The Trump administration has said it seeks further trade talks with China in the face of a deadly outbreak of Chinese coronavirus around the world. Beijing has sought to avoid accountability for their behavior which led to the global spread of the disease, even launching a disinformation campaign to place blame on the United States.

The White House has stated it considers the trade agreement still in place despite the pandemic and expects China to fulfill its side of the agreement, or tariffs will be reinstated.

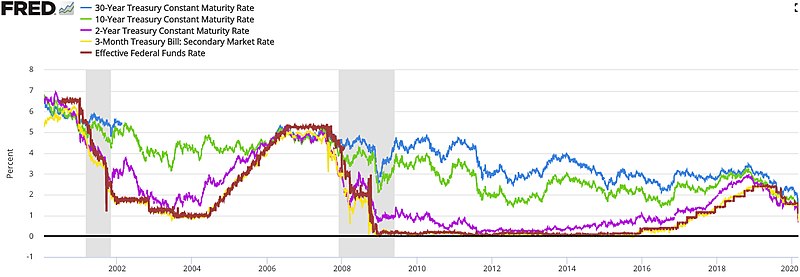

Bond market behavior today has been spooky as negative rates have been priced into the futures market.

We, as well as every Short-Term Interest Rate trader on Wall Street (or rather at home) is speechless at the insane action in the Eurodollar futures complex, where shortly after the Jan 2021 implied fed funds rate turned negative, the cascade of buying in ED futures has tripped above 100 in both Dec and moments ago, November 2020, meaning that the market is now expecting negative rates as soon as November, writes Zero Hedge.

What the real impact of this on the US economy will be is yet to be seen; however, one could be sure in saying it won't be positive. As we have stated before, at some point, the Fed could lose control of interest rates and the market could price in our lack of will, and ability, to pay back what we have borrowed.

Unemployment and service sector data released today was dismal.

Continuing Jobless Claims (Apr 24) printed at 22.647M vs 19.905M consensus estimate.

Non-Farm Productivity (Q1) PREL printed at -2.5% vs -5.5% estimate.

Initial Jobless Claims (May 1) printed at 3169k vs 3000k estimate.

Unit Labor Costs (Q1) PREL printed at 4.8% vs 4.0% estimate.

EIA Natural Gas Storage Capacity Change (May 1) printed at 109B vs 106B estimate.

Consumer Credit Change (Mar) printed at -$12.04B vs $15B estimate.

This last credit reading is interesting as Americans paid off massive amounts of credit card debt in the face of the financial crisis.

Subscribe to our evening newsletter to stay informed during these challenging times!!