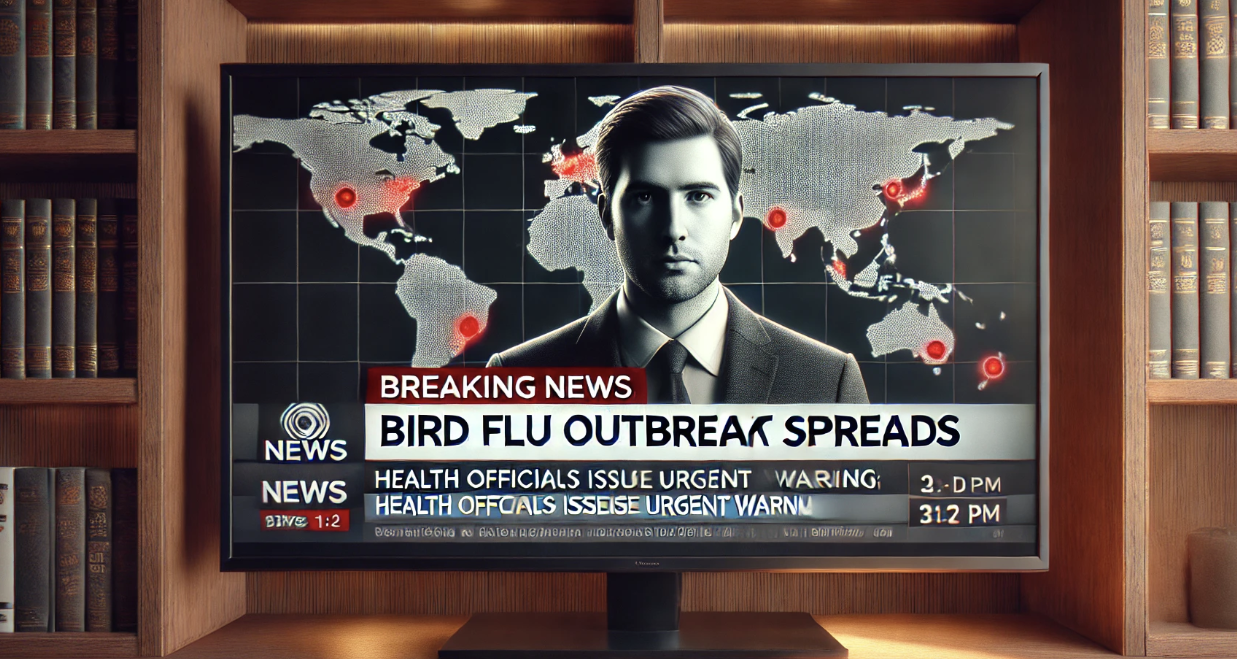

S&P Limit Down, Oil Collapses, Vix Rockets Higher

As a former Wall Street professional who has seen many bear markets, corrections, I have to say, this one looks no different. We have been talking about a correction for some time now at CD Media as we felt securities were priced for perfection a few weeks ago. If there ever was a black swan to hit financial markets, the coronavirus epidemic is it, curiously coming right after impeachment and right before the Nov 2020 presidential elections.

We have published information from multiple sources over the last several weeks outlining the probable case that this virus was released from the bio lab in Wuhan, China. The origins of the outbreak will most likely never be known. However, now that it is out of the lab, we have to deal with the consequences.

First of all, markets have to come down to a valuation that discounts slowing global economic growth, and then probably then some. We are well underway in that process; it looks like tomorrow we may break at least intraday the 20% down psychological barrier from the high which is the technical definition of a bear market. We may see final capitulation soon, as weak hands are forced to sell so they won't lose everything. Margin calls will wreak havoc on the rest.

As of the writing of this article, the S&P has hit limit down, meaning no further trading is allowed at lower prices, in an attempt to stop the bleeding. The VIX has rocketed higher as the 'fear index' explodes. Oil has collapsed on international markets as the Saudis flood the zone with crude in either an attempt to force out shale competition, or give the global economy a boost from low energy. President Trump could possibly be behind this move to help the American economy with cheap fuel.

If you're a trader and your long equities, it's going to be a rough day. If you're an investor, we advise looking at this correction as needed and healthy, and most likely the start of a new market run into the election. If you're liquid cash, this is a great buying opportunity.

Coronavirus will lessen eventually and the American economy will be fine. We have the most liquid, resilient financial markets in the world. The Trump economy will only get better as the trade deals kick in -- POTUS is right about that.

If there's one thing I learned on Wall Street, you buy when no one else wants it, when everything is on sale.

Tomorrow is a blue light special kind of day.

This article is not meant to take the place of investment advice from your financial market professional; consult your advisor before making any decisions for your portfolio.

In all probability it has spread all over the world already. Flights were going in and out of China for over a month before China even recognized the disease. And the US has no doubt had the most significant exposure of all countries prior to any travel bans. The good news is that corona virus deaths have not stood out in any way during this past two months of unrecognized community spread. One can conclude that in a healthy population, with reasonable hygiene this virus is not a significant threat (as suggested already by Rush Limbaugh) Just be sure you keep up and bolster your immune system ( eg: vit C and D, eat healthy, get plenty of sleep), avoid exposure to big groups, keep up good hand sanitation to avoid transfer from contaminated surfaces to face. This is the same advice as suggested for influenza and similarly, the elderly and immune compromised have to be extra cautious.