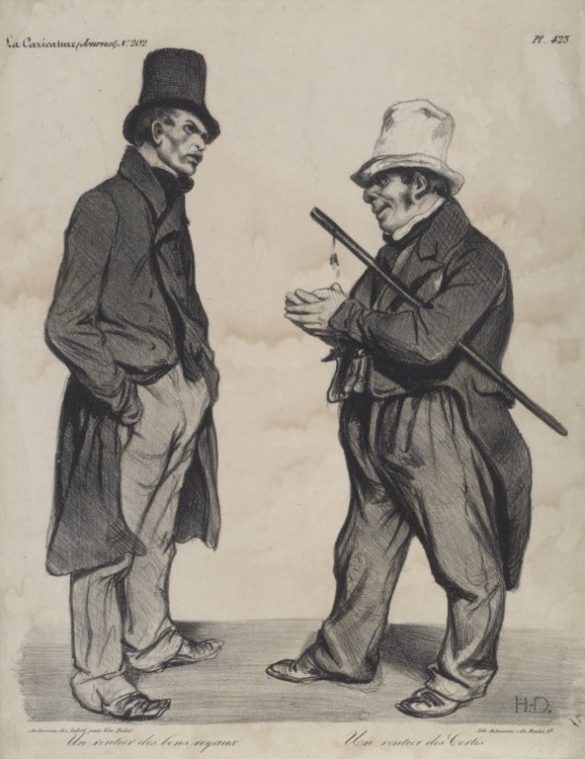

Not so long ago the world belonged to the lenders. Now it belongs to the borrowers. The French had a whole category of people they called “rentiers”. Far from being renters, these were the beneficiaries of rents. In other words, these were people who had wealth in the form of real estate, or bonds, or shares in private businesses, or dividend-bearing stock in publicly traded companies and they lived off of the rents that they collected from letting other people use their wealth. The rentiers were the French middle class and thus they were the backbone of the French state, of France itself.

This situation was normal for all democracies countries; the truly rich were too few in number to matter, the truly poor usually didn’t vote and so it was the middle class, which had the right balance of wealth and numbers that the politicians had to pander to. The middle class was a class of small-time owners. Its members owned more than they borrowed, in other words they had positive net worth. Many of them derived a substantial part of their incomes from letting others use their wealth whether in the form of rent from real estate or rent from money.

Middle class people had savings in banks, which paid them interest because it was from these deposits that banks could make loans to individuals and businesses that needed credit. In that sense, banks used to be intermediaries, agents really, acting on behalf of small investors to bundle up their deposits and use them to extend credit to those that needed it. For their services, banks collected a fee in the form of a spread between the interest that they charged their borrowers and the interest they they paid out to their depositors.

Some middle class people, especially those in the upper echelons, could avoid the bank intermediaries and lend their money directly to those that could make use of it in the shape of valuable paper such as stocks and bonds. While the former entitled the lender to a share of ownership in the borrower’s business and the latter did not, in practice these instruments were not very different. Bonds yielded guaranteed fixed income, capturing less of the upside, but also providing less exposure to risk, while stocks paid dividends, which could go up if the company was doing well, but also down all the way to zero if it was not. Nevertheless, stock investment back then was more about the dividends than the idea that a company would grow in value making the stock itself more valuable and allowing for speculation or arbitrage in the company’s shares, which is at the core of nearly all stock investing today.

To summarize, middle class Western families had little to no debt and derived a portion, sometimes a significant one, of their incomes by letting others have the use of some of their assets. This economy is now all but gone. Today, Western middle classes are neck deep in debt with little to no positive net worth and the little they have is only the result of property and equity prices that are inflated beyond all measure. Should real estate and equity prices be restored to their 20 or 30 year averages, there would hardly be a middle class family in America, in Canada, or in Western Europe that would not find itself with a highly negative balance sheet.

This shift is a tectonic one. It transformed Western politics from belonging to those with wealth, in other words to lenders, to those with debt, in other words to borrowers. The very rich are still few in number, but the two other groups, the middle and the bottom are radically different. The middle class is now a class of borrowers and the poor were taught how to vote. Together, these changes turned Western politics and policies alike upside down. In the past, reasonably high interest rates in the 5% range and low liquidity were desired by the most influential voting bloc because it was comprised of asset owners who wanted a high return on their assets and a restricted supply of additional liquidity. Today, the two largest voting blocs, the middle class and the poor require zero interest rates and unlimited money supply because they pay rather than receive interest and because such assets as they may have, i.e. speculative stocks and real estate can only maintain their inflated values in a zero (in real terms, negative) interest rate environment and an unlimited money supply. The negligible cost of borrowing and bottomless liquidity not only allow for more consumption, they fuel business growth, which in turn drives up share prices, and so on.

This could be a virtual spiral had it been in the least sustainable. Alas it is not. Stable systems, control theory teaches us require two things: a tendency to return to an equilibrium point if left alone after having been disturbed and some degree of friction that syphons off energy, keeping them from oscillating forever. While a return to stable equilibrium seems like an impossible goal right now, introducing some friction into the economy is all the more desirable.

This inversion of common sense, this state of affairs in which unless you are a very wealthy person you cannot benefit from assets that are not either highly speculative or inflated, creates a radically different international environment, one that is quite unprecedented in human affairs.

Whereas before governments wanted people and businesses to hold sovereign debt denominated in their currency because it helped maintain the relative value of their currencies, now they can no longer do that because that would imply higher interest rates, rates that would make their highly indebted voters unable to service their debt and cause a systemic collapse of their domestic economies. So today, governments do the opposite. They make you pay them to denominate your assets in their currencies rather than paying you for doing so. Naturally, you may want to say no thank you to that idea and they are just fine with that because it devalues their currency, which is precisely what they want.

In the interconnected globalized economy, as president Trump constantly mentions, devalued national currency is the new gold standard. It is a race to the bottom, except the bottom does not really exist. As long as your country is fortunate enough to produce products and/or services that are sufficiently high value add and/or have a sufficient degree of vertical integration, you are golden because most of the cost of adding value is denominated in your devalued currency, while the eventual finished product or service is exported and thus paid for in (that is the hope, anyway) less devalued currencies. The spread between your devalued currency and your customers’ less devalued one is the new interest rate spread.

Consider for example the cases of Germany and Brazil, both targets (or potential targets) of Trumpian tariffs. Germany does not have significant natural resources, but it has a tremendous base of intellectual property, a highly skilled workforce, and a large base of fully paid for manufacturing infrastructure. With these items in place, it can buy raw materials even at higher prices because it then adds a ton of value to them on its own soil using cost basis denominated in euros, the value of which it substantially controls. It helps that when it comes to Germany’s crown jewel, the automotive industry, it sports a high degree of vertical integration from spark plugs and ball bearings to Audis and BMW’s.

Brazil may not have all the benefits that Germany does (though it is a highly industrialized country with a highly developed aerospace sector), but it is a vast country with a tremendous amount of natural resources. The Brazilian steel and aluminum that Trump has now slapped tariffs on may not be, at first glance, as high value add as a Mercedes Benz, but considering that the iron ore originates in Brazil, Brazilian steel has sufficient value add and vertical integration to become a player in the “let’s see who can devalue their currency more” game.

When you are a sovereign like the US, you can use tariffs to offset the effects of currency devaluation by your trading partners by making the real cost of their exports to you equal that which it would have been had their currency been less devalued. If you are a large enough market, like the US certainly is, you can use tariffs to substantially supplant the currency manipulation ability of those governments whose economies depend on exporting to you. Theoretically, you can set the tariffs at any point that makes the cost basis of the products subject to them to be virtually denominated in your own currency for example.

Reality is of course more complicated. Tariffs on imports make things more expensive as long as they have a large percentage of imported components or raw materials as most things Americans buy do. In a zero interest rate environment where everything is bought on credit, this hardly has an effect, at least in the short term. If you pay for your car over 72 months same as cash, do you really care if your monthly payment is $20 higher? Tariffs also force American manufacturers to become more vertically integrated and that creates good, stable, high-paying jobs for Americans.

One thing tariffs are not is a tax, no matter how many times so-called conservatives and never-Trumpers repeat that mantra. The tax comparison is particularly misleading because when most people hear that word in America they think of income taxes, to which tariffs are completely unrelated. The real effect of tariffs in today’s borrower economy is more akin to a slight bump in borrowing costs or in taxes on consumption like sales tax. Both effects are easily offset by increased domestic manufacturing and the actual revenues from tariffs that help maintain government revenues even in the face of lower taxation on income. This makes tariffs a double win for America, but wait, there more!

Tariffs are a must in today’s economy if you are a large manufacturing economy with large internal consumption base like America because the bottomless devaluation of their currencies by your competitors will lead to the decimation of your manufacturing base and the development of a dependency on foreign suppliers and the cheap goods that they dump on your market. In the past, raising interest rates to curb consumption, cool down the economy, and reduce imports was an option, but now that most voters are in debt, it is all but unthinkable. Furthermore, raising interest rates will increase the value gap between your currency and those of your international customers, making it even more difficult for your own manufacturers to compete on the world stage.

This leaves only two instruments at your disposal to stop your already overly indebted, zero interest rate economy from becoming further inflated by cheap foreign goods. One is lowering your own borrowing costs by cutting interest rates even further and increasing liquidity, which would devalue your currency compared to those of your suppliers. The other is slapping tariffs on imported goods, virtually increasing the value of their currencies as related to yours. Trump has been publicly pushing the Fed to do the former and he himself has been busy doing the latter.

The global race who can devalue their currency more and provide even more liquidity to their own borrowers is a dangerous game of flooring the gas pedal when your car is already barreling downhill. Tariffs are a brake. They are friction. In a global economy that is unstable and diverging, tariffs at least slow things down.

While the wisdom of simultaneously stepping on both the gas and the brake pedals by increasing liquidity, lowering rates and slapping tariffs on imported goods can be debated in the long term, in the short term taking the foot off the gas is simply not possible without driving the American economy into a recession or worse. America cannot right now return to historically normal interest rates without a collapse in real estate and equity markets and suffering as a result defaults, unemployment, and economic contraction on a massive scale. Kudos then to president Trump then for giving this runaway train at least some braking action in the form of tariffs. It’s the right things to do.

Subscribe to our evening newsletter to stay informed during these challenging times!!