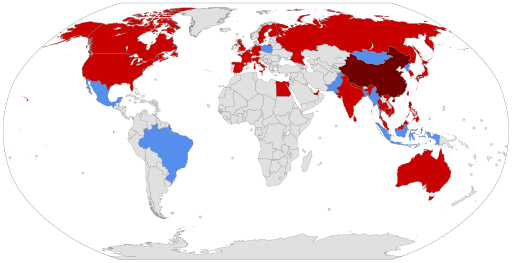

Economic data released today was mixed, still mired in the fluctuations in the fourth quarter due to the China trade war, impeachment, and the spreading epidemic of the coronavirus, all which injected massive uncertainty into financial markets.

Markets hate uncertainty.

However, as 2 out of 3 of these problems have been resolved, at least in the short run, financial markets ran higher on optimism for a second Trump term in recent weeks.

But we still have coronavirus which is the big cahuna of uncertainty...lurking to become the catalyst for the next correction, which we still think would be very healthy.

Economic indicators pointed out rising US export pricing and falling import prices. This can only be a good sign for the trade imbalance. Consumer sentiment ran strong to the upside.

Retail Sales ex Autos (MoM) (Jan) printed at the consensus estimate of 0.3%.

Import Price Index (MoM) (Jan) printed at 0.0% vs estimate of -0.2%.

Import Price Index (YoY) (Jan) printed at 0.3% vs estimate of 2.5%, showing import price declines

Export Price Index (MoM) (Jan) printed at 0.7% vs -0.1% consensus estimate.

Export Price Index (YoY) (Jan) printed at 0.5% vs estimate of 0.4% showing rising American export pricing.

Retail Sales Control Group (Jan) printed at 0.0% vs 0.3% estimate.

Retail Sales (MoM) (Jan) printed at the estimate of 0.3%.

Industrial Production (MoM) (Jan) printed at -0.3% vs estimate of -0.2%.

Capacity Utilization (Jan) printed at the estimate of 76.8%.

Michigan Consumer Sentiment Index (Feb) PREL printed at 100.9 vs estimate of 99.5.

Business Inventories (Jan) printed at the estimate of 0.1%.

Subscribe to our evening newsletter to stay informed during these challenging times!!

[…] piece originally appeared on CD Media and is used by […]

[…] Economic Data Mixed As China Weighs On Global Trade, But American Optimism Abounds […]

[…] Economic Data Mixed As China Weighs On Global Trade, But American Optimism Abounds […]