Today's market action should be seen in the context of a massive geopolitical cage fight for share in the crude oil market globally.

Saudi Arabia is losing its long-held position as the oil market leader to the Untied States and Russia. MBS is not happy and somewhat petulantly decided to flood the market with oil.

Russia is not happy with America's rise to the number one producer of crude in the world. America has stopped the Nord Stream II pipeline, at least temporarily, that was intended to provide natural gas to Germany, which would make the NATO member even more dependent on the Kremlin for energy. Moscow is also unhappy with American pressure on its client state - Venezuela. In addition, the Trump administration's 'maximum pressure' campaign on another Russian ally - Iran - has also hurt the Kremlin's pocketbook and geopolitical influence.

For its part, the Trump administration has been pressuring Saudi and other producers to pump more to reduce the price of crude on international markets. It looks now like the old saying 'be careful what you wish for' is apropos.

An oil price below $40 per barrel is bankruptcy territory for many American shale producers.

This crisis was building even before the coronavirus outbreak happened (or was instigated); the epidemic simply hurried the process along.

These tectonic shifts in the geopolitical great game are what are driving today's market action -- because they create extreme uncertainty. Financial markets hate uncertainty.

It will be interesting to see the Trump administration's reaction to Russia and OPEC pumping more oil to hurt American shale producers. POTUS could very well announce some type of financial assistance for his pet project - making America energy independent. It is doubtful Trump will take this lying down.

If the world should have learned anything over the last few years, it is that Trump always thinks several steps ahead of the competition and should not be underestimated.

Although Russia has weaned itself off the USD-based global financial system in many ways, they still have large exposure financially, even though Moscow has been very prudent with its fiscal and monetary policy, having almost no debt and large 'rainy day' funds available for use. Former Russian Prime Minister Dmitry Medvedev famously declared, "American sanctions on the Russian banking system would be an act of economic war."

The 30,000 picture is that coronavirus will most likely fade into the summer. The Trump economy will continue to roar and America will continue to come back energy and manufacturing wise. This crisis will force us to become more resilient as far as supply chains and medical security is concerned.

That can only be a good thing for what doesn't kill you makes you stronger.

Subscribe to our evening newsletter to stay informed during these challenging times!!

Cheap oil will probably stimulate the economy even more and may cause supporters of the Green New Deal to become fanatical in their fury at rising oil use.

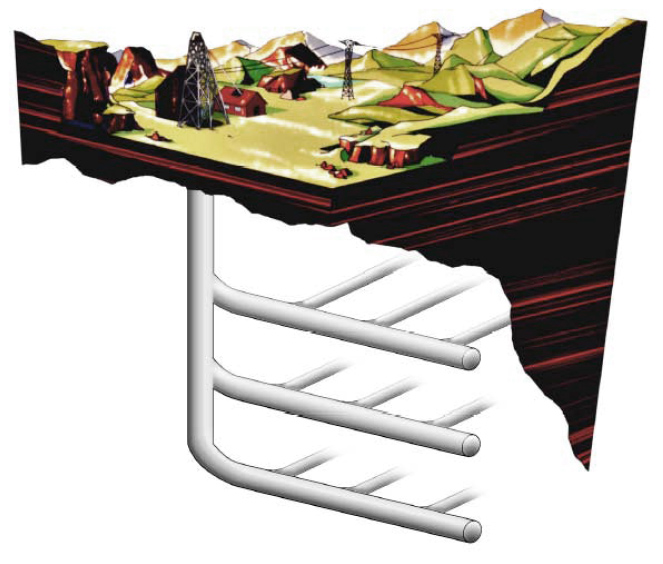

Much of shale fracking is for natural gas production, so that will probably remain steady will lower petroleum prices will likely, as in the past, stimulate production of larger vehicles, SUVs and pickups, which have transitioned into luxury and high performance off road vehicles costing way more than comparable luxury cars.

Trump will likely provide breathing room for oil producers much as he has for American farmers when China stopped buying their produce.

I’ve thought the only way to save the American dollar and the American economy is by the return of 25 cents per gallon gasoline. Probably considering inflation, it won’t happen, but cheap gasoline will stimulate spending on related items and free up money from the pocketbook for essentials that American families haven’t been able to afford, even things such as deciding they could start a family or similar related matters.

The price of Russian crude can’t go down much since the cost of operations in Siberia in super cold climate is expensive with specialized equipment and hardship for oil field workers. Saudi oil on the other hand is extremely cheap to produce, but the cost of security if not warfare with Iran and its proxies has to come out of the till.

Excellent analysis