The free market is no more, leaving only a finance ‘capitalism’ consisting substantively of ‘financial markets’ that are being prepped for something called ‘market socialism’, which, in turn, cannot, by its non-existent nature, actually exist. Yet this is the economic goal of the liberal left progressive, whose agenda, above all, is to preserve the wealth of the super wealthy—i.e. the platitude-rich tech billionaire on the west coast, ‘Fed Street’ on the east—both of these the American political socialist’s closest allies and truly most useful idiots. There is no contradiction here, as communism and socialism have always despised wealth because they can’t help but covet it, fully aware that such ideologies could not have existed without capitalism, as it once was known.

This will take place on two levels: an increase in the Welfare state, in which technological advances such as in automation will be seen as necessitating a ‘safety net’ in the form of guaranteed handouts, and welfarism’s next-generation iteration, the Reparation state.

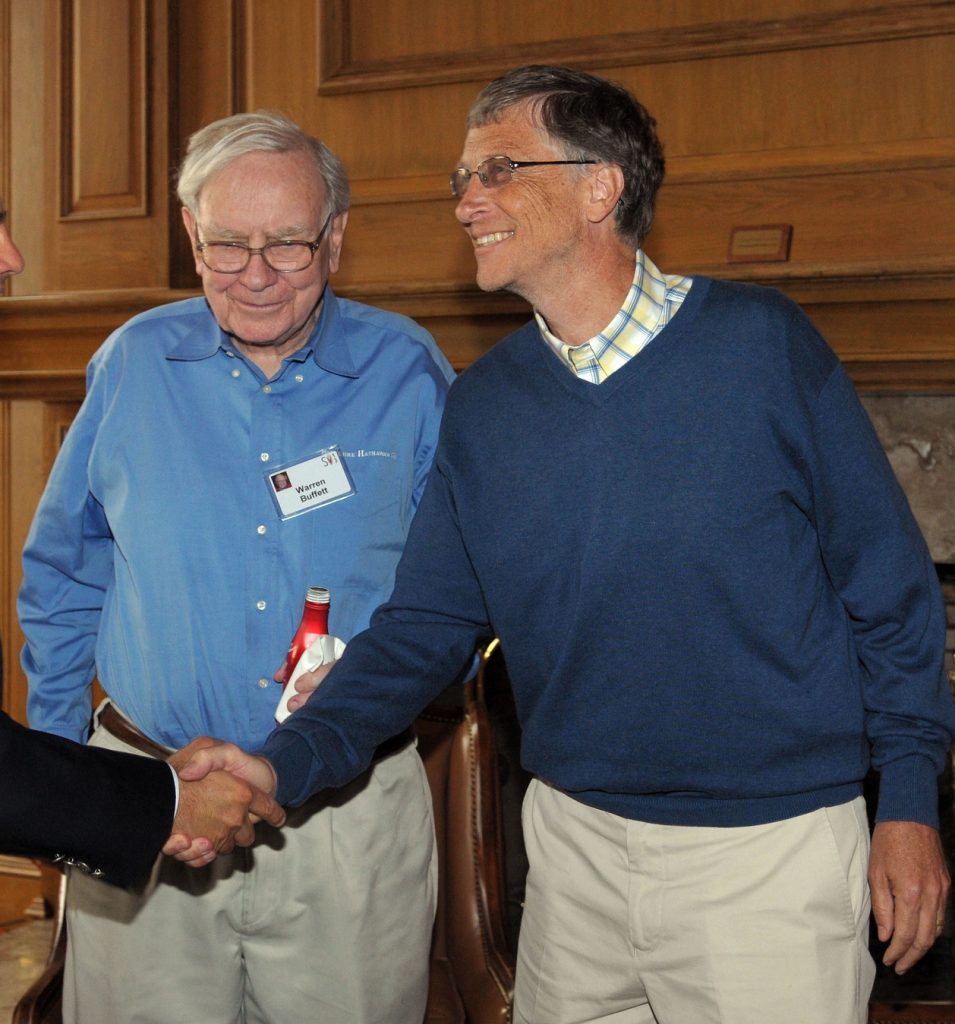

In the former, several influential investors have joined philosophically with the likes of Bernie Sanders and Elizabeth Warren—notably, figures such as Ray Dalio, Warren Buffet, Howard Schultz or Bill Gates—who are still old-school enough to defend capitalism, but with appropriately zeitgeist appeals for higher taxes and investment in public education. The grandstanding tends not to go beyond this point, however, with little investigation considered as to how the higher levies will be applied or what the nature of ‘public education’ might look like. However, these are the more mild reformers.

More aggressive is the idea of a universal basic income touted by the tech world. In 2017, Mark Zuckerberg at a Harvard commencement address supported this idea of income, as did Elon Musk a year before, saying that automation would be so severe that the government would have to pay people to live. Sir Richard Branson, as well as the founder of social media giant Slack and funding platform Y Combinator have joined in with their support, arguing that hand-outs would end poverty. Stockton, California, set such a program in motion recently, funded entirely by private individuals and the Economic Security Project out of Silicon Valley, and other cities such as Newark and Chicago are lining up as well, as are the Democratic presidential hopefuls as part of the cheering squad. Yet where this idea has been tried—in Canada, Europe—the funding has proven a bureaucratic nightmare and have quietly ended. For example, Finland piloted a universal basic income program with unemployed people, yet it did not help to improve employment prospects. When officials asked for more money, it was rejected. Alaska, touted by Zuckerberg, pays a $1000 a year oil dividend to each resident, but this is not ‘basic income’ and it certainly is not enough to maintain any kind of living standard. Moreover, the median income in the state is $73,000 and is not a state rife with disparities and unemployment.

Reparations as part of a policy platform will continue to gain momentum and in this form, the black-mark of social dependency will be transformed into the honor badge of social justice. Redistribution, in this sense, will take place through slippery confiscations in the name of correcting ‘economic inequality’, ‘institutional racism’, prelapsarian ‘white privilege’ and generally anything that ‘offends’. Both welfarism and this kind of ‘payback time’ community financing will sky rocket together: with welfare, the eventual Baby Boomer social security outlays atop an increasing number of minorities on federal aid; with reparations, a new form of entitlement mentality that will guilt-trip its way into acceptance.

How sad to note that only thirty years ago students at the Karl Marx Institute in Budapest were writing glowing dissertations of F.A. Hayek and the voters of (then) Leningrad, Gdansk and Tiananmen Square saw in the expression ‘free market’ a kind of venerable concept, one now cynically mocked even by its once most ardent philosophical defenders. F.A. Hayek wrote in The Fatal Conceitthat socialism was doomed from the outset. It was wrong about the facts of man and society and therefore not only did it fail as a system within itself but threatened those who lived under it. Yet, as with every passing decade, few seem to learn this lesson and the progress of capitalism that has not conferred blessings on all who expected it to trickle down to them. These are the groups that still demand their place in the sun, demand it ‘now’, and through handouts or re-distribution. This time, they have the mega-capitalists on their side.

That extreme wealth-producers in the U.S. are complicit in this monstrous development may seem counterintuitive, but it is they who, in fact, more than their ideological opposites, are in large part responsible for this ruinous mindset regarding wealth. The economic trends encouraging such thinking include: a) an inflated sense of value where little to none exists; b) the lack of a fiscal culture of accountability and consequence; c) money for nothing and, (apologies), your sh*t for free.

At the foundation, it is a situation that no economic model, or Mr. Trump’s stock market, or Fed ‘policy’ can fix. It is, rather, a new nasty outlook, rooted in rotten education and the fertile soil of a fat, exhausted land. It is also truly un-American.

In 1907, there appeared an intriguing monograph by Walter Sombart, a contemporary and associate of-Max Weber, entitled, straightforwardly, Why There Is No Socialism in the United States. This important, though not well-known scholar was curious as to why the country most ripe for a worker’s revolution to secure the prosperity then exploding at the seams the country, was not undergoing such historical ‘inevitability’. The most compelling of Sombart’s answers, as one reviewer noted, was that in America, collective action was not needed to change the condition of the individual. The frontier mindset meant that individualism could satisfy aspiration by one’s own efforts. Sombart detailed four main arguments for this: first, that of the great vigor of capitalism in America at the turn of the century; second, that unlike those European nations at the time, the U.S. was almost completely dominated by the spirit of competition that cut across class lines; third, that the American worker had a favorable attitude toward capitalism as a whole, and, fourth, that he had a high regard for the American system of government and his own participation in it.

Fast forward to today, in which classic capitalism has morphed into a funhouse-casino strangulating into a bloated social welfare program—a phenomenon to which politicians, such as the notable suspects mentione above, have adjusted their antennae. It goes by the name, as these delicate transitions must, of ‘reforming capitalism’. Former Colorado governor John Hickenlooper turned presidential hopefull is one such proponent, convinced that such ‘reform’ must consist of more government programs, free tuition and ‘aid’ all around. Certainly, however, if Mr. Hickenlooper cared to save capitalism’, he might consider the need for enhanced individual responsibility and not more government programs. For if, in fact, as he notes, 40% of the population cannot cover an unexpected $400 expense and there is no honest analysis of why this is the case, no society is going to feel the effects of ‘reform’ of anything. As one reader of The Wall Street Journal noted in a letters column on Governor Hickenlooper’s proposals: “Government isn’t stopping people from saving money. Capital gains and inheritance tax rates have nothing to do with the issue—bad decisions do”. The reader added: “All the free college one can eat serves no purpose if the students don’t apply themselves or study material which enhances their marketability.”

Yet such political leaders are but the philosophical-policy parrots of a fiscal culture that has skewed notions of what ‘value’ means, or for that matter ‘profit’ or ‘market realities’. If these politicians live in fantasy land, it is modern American capitalism that has paid their entrance fee. Uber, AirBnB, Lyft, Postnotes…it appears that the app as future of the economy is here to stay, yet how few seem to understand the economics of such companies—or if the companies themselves understand. Pre-IPO Uber was valuated at $180 billion, yet showed little in the way of actualprofits; Snap went public to great fanfare but, as of this writing, is trading at $11; while Groupon, another highly touted IPO, is trading at $3.

To take an example, when the exercise company Peloton went public, one respected private banker in New York was offered to participate in a several hundred million dollar bridge financing that valued the company at $4 billion. The banker regarded the valuation as thoroughly ridiculous, yet when the bridge financing closed and the company picked Goldman Sachs and JP Morgan to do their offering, the valuation was set, only four months later, at $8 billion, without the firm creating anywhere near that newly doubled value.

Amazon, the greatest wonder of them all, trades off and on at 150 or 200 times income. As David Stockman, the former Reagan official turned investment banker turned bête noire of both Washington and Wall Street, noted in a March 9, 2019 podcast interview with The Wealth Standard:“If [Amazon] were valued rationally, it might be worth $5 billion. At $5 billion, [Amazon founder Jeff Bezos] would have one kind of business model. A growth strategy for Amazon at $150 billion is something totally different.” Stockman added: “We’re not getting just creative destruction, we’re getting just pure destruction.”

Where did this come from? Essentially, Wall Street’s own hand-out culture. Malinvestments are badly allocated business investments, due to the artificially low cost of credit and an unsustainable increase in the money supply, in turn causing bubbles caused by the central bankers. In this context, it is important to remember that the magic of the gold standard was that it was not about the magic of gold but about accountability and discipline. After 1971, when Nixon took the country off the gold standard, the concern was this would do to tempt central banks to run amok with the financial system. For during the reign of that standard, one could not create credit and money at will in any quantity. In the words of William McChesney Martin who was Chairman of the Fed at the time:, “You can’t print your way to prosperity. As Mr. Stockman points out, our real GDP growth rate now is 1.5% compared to 3% to 4% “back in the heyday before 1971 when Nixon took us down the path we’re on.”

Hand-in-hand with the easy money hand-outs is the culture of debt, and debt as an acceptable form of wealth. With government debt estimated to reach $40 trillion by 2020, stagnation and increasing resistance to growth in the country at large are a given. In roughly nine to ten years since the onset of the crisis of September 2018, an estimated $3.5 trillion of central bank credit was made out of thin air and pumped into Wall Street in turn causing the price of bonds to soar because of all of this artificial demand from the debt. “Wall Street has learned to love money burning because, in the short run, it helps to inflate financial assets. It made interest rates lower. It made capital rates and our P/E multiple times and everybody lived happily ever after except Main Street”, states the author of The Great Deformation, maintaining that since Alan Greenspan, the U.S. economy has been living in what he calls “bubble financer Keynesian central banking”. As Mr. Stockman succinctly sums up the situation:

“You need very honest, efficient and discipline money in capital markets. If you have those, it will spread out to the rest of the GDP and the Main Street economy. The great trade market economist Joseph Schumpeter has this concept of creative disruption and that’s all capitalism progresses. Buggy whips go by the wayside and you get a horn on your automobile, your Ford, your model-T or whatever it is. That is important, but creative disruption is not working efficiently and productively if the financial markets are falsified by central bank manipulation and intervention. When they’re falsified and you get stock prices that are way too high, people are rewarded for doing the wrong thing where they should be doing something else.”

Yet with money so easily won and contemptuously regarded,it is no wonder that a mentality of entitlement persists among those with little knowledge of what great industry and industriousness is about or how a market—a real one—is supposed to function. And so the parasitical and praying mantis politicians swarm in, seeing no consequence for their trillion-buck environmental programs or social programs or ‘leveling the playing field’ programs, because it’s all digital hocus-pocus anyway and if some see-no-evil black hole debt of galactic proportions is incurred along the way—What of it?

What indeed. The biggest victim of all in this situation is, in fact, the market itself, in being blamed for a market it did not create. Ayn Rand used to say, ‘you can avoid reality but you cannot avoid the consequences of avoiding reality’. The only problem with that wisdom as it applies today is that when there are no consequences to the consequences, reality cannot possibly mean much anyway.

Subscribe to our evening newsletter to stay informed during these challenging times!!