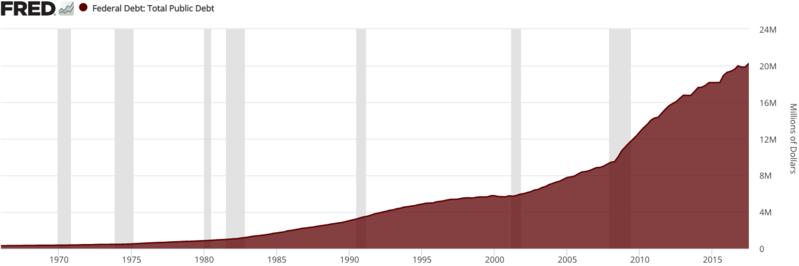

There is an old Wall Street proverb -- interest rates are low until they're not. With the sovereign debt level of the United States rising with no end in sight, America runs the risk of an interest rate shock which could be devastating to its economy. Think back to the 1970s when you had to pay 20% for a mortgage. Hopefully Donald Trump will deal with this issue in the second term.

You see the Federal Reserve Bank of the United States has been playing a game of bait and switch. During the Obama years, the Yellen Fed basically kept short term and long term rates at zero, allowing Hussein to run up more debt than all previous American presidents combined -- essentially give aways to the commie class that are Democrat voters. But it has not just been Obama that has run up the amount we owe to the world, globalist Republicans have done the same, just not to the extent of the debt carnage that Obama inflicted.

The Fed became a participant in the treasury market, buying its own debt, creating demand, to keep rates low. In banana republics they call this printing money; here we call it quantitative easing.

Now we have to pay the piper. Especially since we now have a responsible person in The White House who has ignited economic growth, with inflation soon to follow.

At some point, the bond market may take back control of the interest rate market and force Americans to pay more to finance their own debt. The average, historical rate for the U.S. ten year bond is around 5%. We are well below 3% as we write this article. Every 100 basis point rise in rates equals hundreds of billions in federal debt service costs. Just to get back to average rate levels we are talking a half trillion dollars a year. If interest rates spike to well above historical levels as investors see that America neither has the will nor the ability to service its debt, well then Katy bar the door.

The irresponsibility of both parties to saddle our grandchildren's grandchildren with this much debt is horrific.

I hope that President Trump deals with the debt issue in the second term after he has rebuilt the military and stimulated the economy to levels where we can generate enough economic activity, and therefore taxes, to bring the debt back down to manageable levels.

After all, in his own words, he is the King of Debt.

Subscribe to our evening newsletter to stay informed during these challenging times!!

The way to deal with debt is to grow faster than the debt grows. Trump is doing the right things to enhance growth (1) tax reform, (2) deregulation, (3) trade treaty reform to eliminate crushing imbalances in tariffs relative to our trade partners resulting from old policies intended to facilitate the post-war rebuilding and the incentivization of separation from Russia by China and India, (4) limitation of illegal immigration bringing in large quantities of welfare dependent low skill labor not needed in an economy where automation and AI is reducing the need for unskilled labor. All he has to do is continue these policies and economic growth, lower unemployment and demand for public services will continue. The next thing required is something he is already talking about - freezing the growth of the non-military federal budget. Simply freezing the budget combined with a one-time 5% reduction would eliminate the deficit within three to four years plus mean a smaller regulatory state to slow down growth.