Please Follow us on Gab, Minds, Telegram, Rumble, GETTR, Truth Social, X

Wow! What a week again! That deserves repeating. Wow! What a week again!

As my customers know, I attempt to be balanced in my thoughts on the metals both positive and negative. This week both gold and silver went below their 50-day moving averages and continue to be well above their 200-day moving averages. These moving averages are what the large money managers and hedge funds look at for their overall trend analysis.

Weighing on the metals this week was an increase in the US Dollar, which has a negative correlation to metals and former FED policy maker and former head of the Cleveland Federal Reserve Bank, Loretta Mester, saying on Tuesday that the market is right that there will not be as many FED interest rate cuts next year based on President Trump’s proposed tariffs.

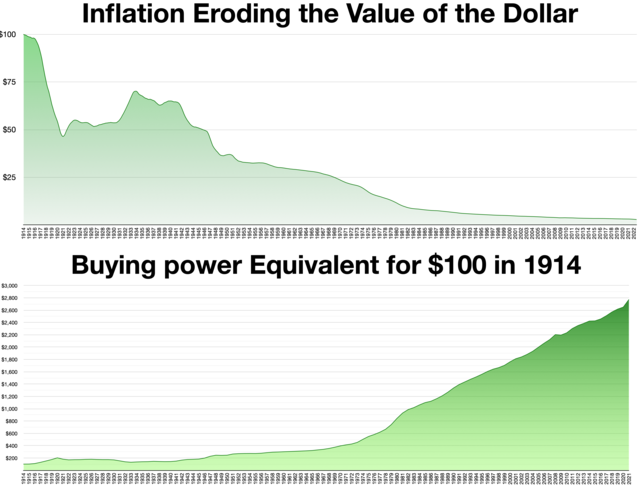

On Wednesday, the Consumer Price Index (CPI) came in + .2 % in October in line with expectations with an annual rate of 2.6%. The core CPI number which excludes food and energy was up .3% at an annual rate of 3.3% all above the FED’s 2% inflation target. The CPI numbers are beginning to trend up from this summer’s lows.

On Thursday, the Producer Price Index (PPI) came in at +.2% in October in line with expectations with an annual rate of 2.4%. The core PPI number which excludes food and energy was up .3% at an annual rate of 3.1% all above the FED’s 2% inflation target. In the afternoon party pooper Powell said that the FED is in no rush to lower interest rates. That lowered the stock indices and gold and silver. The metals have rebounded with gold recouping almost all of that drop and silver having recouped that drop and has moved higher.

Thursday saw the crypto prices decline having a moderating effect on metals prices. The stock indices have now had three declining days in a row with the potential for lower prices today. Are metals prices ready for a rebound from, in my opinion, the overreaction to the downside? (I believe so!)

Until next time…

Subscribe to our evening newsletter to stay informed during these challenging times!!