It's just another day in the life of that lovable, laughable economic farce known as Erdoganomics (yes, it's even more laughable and idiotic than MMT, if one can believe that), where cutting interest rates in the middle of hyperinflation is supposed to fix everything. Unfortunately, it doesn't work like that, and the latest CPI and PPI data out of Turkey today confirmed as much.

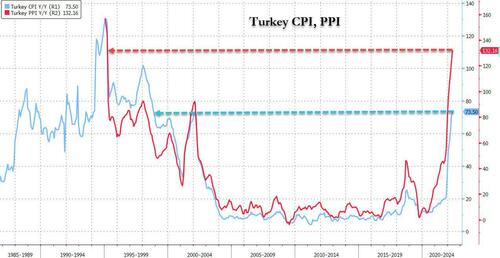

Turkey’s inflation soared in May to the fastest since 1998 as the continued surge in food and energy was not helped by the country's ultra-loose monetary policy. Consumer prices rose an annual 73.5%, up from 70% in April, according to data released by the state statistics agency Friday whose head will either quit or be fired soon. The median forecast in a Bloomberg survey of 20 economists was 74.7%. There was a silver lining in the core index which strips out the impact of items such as food and energy (which nobody needs right) and which rose "only" 56%. Meanwhile producer prices rose by a mindblowing 132% - yes PPI exploded more than double from a year ago.

The chart showing Turkey's descent into hyperinflation is shown below.

To read more visit Zero Hedge.

Subscribe to our evening newsletter to stay informed during these challenging times!!