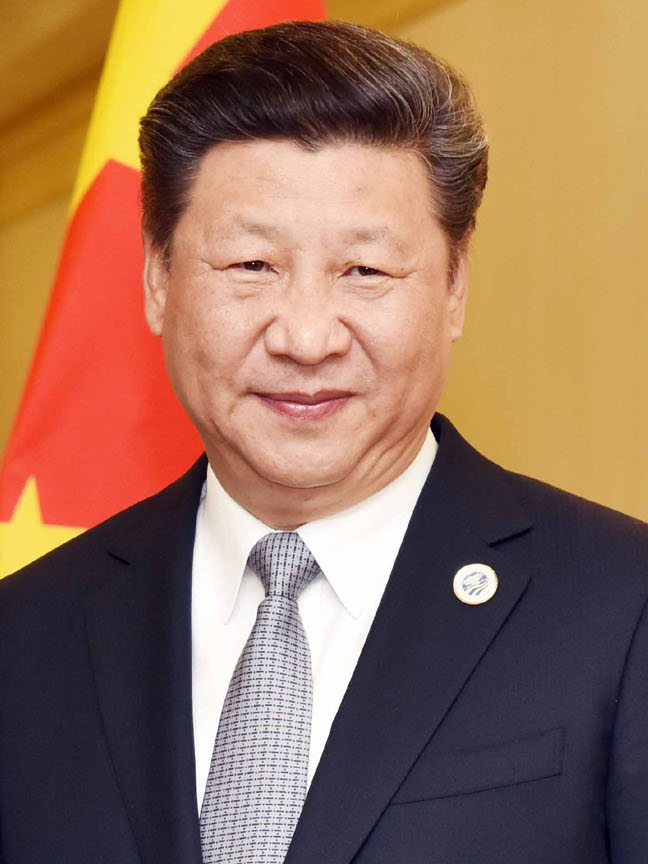

In the ongoing trade war, China has retaliated with $60bn in tariffs effective June 1st, which is close to when US tariffs would take effect on new Chinese goods (beginning three weeks after the US announcement). In effect, both sides have kicked the can down the road just far enough to allow for further negotiations. Still, there is no sign from Trump or Xi that a meeting is imminent. White House adviser Larry Kudlow said today that the two might meet in Japan later in June, but that would be weeks after mutual tariffs go into effect.

Tremors from the burgeoning trade war were felt in virtually all markets. US Stocks opened down roughly 2.5% and have remained near those levels. Global markets reflected similar moves. Oil opened up but has retraced to flat.

Bloomberg reported that an "unverified Twitter post purportedly by editor-in-chief of China's Global Times says 'Many Chinese scholars are discussing the possibility of dumping US Treasuries.'" If true, this is significant news as China is the largest holder of UST. Ten year yields were also down.

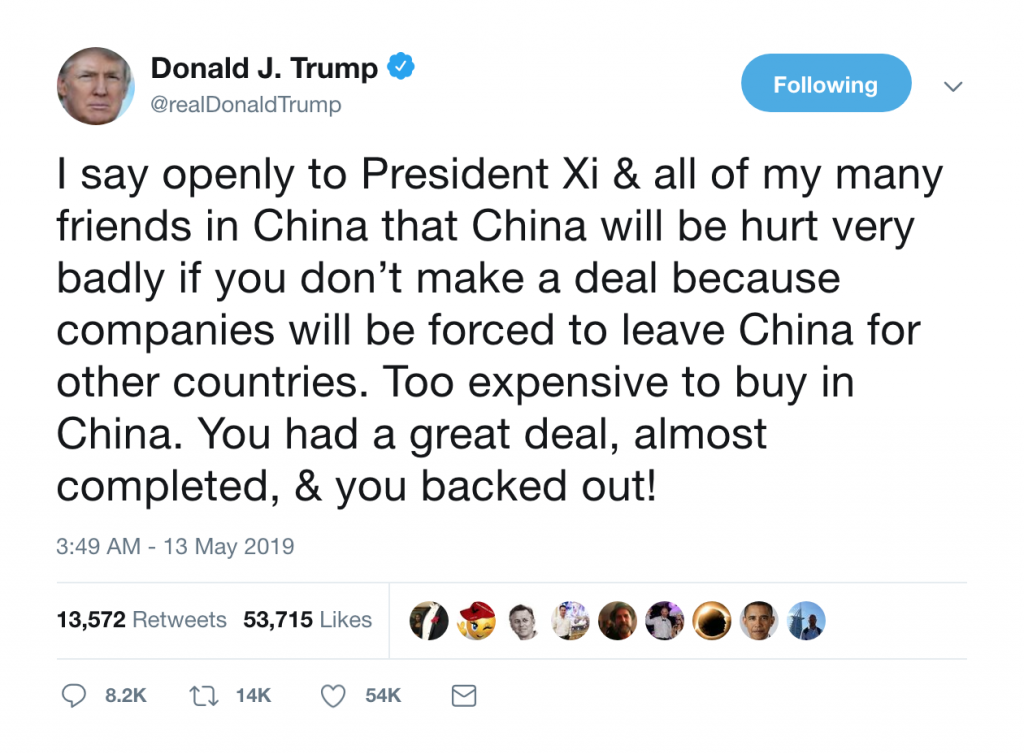

There was further speculation that China might stop purchasing US agricultural goods and Boeing aircraft, moves that would hurt American workers. In a flurry of morning tweets, President Trump continued to bemoan the Chinese position.

Subscribe to our evening newsletter to stay informed during these challenging times!!