The Federal Open Market Committee at the Federal Reserve Bank of the United States announced today they are keeping short term interest rates unchanged a 0.25%. The Fed justified this decision saying the economy, although rebounding, was still below pre-pandemic levels and inflation was muted.

With rates this low, and a vastly expanded balance sheet, many analysts are wondering if the Fed is 'out of bullet's to manage economic growth and keep the currency stable.

As BofA ominously warns, "perception that the Fed is out of ammo could cause a reassessment of the Fed "put" and support USD via lower risk assets", reported Zero Hedge.

The Fed also announced it will keep lending lines open for the foreseeable future and continue to buy assets to prop up financial markets.

Oil moved higher on an unexpected draw of crude oil stocks.

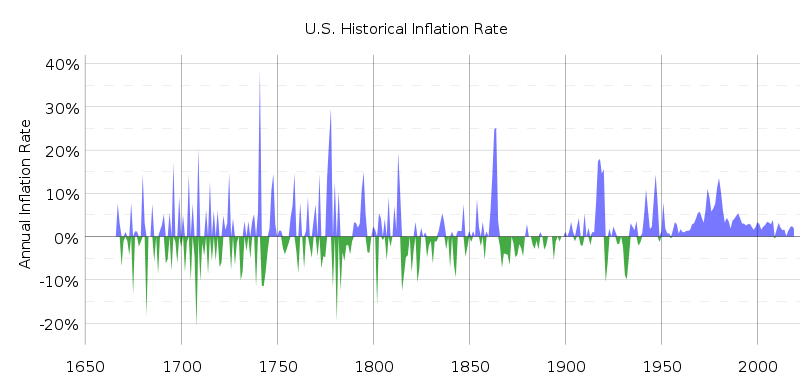

Gold moved higher on the long-term outlook for inflation based on rising U.S. sovereign debt.

MBA Mortgage Applications (Jul 24) printed at -0.8%.

Wholesale Inventories (Jun) PREL printed at -2%.

Goods Trade Balance (Jun) printed at -70.64B.

Pending Home Sales (YoY) (Jun) printed at 6.3% vs -10.2% consensus estimate.

Pending Home Sales (MoM) (Jun) printed at 16.6% vs 15% estimate.

EIA Crude Oil Stocks Change (Jul 24) printed at -10.612M vs 0.357M estimate.

Subscribe to our evening newsletter to stay informed during these challenging times!!