As a former emerging markets bond professional for almost 20 years, this is not my first rodeo. I sat through the 1994 crisis, the EM currency crisis in 98, 9/11, and of course the Great Recession in 2006-2008, all the while dealing with customers and absorbing the ebbs and flows of the financial markets.

And I can tell you this -- something is not right. In fact, I think something is really wrong.

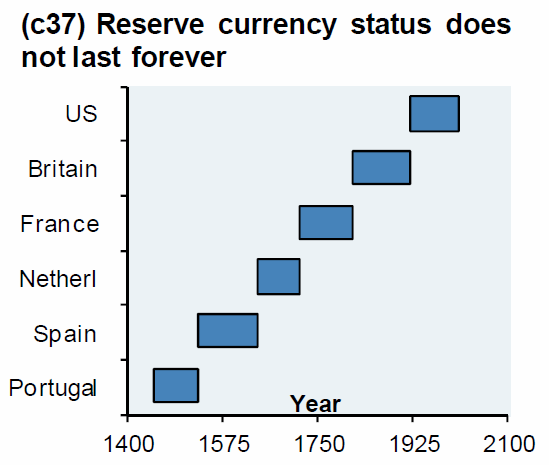

First let's look at the global macro picture. We are all aware of the trade war with China. What you may not be aware of is the breakdown of the global financial hegemony of the United States that has existed since the end of World War II, or the Great Patriotic War if you live east of Berlin.

The world is de-dollarizing. In a nut shell, our adversaries are tired of being under the dollar's thumb for financial sanctions, trade flows, and for a reserve currency.

Think about it, why would you allow your adversary to hold an existential threat to your economy over your head? So, they are removing the USD from their trade transactions, and as a central bank reserve store of value. The US is still dominant and holds the power to destroy an economy with a decision to shut down a bank's access to the American financial system. However, this will change, much sooner than we think. Who knows what will slowly edge the dollar off its perch -- crypto is my guess.

This tectonic shift will have massive implications for the financial markets; consequences we don't even understand yet.

Second, I believe the consequences of our irrational, irresponsible mountains of sovereign debt are beginning to be felt. I have written many times in the past decade that at some point, the financial markets will start to wonder if the American people have the will, or even the desire, to pay back the almost $30 trillion in debt they owe the world. Again, we cannot understand how these pressures will resolve themselves, except if we go back to before the fall of the Roman Empire and look at their financial recklessness. There are eery parallels.

At some point in time, and who knows when that may be (maybe right now?), the Federal Reserve could lose control of the interest rate market. If the bond market sets a real price for American risk, it could be much higher than where rates are now, after a decade of Fed interference to keep rates low. An interest rate shock would be devastating for the American economy.

On Wall Street there is an old proverb -- interest rates are low until they are not.

Now let's get back to China. As we have written before, there is no way China can make a trade deal that is good for the American people in the long run. To do so would destroy their entire agenda they have meticulously crafted over the last several decades in their bid to become dominant over the West.

The financial markets are ignoring this as equity indexes drift below all time highs. The risk is great for an emotional let down for those wishing for the 'perfect deal' as the 2020 presidential election approaches.

I have never been able to 'time the market' on a day-to-day basis, but I can say I have been able to feel when we are at an inflection point. I have this feeling right now. There is something really wrong out there and financial markets are ignoring it.

The last few days have seen a 'funding crisis' for dollar-based financial institutions, causing the Federal Reserve to have to injected almost a hundred billion into the overnight money markets two days in a row to satisfy demand for dollars.

This is not ok. This is the canary in the coal mine.

“As of yesterday, the Fed had lost control of the funding market,” said Mark Cabana, head of short rate strategy at Bank of America Merrill Lynch, reported CNBC.

If today's second consecutive repo was supposed to calm the stress in the secured lending market and ease the funding shortfall in the interbank market, it appears to have failed. Not only did O/N general collateral print at 2.25-2.60% after the repo operation, confirming that repo rates remain inexplicably elevated even though everyone who had funding needs supposedly met them thanks to the Fed, but in a more troubling development, the Effective Fed Funds rate printed at 2.30% at 9am this morning, breaching the Fed's target range of 2.00%-2.25% for the first time, writes Zero Hedge.

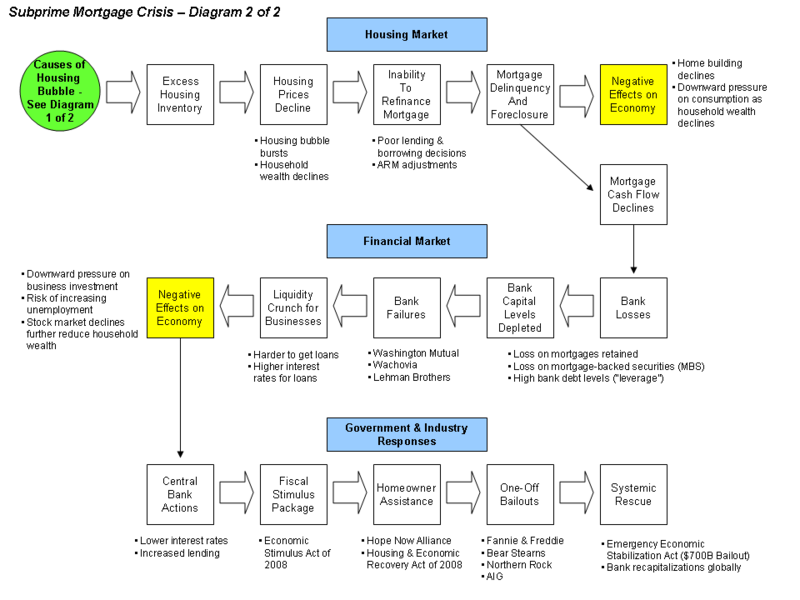

Just FYI, the 2008 financial crisis started in the money markets.

I won't pretend to understand exactly what is going on, but I will say that risk is extremely high for a 'black swan' event that could take a lot of the equity index froth out of the markets; in other words, a nice correction, or even bear market, that would be healthy and much welcomed.

Of course, President Trump would not like this as 2020 approaches. What we are seeing is not Trump's fault. He has been rational discussing possible solutions to America's debt problems. And, the America First crowd needs to get control of Congress so we can drive lasting change and financial responsibility, like not spending trillions we don't have.

The problems in the markets have been building for decades as the irresponsible Clinton, Bush 1 and 2, and Obama administrations piled on debt and interfered to manipulate the bond markets through QE, or quantitative easing.

In banana republics we call that printing money, lots of it.

Be careful out there.

Subscribe to our evening newsletter to stay informed during these challenging times!!

The old adage..."buy low , sell high.." still is the best advice next to .." don't get greedy.." follow your gut has always worked for me...thanks for your columns Mr. Wood!! Read you in the Washington Times as well...

Thank you! I have left the Times, look for me on CD Media going forward as we build this company. thank you!

The Opposite of that is CHINA owning AMERICA.. Experts don't mention that?? I wonder why?? Are they the Enemy inside?

Great article! Just wondering if your humble opinion, are there enough very rich, liberal people, like George's Soros - who made his money manipulating Britain's currency - who have enough money that they could manipulate markets, etc to make this, or other downturns in our economy happen, before 2020, so a Democrat wins and President Trump loses?

good question...I think manipulating information is a much bigger threat... have a good day