Please Follow us on Gab, Minds, Telegram, Rumble, Gab TV, GETTR

No doubt, readers have picked up what is nearly everywhere – inflation in the USA is rising, and rising rapidly. It hit 7% recently, measured by the CPI. That’s the highest in 40 years. If you include housing prices instead of how the government calculates rent, it’s 11%. What is next on the inflation front? Unfortunately, having seen these cycles before, Decoding Politics here is not optimistic. But we will give you several strategies to last through it and not have your purchasing power destroyed. We are probably a quarter of the way into this particularly inflationary episode, and it looks like no one will be able to put the genie back in the bottle for several years.

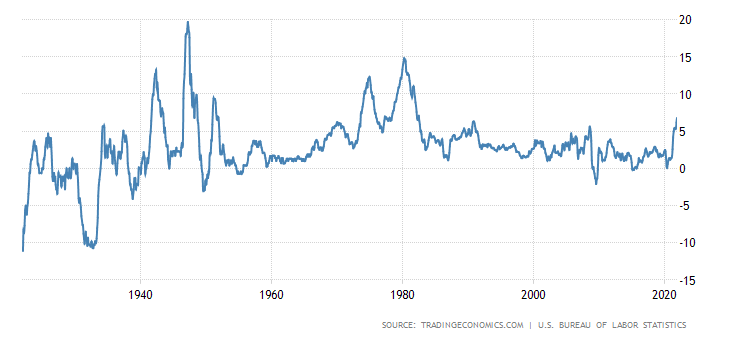

US CPI Year over Year

Inflation is a Process

If you look up inflation in the dictionary, it says “a general rise in prices”. That now shows the highest rise in prices since the 1980s. If we go a little further, we will reach 1970’s/1980’s levels of high inflation.

However, we will have to differentiate here. Inflation, as defined above is incomplete. The real definition of inflation is ‘an expansion of the money supply beyond economic growth’…..which eventually generates a general rise in prices. The amount of money increases significantly, but not the amount of raw materials, buildings, factories, peoples, or skills. Demand over supply forces prices up. But there are a couple wrinkles along the way which bear exploring and explain where we are. In the rest of the piece we will use ‘inflation’ in its conventional sense, but, we need you to understand that this is a process.

An important part of the inflationary process is how is the money generated, and who gets it first. The classic example in economics is helicopter money- people just receive money throw out from helictopers, and go spend it. That works in economics texts, but the real world is slightly different. Money is created and distributed through the financial system. The Federal Reserve, which controls the number of dollars in circulation and indirectly the amount of credit, leads the process. How it distributes the new cash and how much is what drive the inflationary process to follow.

In the post COVID case, it came about because the Federal Reserve committed to buying over $100bn of bonds a month and cutting short term interest rates to zero. Thus, bond holders got extra cash for their holdings and the financial sector received a huge favor. The money went into bonds, and then stocks, and then more speculative assets after that- the prices of crypto, watches, art, exotic cars, houses in Miami and Palm Beach, all exploded. This is not because people suddenly found those assets better investments. No, it’s because with far more money in circulation, the money had to go somewhere and that’s who got it first.

Indeed, the amount of money in circulation in late 2020/early 2021 was growing at an almost 25% rate. It has come down to 13% now, but that is still extremely high historically. And in our math, it should correspond to a 10% or more rate of inflation for the next two years.

Is it any wonder we are seeing a general rise in prices? The government has essentially increased the amount of money in circulation by 50% in two years. Wall Street and the government got it first, but now it’s circulating to the rest of the economy. Stocks have gone to the moon, and now consumer goods like beef are beginning to follow.

But as that expanded money continues to circulate, it will move into new categories. Consumer items like chicken and beef are starting to see large increases. Other consumer goods should spike in price. Interest rates, which were held low for a long period due to how the Fed was distributing money, will begin to rise to the level of general inflation. All of this will continue to be good for those with assets, and bad for ordinary people.

The people hurt the most in high inflation are those on salaries. The price of everything you buy goes up 10-20% in a year, but you have to wait until year end for a review, that may or may not just match inflation. You trade down to less expensive brands and goods. You hoard your money. You know your purchasing power is declining but you don’t know how to react. Inflation is a hidden tax on the poor and middle class.

Decoding will break down the various things that happen in an inflationary episode and why.

Inflation and shortages

Inflationary periods nearly always have shortages of major goods. There are several reasons why. The main one is that the people who get the money first buy up the key objects/assets, knowing they will be needed. Secondly, inflation produces high interest rates, which makes debt financing generally less available to produce or purchase goods. Thirdly, as inflation hits, the ability for money to invest longer term is reduced, as people worry about the loss of purchasing power for longer term contracts. In serious inflations, people don’t want to take your currency as payment and other forms have to be negotiated.

The last three years have also seen a substantial renegotiation of trade with China, the US’s largest trading partner, and a huge transfer of supply chains. The related COVID shutdowns and lockdowns, and the vaccine mandates forcing workers out of a job, have constrained the supply side. All of these have pinched the supply from our economy, while the government and Fed have turbocharged the demand. Is it any wonder we have rising prices now?

Inflation Begets Inflation

An inevitable consequence of high inflation for a year or two is that it begets more inflation. Instead of thinking the government will solve it and bring it back to normal, they become skeptical. They bake in expectations of price increases to each deal and each contract. People find a way to embed the rate of inflation into everything. And they burn cash buying anything they can to get rid of it before it devalues.

The US is only one year into its inflationary episode, and people have set it aside as transitory. But looking at the sheer numbers, it should be higher for longer- you print 50% more money, you should see a cumulative 50% rise in prices, if not more. And that’s a baseline. If citizens think inflation is embedded, they will switch to another means of payment, play inflationary hot potato, and the inflation will be higher for longer. Once the expectations and behaviors get embedded, it becomes hard to change them and restore order. Given that there is zero political will to tame government spending and inflation, this is likely to happen.

Clearly, the USA is seeing all three of these key characteristics of an inflationary period. The President wants to spend as much as he can and has only Senator Manchin standing in his way. The Federal Reserve has bent over backward to finance it all. They are still, almost two years after COVID began, buying tens of billions of bonds each month and only recently announced plans to go to zero by mid year 2022. But interest rates are still zero versus 7% inflation, close to the largest gap in history. Clearly, we are far behind the curve of the inflationary episode. And in the past 15 years, with each economic crisis, the Fed has responded by throwing tons of created money at it. It is hard to believe that if we have a recession in the next four or five years, that the Fed would not go crazy again.

The Fed’s balance went from $700bn pre Global Financial Crisis to $4tn five years later. After an attempt at selling bonds, the Fed reversed course and took it from $3.8tn to a mind boggling $9tn+ now. Clearly, the balance sheet will not go down on a sustained basis, so inflation is here to stay. Expect high inflation rates until at least 2025 and the entrance of a new administration. Fed Chairman Powell, in the highly likely scenario that he sees his term renewed, will be there until 2026. Clearly this genie is not going back in the bottle any time soon.

Total Federal Reserve Assets = fast circulating money

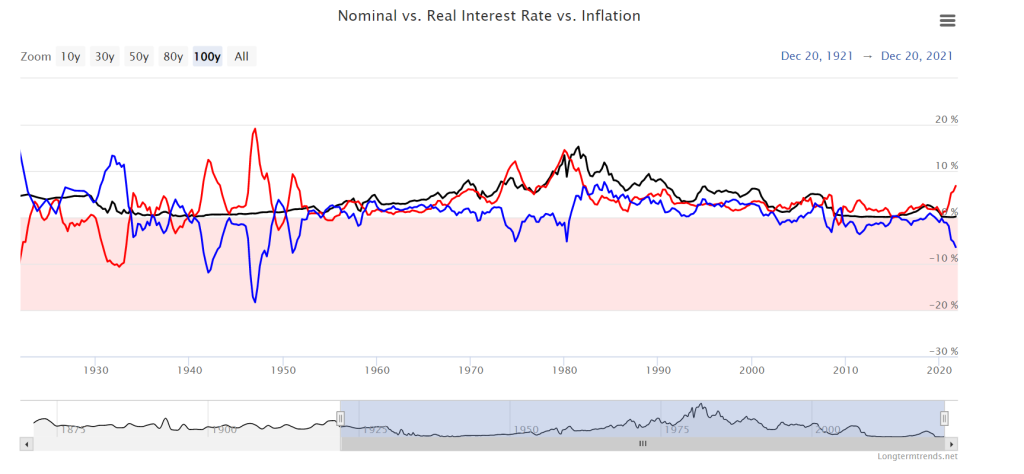

Negative Real Rates

Real rates are the essential way to measure if you are getting your money back after inflation. You take the interest rate you are getting, and then subtract inflation. If positive, you are making money on your purchasing power. If negative, it’s being taken away. Negative real estates are associated with high inflation and stock market bubbles, positive real rates with good times for savers.

The blue line here measures real rates, and you can see how out of whack the current period is. We are back to 1940’s level real rates, when the world was fighting a massive war, commodities were in high high demand, and the global supply chains had been shattered.

The current level of rates is worse than the 1970s or early 1980s’. This time though it’s a policy choice. The only way the government can handle its massive $25 trillion debt is through negative real rates, and so they will keep doing this. More on what that means for individuals later.

Handling Inflation as an Individual – How to Play Defense

*This is not financial advice, just recognizing patterns*

From our experience in dealing with high inflation economies, a few rules have emerged. These are going to be quite different from what you are taught in conventional personal finance and investment classes, modeled around a steady low inflation regime.

Your job is to play to defense, protecting your purchasing power at all costs during the high inflation period, so you can deploy capital and make money when the inflationary episode passes. You never know how long and high the inflation can persist. And 7-10% inflation compounded over a decade is a catastrophic loss of purchasing power for one dollar. Or it can get really out of control – as one Argentine once told me “In my career, they’ve added fourteen zeroes to the Argentine currency”. That’s a lot of inflation.

A perfect parallel to this is the USA from the late 1960s to early 1980s. Inflation quickly rose and persisted at high levels from 1967-1982 until Volcker finally killed it. The Dow Jones Industrial Average hit 1000 in 1966….and again in 1973…..and again in 1980…..and by 1982 was below 800. In nominal terms, it was flat. In real, post inflation terms, it was a huge loss. At the same time, the price of gold, when it was legalized in 1973 was $35/oz and went to $800 in 1980. If you had just sat out and played defense in the 1970s, you could have bought a ton of stocks at the lows in 1982 and ridden them for a 25 year bull market.

Find a Harder Currency, Fast

This is usually the foremost issue to people in a high inflation country. In Turkey, as the lira has crashed 50% this year versus the dollar, as imported goods become more expensive, inflation is rising to near 40%. Interest rates at the bank are 15%, nowhere near compensating you for the risk. If you live there, you have to move your money to dollars or gold or something else in order to preserve your purchasing power in lira. Ten years ago 1.7 lira equaled a dollar. Now, it takes almost 20 lira to buy a dollar. If you were a saver in lira you got decimated in real terms.

Turks hold $300bn of USD and Euros in Turkish banks, and the number should increase. But, in US dollar terms, the Turkish stock market is down almost 90% from its highs, so anyone sitting on dollars will be able to buy Turkish assets now at an enormous discount.

For US investors currently, as they greatly increase the supply of USD, your cash savings should be in gold, silver, bitcoin as they are supply limited, whereas the supply is rapidly expanding in USD.

Own Assets, but be careful

Inflation is great for asset owners- if there are 50% more dollars and the building you own is the same, all things being equal, it should be up 50% in dollars over time. It will keep pushing asset prices higher over time. Same with stocks. However, you have tochoose carefully.

In a high inflation environment, interest rates inevitably rise to match the high inflation. Therefore, anything that is valued like a bond, with a long steady stream of cash flows, actually sees its valuation contract. So, own stocks, own real estate, own precious metals, own crypto yes, but be careful to avoid the most interest rate sensitive assets. Many tech stocks, because of their long termpredictable cash flows, are valued as bonds. Because rates are low, they trade at high multiples of 20-30x sales. Avoid.

And also accept that prices in general will rise, but valuations of business (things like price to earnings, price to sales etc) will come down as interest rates rise. That means, do not overpay on a multiple for something just to own an asset. Try to find a reasonably valued asset today that can benefit from rising inflation and rising commodity prices.

Debt is Your Friend

One huge benefit of the current regime is that inflation is running hot, but interest rates are very low. This represents an enormous benefit to asset owners who use debt in this time period before they rise to match inflation.

Imagine this, you own an apartment building. You can raise rent 10% a year, in line with inflation, while your mortgage is 3-4% per year. This is going to cause your net profit to grow significantly over time, and the mortgage as a percentage of the property’s value to decline rapidly too. After ten years of this, the debt will have been essentially ‘inflated away’. Obviously do your work and run your math, but know that the inflation tailwind is at your back.

Decoding has an Argentine friend who mortgaged an apartment in Buenos Aires in 2012 with a 15% rate, in line with inflation, at an 80% loan to value in pesos for roughly 200k USD at the time. The currency was ~8 pesos to the dollar. He moved the cash from the mortgage into USD. Now the apartment is roughly the same value in US dollars, trading at replacement value, the US dollars are the same value, but the peso has gone from 8 to 200 versus the dollar. His mortgage is now essentially zero in dollar terms.

Decoding knows Venezuelan developers who built an apartment building with subsidized loans from the government. They took all the money upfront, bought their materials, built the building. They sold 20 units, got paid offshore in dollars, and then kept the remaining 4 units to live in. Their loan two years later was effectively zero in dollar terms due to the crash in the bolivar. That’s how you play the game in high inflation environments.

Inflationary Hot Potato

While we are not there yet, when inflation really gets going, you will want to hold zero cash and buy anything to preserve purchasing power. The prices of collectibles, art, cars, and crypto are all up massively in the past two years – why? That was where the massive money expansion went first. As it continues to circulate, we could see a rise in consumer prices similar to those assets. In that case, the prices of TVs, furniture, etc would be up 30-50% in a year as well. Basically anything that can be traded and is paid for in a harder currency will go up in price.

We remember once meeting a young Zimbabwean working during their 2008 hyperinflation. He said that he spent half his paycheck on the rent/bills/essentials, and the other half on buying TVs. He had thirty TVs and growing around his apartment. They depreciate far less than the currency, and he can sell for dollars when he needs to – so why not? When you enter a crazy high inflation environment, decisions like this become utterly rational.

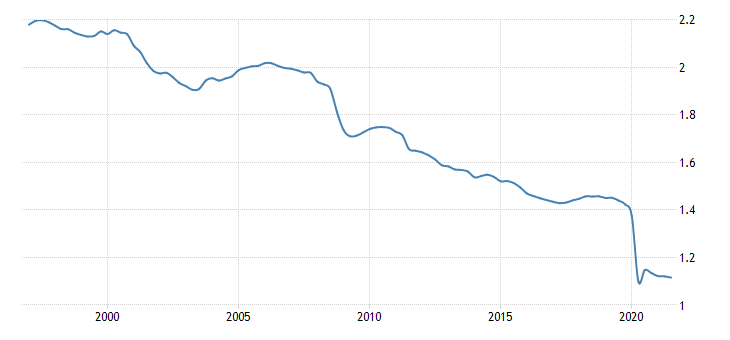

The measure of how fast money is circulating is known as velocity of money. The reason inflation has not gotten out of control, yet, in the USA is because despite the enormous money printing over the last 12 years, the fall in velocity has largely offset it. Indeed, velocity has fallen almost continuously for two decades.

US Velocity of Money

If this were to begin to rise, then the inflationary hot potato game would begin, and in order to protect yourself, you would have to buy everything when money comes in and sell it as late as possible. Owning extra TVs and furniture would not seem too crazy. Watch this variable closely to see if an inflationary mindset is beginning to set in. Velocity rising to pre-COVID levels would cause multiple years of 10-15% inflation. Velocity going back to 2010 levels would essentially cause a doubling of overall prices. So be careful and keep an eye out for a change.

Avoid Bonds, Cash Fixed Income at All Costs

If you take away nothing else from this article, let it be this. This inflationary episode, where it goes higher for longer, is going to cause a disaster for anyone holding cash and especially long term bonds.

Bank interest rates at zero and inflation at 7% means your cash loses purchasing power each year. Similarly, the US ten year bond yields 1.41% and the thirty year 1.81% as of this writing, far less than inflation. If you own US bonds or hold cash, you are getting stolen from each year because of inflation.

But the worst part is what’s known as duration risk. Bonds are basically math formulas in security form. There is a schedule of payments and dates to them. From that, you can calculate the sensitivity of a bond’s price changes to the level of interest rates. In the industry it’s known as duration, the change in a bond’s price per 1% move in interest rates generally.

Bottom line, if long term bonds’ interest rates were to rise to the level of inflation, it would represent a loss of 60% or more of your principal too. Many developed world countries have issued 50 year and longer bonds, which will constitute a total wipe out. And that is with current inflation rates. If inflation were to be higher for longer, the damage would be even more intense. And if we are wrong, and inflation returns to 2%, you are still just breaking even for the next thirty years.

Owning bonds here is a massive risk with very little compensating return. Bonds are also the underlying asset for so many things. Many pension funds maintain half their asset in bonds. Insurance contracts, especially whole life, are supported by long term bond portfolios. Many assets are priced off of long term interest rates, so buying apartments at a 2% cap rate now may into an 8% cap in the future. And so on. Avoid fixed income and its many related assets.

If you need yield and income, there are a ton of other ways to get it out there in high yielding stocks or other solutions. Energy and mining stocks offer high dividends and exposure to the inflationary cycle. Conventional fixed income should be sold tomorrow and avoided at all costs.

Inflation nearly always yields to ‘Unconventional Measures’

When inflation really starts moving though, governments love to slap on the restrictions. High rises in rent see cities establish rent controls. Inevitably price controls come in on consumer goods, like Nixon imposed. The government also famously regulated oil prices in all sorts of manner in the 60s and 70s so as to avoid too much inflation. And gold and silver were banned until 1973. The UK during the inflationary 70s had capital controls- you could not take out more than 50 pound sterling a year. And so on. So be careful with putting all your eggs in real estate. Diversifying between say a couple of foreign currencies, gold and silver, commodity stocks and real estate should serve you well. The government cannot punish all of these at the same time.

In many developing countries, countries and companies would have to borrow in dollars to access international markets. Yet, the local economy was in another currency- pesos, cruzeiros, bolivars, lira, whatever. That meant that when inflation hit the purchasing power of the local currency, the burden of the dollar debt would grow and grow. Eventually, the burden became so high that the country would either a) confiscate any dollars held by citizens in the country (Argentina, Mexico etc) to pay it backb) default and get kicked out of international markets for a time c) forcibly convert one currency to another d) heavily tax transactions in another currency. The end game in a high inflation environment nearly always involves some mix of the minor restrictions and these major realignments. Keep your eyes open as the inflationary process gains momentum.

How to know when inflationary period is ending

Now that we have seen how the inflationary episode starts and continues, you will likely wonder – how do you know it’s over? What are the signs that the inflationary wave is cresting and it’s safe to ‘invest normally’ again and to dump all your inflation hedges?

A credible shift in a government or monetary authorities to an anti-inflationary regime

The classic example here is Fed governor Paul Volcker. He was appointed in 1979 to run the Fed and began to implement policies to get then double digit inflation back to normal. After some experimentation, the policy bit in hard. There was a large recession, positive real interest rates, long term yields hit mid-teens, but it worked. Inflation began to come down. It reached below 5% in 1982 and then down to 3% by the end of Reagan’s first term. He had become a dragon slayer.

What did he do? He set interest rates well above the rate of inflation. The Fed at times targeted the amount of money in circulation and tried to keep its rate of growth in the low to mid single digits, well below the high rates of the time. Even though there was a steep recession, they did not take their foot off the brake.

It took a new government, a new central bank, and the Plano Real in Brazil during the late 1990s/early 2000s. But it got inflation from the mid 20’s in 2000 below 5% by 2005. It took linking the peso to the dollar in 1991 Argentina, but it worked in a year.

What this means is that the US is going to need either a tight money President, or a new Federal Reserve board committed to minimal balance sheet expansion and positive real rates. Not likely any time soon.

A new regime enters and restores confidence

While this may sound like the same point, it’s subtly different. Sometimes, countries can have good fundamentals but have a leader that the market hates or with a destructive policy. Often times, all that is needed is to replace the old regime with a new, and the subsequent ‘benefit of the doubt’ sees capital flow in and expectations go back to normal.

Under Thaksin Shinawatra, Thailand handed out money to lower classes and ran the fiscal spending very high. Inflation rose both times he and his party were in power. When the military kicked him out, inflation immediately fell. It has been around 1% or lower for the past seven years with his party out of politics. Thailand had implemented no comprehensive reforms, new currencyor anything like that. It was simply the existing policy mix minus Thaksin and his over spending.

Currency euthanasia

This one is a remote scenario for the time being in the USA, being the world’s reserve currency. But often times, countries with hyperinflation just see people stop using it one day. No matter how hard governments try, you reach a point where no one can or wants to use it. In 2008/9, Zimbabwe dollars just stopped being accepted. Everyone used what little South African rand, US dollars, British pounds, etc that they had. Or they bartered. But even though it was legal tender its purchasing power had crashed so much that it died a natural death.

In Venezuela last year, we reached the same point. The government admitted it could not print bolivars fast enough or at high enough denominations. So they allowed people to use whatever they want. Effectively, the country dollarized overnight. Little markets popped with paying in Square. Money was moved around via crypto. Slowly but surely, living standards have improved.

If currency euthanasia were to hit the USA, I would imagine that people would transact with each other via crypto or a precious metals back international currency, and only use dollars for mandatory items like paying taxes and government fees.

The government calls in the IMF

When governments get into fiscal trouble, they get bailed out by the International Monetary Fund (IMF). This is not just a third world bailout- we saw IMF money go to Greece multiple times, Ireland in 2010, the UK in the late 1970s, South Korea 1997/98. When the IMF comes in, you know that anti inflationary policy is here. They will routinely hack government spending, impose an inflation crushing regime, and keep a firm hand on the reins for five to seven years. If you are in a country with an inflation problem and the IMF’s helicopter lands, you can be sure inflation is coming to an end.

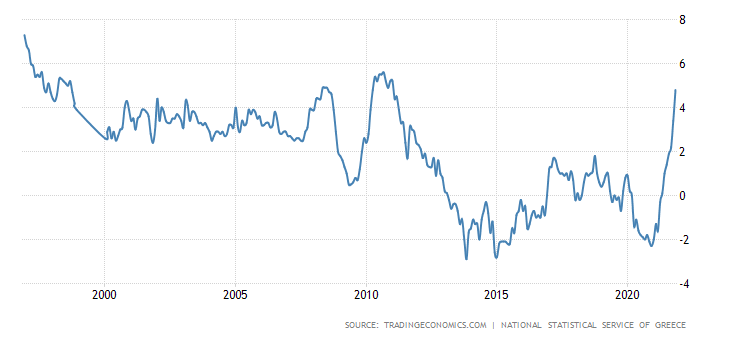

Greece called the IMF in 2010, and had ten years of essentially zero percent inflation. The recent inflation globally and stimulus boom have sent the 2021 rate soaring.

Greece Inflation Rate- 2010 IMF involvement

Politics of Inflation

In the short term, governments love inflation. It pumps up economic activity, they spend the money first, they reduce their debt load in real terms. Medium term and long term, when the cat is out of the bag, it comes with numerous risks. Policy becomes increasingly erratic. Popularity of the government erodes as people see their purchasing power eroded. And often times, harsh measures have to come at the end in order to patch things back together.

How the current Biden administration and Powell Fed will handle the burgeoning (and likely rising) inflation remains to be seen. But it looks highly likely that these guys will do too little too late. We will likely only see a major shift in 2025/26 with a new Fed chair and President, if those happen. And even then, it will take time to construct and implement a new policy mix. Best to get out the umbrella while it’s raining money.

Subscribe to our evening newsletter to stay informed during these challenging times!!

Wow, thanks for the gravity.

Russell Napier is an excellent historian of markets and finance. He did an interview recently explaining why he has changed from a disinflationist to an inflationary guy. Just excellent stuff all around, and such a great historical perspective.

https://www.youtube.com/watch?v=hJg7lkJVdh4