risk to ExxonMobil in its present operations.”

Thayer added that it’s a relatively minor matter for China to put pressure on Repsol, a Spanish company, but it would be a major matter if China took action against a US owned company.

“China is more likely to press Hanoi to stop ExxonMobil’s Blue Whale project and thus drive a wedge between Hanoi and Washington,” he said. “Beijing will play the long game in the South China Sea while the US is focused on North Korea and its trade imbalance with China.”

However, two Vietnamese energy professionals I spoke to already believe that China is complicating the ExxonMobil-led project. They point to the recent postponement of the project’s FID until sometime next year. Others I talked to in the country were more reluctant to offer comment, but the general census in Vietnam is that Beijing could very well be preparing to challenge or at least apply pressure over the project.

The official line from ExxonMobil in January was that the FID will be based on a number of factors, including regulatory approvals, government guarantees, executed gas sales agreements and economic competitiveness.

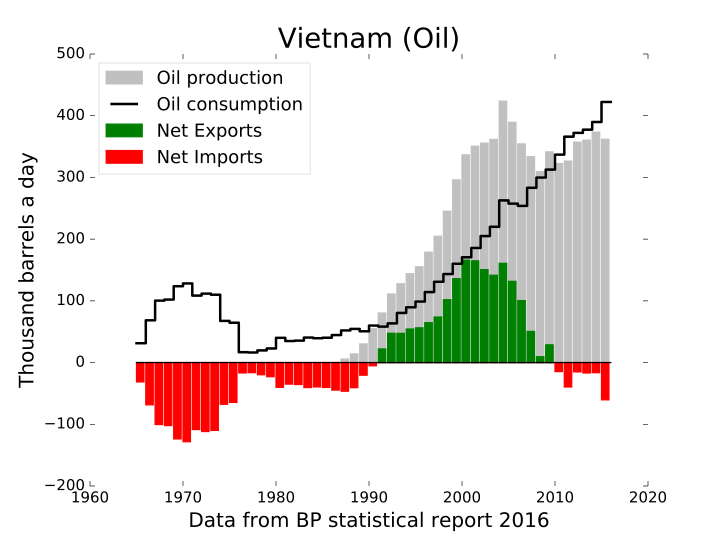

Looming Gas Shortages

Since Vietnam is being blocked in developing much of its offshore gas reserves, the country is facing projected natural gas shortages by at least the mid part of the next decade. Consequently, it will have to turn to costlier liquefied natural gas (LNG) imports, as well as renewables to make up the difference.

Some analysts have also indicated that Chinese ambitions against Vietnam in the South China Sea could have yet another motive. Blocking Vietnam's gas development in the South China Sea could be to cajole Vietnam into Chinese invested coal-powered power plants for which China would provide the coal, which obviously would make Hanoi more dependent and vulnerable to China for its energy security.

Subscribe to our evening newsletter to stay informed during these challenging times!!

[…] chuyên gia dầu khí Tim Daiss, Bắc Kinh muốn ép Hà Nội không được hợp tác với ExxonMobil tại dự án Cá Voi […]