For Italian speakers (sadly not me), a ‘c’ followed by an ‘e’ makes a ‘ch’ sound. I have a penchant for consonance, so I wanted to continue this piece in the tradition of Theta Thursday, which readers may recall from my days as Cantor’s global chief market strategist. This piece will focus on the topics that I consider most relevant to making investment decisions. Most of the time, it will start with a ‘big picture’ assessment and slowly attempt to grind down to how that might impact portfolio management or even ‘single name’ investment decisions.

First and foremost, it will remain focused on divergences and dislocations across asset classes, dislocations relative to fundamentals, and even dislocations within capital structures. Identifying dislocations, which often occur based on misplaced faith in a narrative du jour, are crucial to identifying investment opportunities. That’s the philosophy by which this weekly (or sometimes more frequent) piece will attempt to abide.

• The Portnoy Top. I’m coining this phrase here and now – unless somebody else already has. It really just explains everything. Read on! As my readers know from my recent writings while Cantor’s global chief market strategist, I held the belief that the recent market recovery is a bear market bounce – my view has not changed. Yesterday may have marked the local top, and this morning’s bounce in futures does little to change my mind.

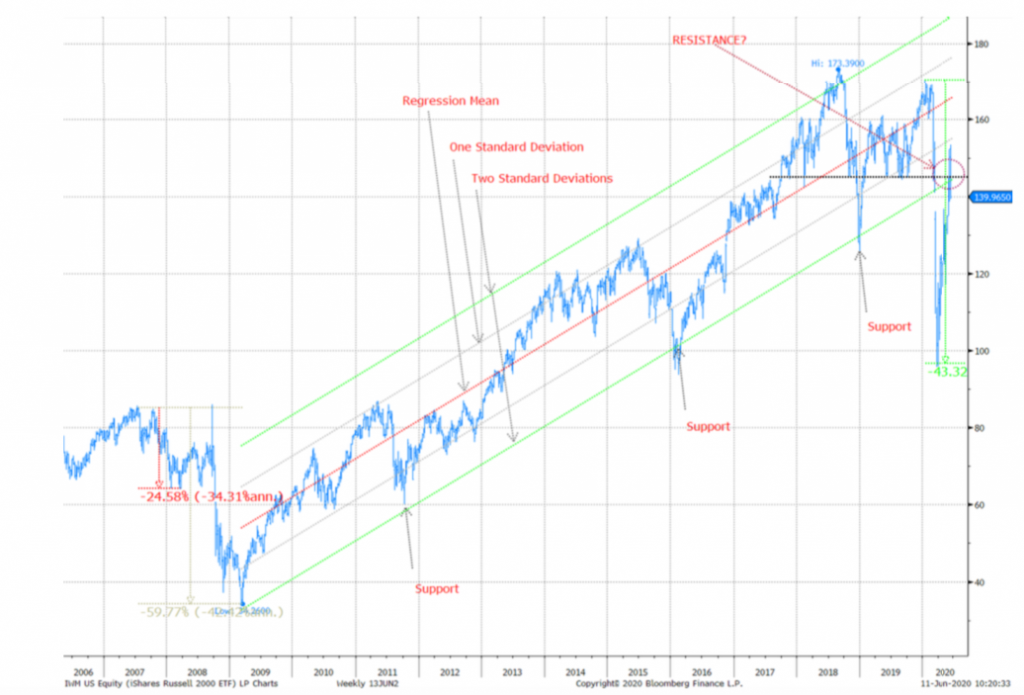

o Small caps and cyclicals. As I have been writing and tweeting over the past couple of days, small caps and cyclicals are currently the most important risk-gauge or ‘tell.’ (Figure 2). I argued they were likely to fail key technical levels. With small caps down over 5% yesterday, that looks to be proving true.

▪ Foundmoney.Thisremainsaretail-drivenrallylargelyunlovedbyprofessionals.Therotation into speculative names is clear from Robinhood’s open-source data. Account openings have also spiked at the major online brokers — Charles Schwab, TD Ameritrade, E-trade and Robinhood. Work-from-home speculation using ‘found money’ in the form of government relief checks is a never-before-seen dynamic, which I underestimated. When combined with easy access to markets through platforms like Robinhood, it’s an unholy speculative mix. Portnoy helped me to understand.

• Monetary Policy (MP).

o The toolkit. The Fed has unleashed a firestorm of policy actions, but U.S MP is no longer the MP of old, as Chairman Powell confirmed yesterday. The Fed is now serving fiscal policy makers and is effectively useless without them – just like the Bank of Japan. Why? Deficit monetization and ‘lending’ under the auspices of Treasury funded SPVs are its new raison d’etre. Monetary policy alone is no longer stimulative.

o Balance sheet. The correlation of the increase in the Fed’s balance sheet and the performance of the stock market is real, but ‘how’ this now works is a critical consideration. Without out FP, the Fed’s toolkit would have been useless, as rates (the traditional MP mechanism) were already near zero across the curve.

• Fiscal policy (FP).

o Deficits. There are no free lunches, as I wrote and posted here on LinkedIn. Deficits will drag on growth through higher future taxes and a pull forward in consumption and investment. Risk-asset returns should reflect growth in (and risks to) future cash flows. They are not right now, as investors are convinced there are apparently free lunches for all.

Figure 1: CDX HY Generic Spreads; Source: Bloomberg and AlphaOmega

I’m coining the Portnoy Top here and now – unless somebody else already has. Anybody who does not know what the Portnoy Top is, take a look. It’s self- explanatory. The Barstool Sports founder is a new, more extreme (and in his case wealthier) version of the day traders of the late 1990s or the house-flippers of the mid-2000s. His attention-getting, wild style is emblematic of just how emotional and extreme equity markets are now. Even more important is the fact that this emotion can be translated to action with a click anytime and anywhere. It’s both impulsive and compulsive. His behavior really just explains everything. It doesn’t even matter if he’s serious or not. His behavior ‘represents.’

U.S. risk-assets (large cap equities and small caps alike) remain wildly dislocated (rich) to fundamentals – except perhaps for U.S. high yield (HY). While he CDX HY index spread has tightened

as equities have rallied, it remains about where it peaked after December 2018’s selloff (Figure 1). The spread reflects the deluge of defaults that’s coming. Default rates will likely peak well above 10%. If that default rate estimate is correct, then the interpolated 1-year CDX HY spread should be around 10%.

Figure 2: The Russell 2000 (IWM ETF) with Annotations; Source: Bloomberg and AlphaOmega

Thus, even at 482bps, the high yield market remains rich – but not nearly as rich as the U.S. equity markets.

Clearly, small caps (Russell 2000) will be most impacted by the defaults I expect in the high yield market. It would seem that at 83x 2020 earnings, there’s little room for this level of defaults. Market participants appear to be betting aggressively on what amounts to continued corporate bailouts vis-à-vis the Fed and Treasuries combined corporate lending facilities. (Please see the Fed discussion below.) S&P valuation is just as bad. At 3,100, on 2020 consensus estimates of $130 in EPS, the S&P is trading just under 24x. There’s absolutely no reason to own U.S. equities right now – unless one likes low to negative future returns.

I wrote last year with my team at Cantor in Robinhood Rally that fundamentals were out the window and that a speculative rotation had commenced – mostly driven by dopamine-fueled, retail access to markets through online trading apps. (Most importantly, that piece debunked the notion that low rates necessarily justified high equity market valuations (P/Es)). Since the pandemic began, this dynamic oddly became even more important. Work-from-home speculation using ‘found money’ in the form of government relief checks is a never-before-seen dynamic that I certainly underestimated. Never before have citizens received this kind of direct bailout. Current fiscal stimulus, including incredibly outsized unemployment benefits - funded by massive deficits facilitated by the Fed’s bond-buying - have encouraged ludicrous risk-taking behavior. The prospect that Congress and the administration will continue to buy votes with the extension of such policies has emboldened market participants. When combined with easy access to markets through platforms like Robinhood, it’s an unholy speculative mix.1

The seminal moment in the press conference yesterday occurred when Bloomberg’s Mike McKee asked a few pointed questions, but I’ll discuss that momentarily. First, I would point out that the Chairman appears to suffer from a delusion of sorts. Alternatively, perhaps he’s not deluded – just deceptive. He was careful to emphasize:

“I would stress that these are lending powers, not spending powers. The Fed cannot grant money to particular beneficiaries. We can only create programs or facilities with broad based eligibility to make loans to solve entities with the expectation that the loans will be repaid. Many borrowers will benefit from these programs, as will the overall economy. But for many others, getting a loan that may be difficult to repay may not be the answer. In these cases, direct fiscal support may be needed. Elected officials have the power to tax and spend and to make decisions about where we as a society should direct our collective resources.”

Baloney. The Fed is directly enabling the massive deficits that are funding veiled bailouts of... everything. Its actions are now fully complicit and inseparable from fiscal policy actions. A pig wearing lipstick is still a pig. Without the Fed’s massive buying, Treasury yields would be much higher than they are now – and corporate bond spreads would be far wider. Moreover, the lending facilities the Fed is offering with Treasury are clearly benefitting particular beneficiaries. After all, when you facilitate the fiscal bailout bail out of everybody, you also facilitate the bail out ‘particular beneficiaries.’ It’s a distinction without a difference!

Without the Fed’s action, both bill and coupon markets would be a mess. We witnessed dislocations in the Treasury market on two different occasions over the past nine months. Both occurred – at least in part – because of the massive bill and coupon issuance needed to fund deficits. The first such dislocation came last September when the repo market dislocated, in part due to excessive bill supply and coupled with the Fed’s failed attempt to normalize the balance sheet (and a collapse in system reserves). This occurred well before the pandemic. Only balance sheet expansion could fix that problem and bring reserves up enough to meet the supply of collateral (bills).

Now, the pandemic as led to annual deficits of at least $3 trillion. That prospect alongside a frenzy for liquidity led to a move in 10-year yields above 1% (from ~35bps earlier in the week) on March 13th at the same time the equity market was collapsing. Yields should fall rather than rise in such risk-offs on a flight to safety. Instead, everything was for sale. This led to the Fed’s March 15th emergency meeting. Make no mistake, without the Fed monetizing Treasury issuance, the Treasury could not act to fund deficits. Without Treasury-funded SPVs, the Fed could not act to bailout companies. The Fed’s current corporate credit lending facilities are TARP in disguise. (Please see my piece Exigent Circumstances).

And what of the positive returns of each and every stock in the S&P 500 since the March meeting? Mike McKee asked whether there might be capital misallocation facilitated by Fed policy that leaves us worse off than before the pandemic. Chairman Powell’s response was wholly unsatisfying. Mike’s question was THE question that needed to be asked, and he had the courage to ask it. My only disagreement with it is the premise that the Fed remains capable of stimulating the economy and juicing equity markets standing alone. It no longer has that power. Only with the help of fiscal policy can the Fed help stimulate. Alone, the Fed is now helpless. We are currently in an unbreakable cycle of addiction to not only monetary policy but also fiscal policy. Fiscal and monetary policy are now one. This may be the reason why David Portnoy just thinks stocks go up and up... can he really be serious? Yeah.... Well, maybe, but it does not really matter. It’s not about him; it’s about what the rants represent.

This article is market commentary only. For investment advice, contact your investment advisor.

Subscribe to our evening newsletter to stay informed during these challenging times!!

[…] Global Chief Market Strategist for Cantor Fitzgerald, has named a theory after Portnoy. He calls it “The Portnoy Top.” He calls Portnoy the next generation of investors that started with day traders in the 1990s and […]