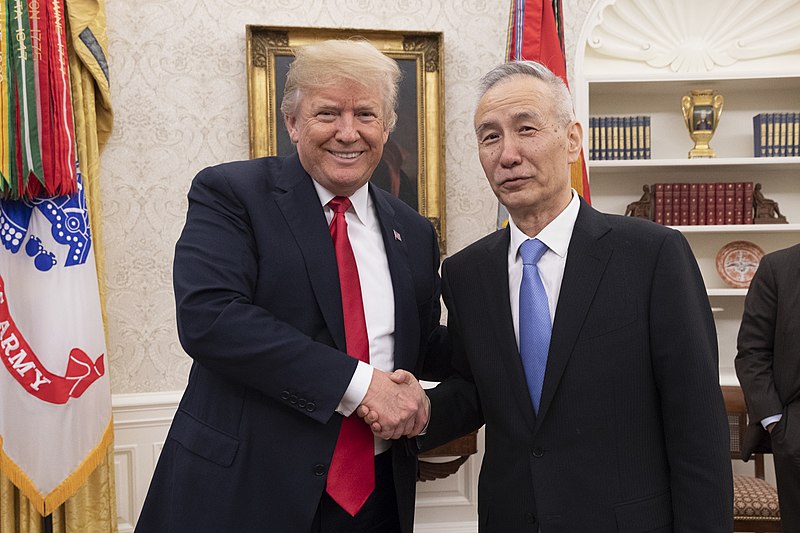

UPDATE: President Trump and Chinese Vice Premier Liu He have announced that 'phase one' of a trade deal between the two powers has been reached. The agreement includes large agricultural purchases by China as well as IP protection and financial services issues, according to Trump at the press conference. The US will not impose a new round of tariffs as scheduled.

Forced technology transfer will also be addressed in "Phase One", though Trump said the two sides might leave that until "Phase Two" to finish up, reported Zero Hedge.

Mnuchin added that the Treasury would review China's designation as a currency manipulator, a label imposed by the Treasury over the summer.

"We have an agreement on transparency in the foreign exchange market...so we're very pleased with that," Mnuchin said.

--------------------------------------------------

Markets are moving significantly higher today on optimistic comments from President Trump on a possible 'mini trade deal', which could include currency and agriculture agreements. Markets are now tied to the news cycle coming out of The White House for direction, and very hard to predict. Trump is meeting with Chinese Vice Premier Liu He today in Washington.

CD Media has been predicting that China cannot sign a sweeping trade deal as it conflicts with their goal of world domination, so they will do something small in hopes of waiting out Trump. Fox Business is reporting China may offer to give up the joint venture requirement for American businesses in China in order to get further tariffs removed.

In economic news, the Import Price Index MoM for Sept came in at 0.2% vs 0.0% consensus estimate. YoY in Sept the number was -1.6% vs -1.8% estimate.

The Export Price Index MoM in Sept was -0.2% vs 0.0% consensus. YoY in Sept the number was -1.6% vs -1.5% estimate.

Consumer sentiment stayed strong with the Michigan Consumer Sentiment Index (Oct) coming in at 96 vs 92 estimate. The number blew away the consensus estimate on strong hiring and wage gains in the Trump economy, making POTUS hard to beat the 2020 election.

Subscribe to our evening newsletter to stay informed during these challenging times!!