Please Follow us on Gab, Minds, Telegram, Rumble, GETTR, Truth Social, Twitter

Reprinted with permission•Mises Wire•Thorsten Polleit

The fiat money system will not disappear just like that. Any expectations or hopes to that end should be tempered. Yes, the fiat money system could collapse; yet there is a significant likelihood it will persist longer than most people might think. This prolonged existence may come at a cost: a fascist state encroachment on the freedoms of citizens and entrepreneurs would be more profound than most people realize.

Much ink has been spilt about the impending collapse of the international fiat money system. It is a debate that naturally gains momentum in times of crisis—as witnessed in the aftermath of the 2008/9 global financial market debacle or the politically dictated global lockdown crash of 2020/21.

At the same time, however, it is entirely justified to harbor significant concerns regarding the fiat money system. After all, it is plagued by blatant economic and ethical defects.

Are you wondering about the essence of fiat money? Let’s break it down into three characteristics:

Whether we’re talking about the United States dollar, euro, Chinese renminbi, Japanese yen, British pound, or Swiss franc, they are all fiat money. We know from monetary theory that fiat money is not “natural” or “innocent.” Unlike moneys emerging from voluntary agreements in the free marketplace, fiat money was introduced through state intervention—involving coercion and violence—leading to many negative effects.

Fiat money is inherently inflationary, gradually losing its purchasing power over time. This phenomenon disproportionately benefits a select few at the expense of the broader population.

Moreover, fiat money causes economic instability by perpetuating cycles of boom and bust that disrupt market equilibria and create societal inequalities. It drives excessive indebtedness within economies and fuels the unchecked expansion of the state, often at the expense of citizens’ and companies’ freedoms.

Last, but not least, fiat money is dishonest money, and engaging with fiat money daily erodes the morals and values of the people involved in its circulation. However, despite these considerable drawbacks, once fiat money has been put into circulation, it is here to stay; it won’t disappear just like that. Why?

Fiat money fosters what I have previously described as “collective corruption,” wherein many people become proverbially ensnared by the structures that fiat money establishes, fostering dependency and entrenching its influence. Consider this: fiat money acts as a catalyst for the expansion of the state, making it bigger and more powerful. Companies receive new orders from the state, prompting adjustments in production and employment to meet artificial demand.

Or consider: people keep their life savings in fiat money. They invest, directly or indirectly, in government bonds and bank debentures and maintain time and savings deposits.

Gradually, people become profoundly reliant on the perpetuation of the fiat money system, consenting to nearly any measure proposed by the state (and the special interest groups taking advantage of it) to keep the fiat money system going.

Yet, akin to Achilles’ heel in Greek mythology, fiat money has a crucial vulnerability. In Homer’s epic Iliad, Hector meets his demise at the hands of Achilles. In retaliation, Hector’s brother Paris strikes Achilles with a poisoned arrow, targeting his vulnerable heel and ultimately leading to the downfall of the seemingly invincible warrior.

The Achilles’ heel of the fiat money system lies in its dependence on the demand for money. However, what does this demand for money signify? Essentially, it reflects people’s desire to hold money, influenced by a multitude of factors.

For instance, people tend to maintain money balances relative to their income. As income rises, so does the desire to hold money. The demand for money typically diminishes when interest rates rise. This is because holding onto money entails opportunity costs when higher returns could be earned through, say, bank deposits and bonds.

History demonstrates that the demand for money remains relatively steady when there is a high level of trust in the currency, meaning people are not worried that the purchasing power of their money will decline or be destroyed. Given this insight, it’s clear how states and their central banks seek to handle the fiat money system in their favor. Their primary strategy involves creating illusions and deceiving the populace to maintain control and influence.

For instance, people are often fed the narrative that inflation of 2 percent equates to “stable money”—a claim that is, of course, inherently false. In reality, a 2-percent inflation rate destroys the purchasing power of money by 2 percent every year. Furthermore, statistical goods price indices are often cobbled together to present a lower inflation rate than experienced in the market. This manipulation serves to downplay the true extent of monetary debasement.

Additionally, central bank officials and mainstream economists frequently attribute inflation to various external factors, such as alleged price gouging by greedy businesses or supply disruptions by oil-producing nations, while vehemently rejecting the notion that inflation is a monetary phenomenon resulting from the central banks’ fiat money printing. In fact, central banks are determined to avert a permanent drop in the demand for money at all costs. When the demand for money falls, people tend to exchange their money for alternative assets, such as stocks, real estate, precious metals, etc.

Consequently, the prices of these goods surge—further exacerbating the decline in the demand for money. In extreme scenarios, this can trigger a widespread flight from money, predicting a collapse of the financial and economic system. To maintain the fiat money system, central banks meticulously adjust the level of inflation to, firstly, ensure a gradual and ongoing erosion of the value of money, subtle enough to either go unnoticed or be reluctantly accepted.

Secondly, this controlled inflationary pressure acts as a defense against episodes of goods price deflation, which have the potential to make the fiat money system come crashing down. Lastly, central banks aim to prevent situations where inflation spirals out of control, where hyperinflation destroys people’s demand of fiat money entirely.

Is this delicate balancing act sustainable? Recent decades seem to suggest so. Despite numerous crises and the chronic erosion of purchasing power, the demand for money in many economies have remained relatively stable. However, can the balancing act succeed in the long-term? Probably not. The primary concern is the enormous accumulation of debt within the fiat money system, eventually reaching a tipping point of unsustainability.

At that juncture, people will be confronted with the question: Should the fiat money system collapse under the weight of deflationary pressures, or should the outstanding debt be financed by creating new money? Unfortunately, history suggests that in a time of “existential crises,” people consider expanding the money supply as the lesser of two evils.

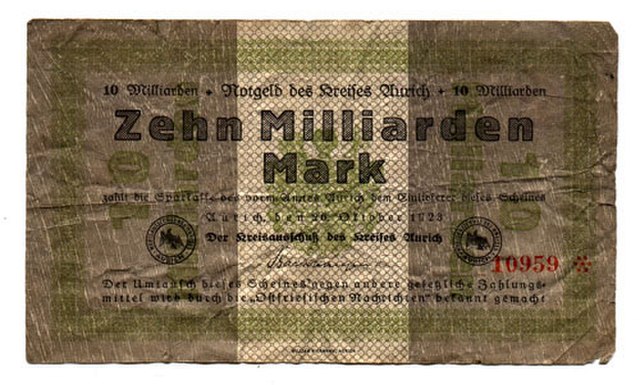

Once initiated, a deliberate inflation policy becomes incredibly challenging to contain, let alone reverse. It has the propensity to spiral out of control, potentially culminating in high inflation or even hyperinflation, thereby precipitating a collapse in the demand for money and eroding the very foundations of the fiat money system.

However, in such a dire scenario, one must reckon with the state’s determination to avert the demise of its fiat money regime at all costs. The state (as we know it today) can be expected to exhaust all available measures to safeguard the continuity of its monetary system.

Consider this: in response to a crisis, the state resorts to drastic measures, such as imposing price and capital controls and even nationalizing banks and large corporations, transforming the economy into a highly regulated command economy.

Under such circumstances, the state assumes unprecedented control over production, dictating what goods will be produced, how much, when, and by whom, even regulating who will be allowed to consume how much and when.

In other words, the economies end in a form of fascism. A bleak outcome indeed. However, it doesn’t have to be this way. There are ways out. Much like Achilles had a vulnerable heel in Homer’s Iliad, the fiat money system also possesses vulnerabilities that can be addressed.

To mitigate the damage caused by the fiat money system, or even dismantle it altogether, the first step must be targeting its Achilles’ heel, weakening the demand for fiat money. The less fiat money people demand, the smaller the damage inflicted by the fiat money system will be. However, how can this objective be accomplished?

First and foremost, it can be accomplished by educating the populace about all the significant harm perpetuated by the continued existence of fiat money and the consequences it has. This entails, as a first step, highlighting the adverse impacts it has on individuals and their communities and encouraging people to use fiat money for transactions rather than for savings.

In other words, this can be through discouraging investments in government bonds or time or savings deposits in banks while encouraging investments in tangible assets such as stocks, precious metals, land, and property. Further actions can include ceasing the support for governments or politicians who endorse the fiat money system and fail to take actions to dismantle it.

Ultimately, of course, it is crucial to inform people that sound money is indeed possible. This involves advocating for people’s freedom to choose their preferred money, whether it be gold, silver, bitcoin, or any other alternative.

The concept of a free market in money is easy to understand and, from a technical standpoint, quite easy to implement. By allowing individuals the autonomy to select their preferred currency, we effectively target the Achilles’ heel of the fiat money system, ultimately benefiting the vast majority of people.

Subscribe to our evening newsletter to stay informed during these challenging times!!