Please Follow us on Gab, Minds, Telegram, Rumble, GETTR, Truth Social, X

This is not rocket science.

If you act fiscally irresponsibly, and spend trillions you don't have, eventually your lenders will cut you off, or make it harder for you to borrow.

That is what we are seeing now in the U.S. bond market as the 10 year yield approaches 5%, and threaten equity pricing.

At some point, the bond vigilantes have to return. You can't print $2 trillion of debt annually and expect everything to be okay.

President-elect Trump has a massive problem on his hands, to reign in criminal spending levels, and convince the world to keep buying our debt, all the while refinancing $7 trillion this year.

When the bond market admits the United States has neither the will, nor the ability to repay our debt, Katy bar the door.

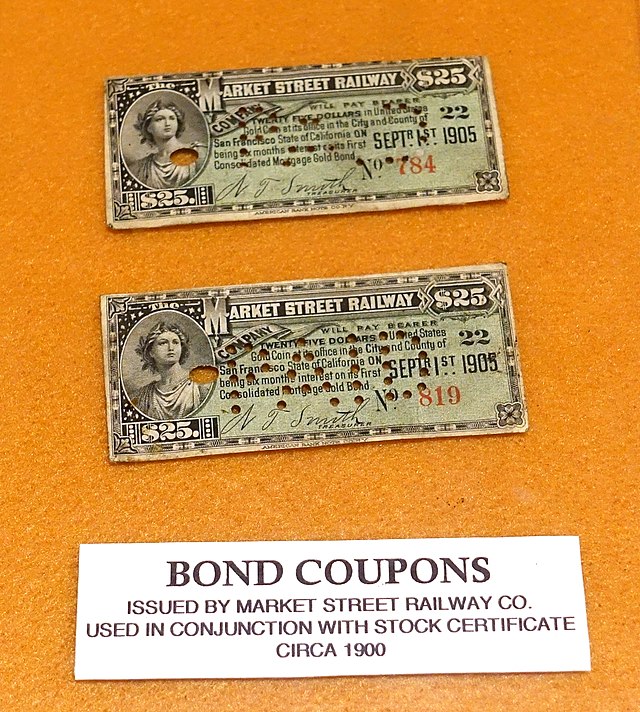

I wrote a book about this over a decade ago when i was 'on the Street' trading bonds - if you like historical fiction tied to geopolitics today, check it out!