The Federal Reserve Bank of the United States began purchasing American corporate bonds in the cash market recently, as was reported in a disclosure by the central bank.

The bank has comprised an 800 issuer index from which purchases will be made. The first day of buying netted $207B. The program expires on Sept 30 of this year.

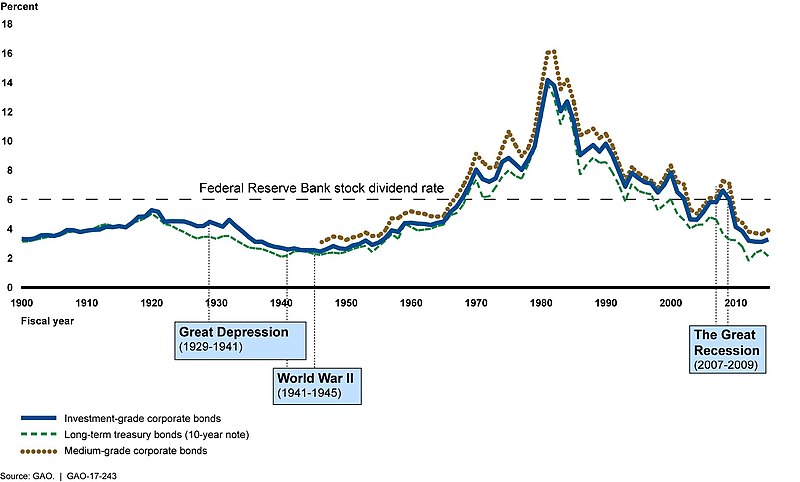

The program is intended to support liquidity in the secondary corporate bond market in order to support issuers' ability to raise debt capital.

"Buying cash bonds is going to form the primary mode of support over time by which we support market function,” Federal Reserve Chairman Jerome Powell said during a hearing before the House Financial Services Committee . “Over time, we will gradually move away from ETFs.”

Subscribe to our evening newsletter to stay informed during these challenging times!!

[…] Federal Reserve Begins Buying Corporate Bonds To Support Corporate Secondary Market […]

[…] Federal Reserve Begins Buying Corporate Bonds To Support Corporate Secondary Market […]