Please Follow us on Gab, Parler, Minds, Telegram, Rumble

There are laws of physics that are unbreakable. Gravity exists. If you jump out of a five story window, you will hurt yourself.

The same applies to fiscal and monetary policy.

If you run up multiples of debt of what you make in a year, with no end in sight, eventually the bank will cut you off. At that point, you become insolvent.

The gross domestic product (GDP) is essentially what the United States makes in a year as a nation. We now owe well above that amount, 100%+. This is a historical red alert for any economy.

The illegitimate Biden administration is about to add another $4-6 trillion to that amount.

This is irresponsible, reckless, even criminal spending. It is meant to destroy the nation, make us insolvent, a vassal to the Chinese Communist Party.

There is an old saying on Wall Street, "Interest rates are low until they're not."

At some point, the bond market will take back control of interest rates from the Federal Reserve, which has been interfering in financial markets for a decade, keeping rates artificially low.

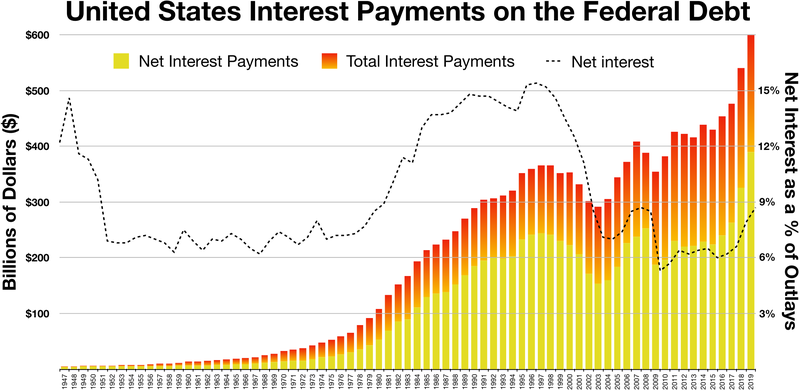

Every one percent rise in U.S. long-term debt means hundreds of billions of debt service cost.

Today, Fed Governor Waller declared the Fed is not doing the above.

This is an alternative-fact statement; in other words, he's lying.

Defending the Fed’s independence from the fiscal authorities in Congress, Waller rejected notions that the central bank is holding borrowing costs low to help service the debt, nor is it conducting asset purchases to finance the debt-laden federal government, wrote CNBC.

“My goal today is to definitively put that narrative to rest. It is simply wrong,” Waller said in prepared remarks to the Peterson Institute for International Economics. “Monetary policy has not and will not be conducted for these purposes.”

The truth is the Fed CANNOT raise interest rates, as the Biden economy would crumple like a wet newspaper. We are experiencing an economic house of cards.

The sad part is now Biden (or should we say #ObamaKamala) will have to borrow more money from the Chinese, giving them more leverage over our children.

America is now ensured an interest rate spike, and a follow-on economic crisis, possibly one we will not recover from in our present state as a Constitutional republic.

No one can say exactly when, but at some point in the future, the world will demand much more financial reward for lending us money. Interest rates will shoot higher to reflect economic reality and our economy will collapse.

Interest rates are low until they're not.

At the end of the feckless Weimar Republic in Germany, they couldn't build the printing presses fast enough to print the fake money as it lost value. Hitler rose from the financial ashes.

Biden/Obama/Kamala know this of course. It is obvious we are now continuing Hussein's policies, who doubled the national debt during his term in office.

God help us find patriotic American leadership, and soon!

Subscribe to our evening newsletter to stay informed during these challenging times!!