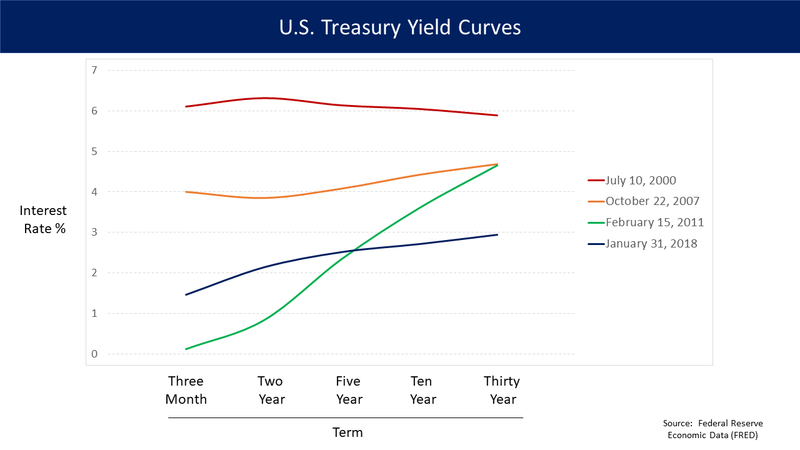

A reliable indicator of an economic slowdown showed itself today in the U.S. bond market as the U.S. Treasury yield curve inverted for the first time since 2007. This means there is more demand for bonds longer term than short term. In other words, investors are buying more longer term paper anticipating economic hardship in the future and looking for safety in U.S. Treasuries.

President Donald Trump lashed out once again at the U.S. Federal Reserve for raising rates too fast after Obama had rates at basically zero for eight years, allowing him to add more to the federal debt than all other presidents combined, doubling our sovereign liabilities.

The longer term worry seems to be sparked by fears of a global economic slowdown as Germany reported continuing weak manufacturing data.

It is worth noting the U.S. economy still continues to grow at a higher rate than during the entire Obama presidency. With pro-growth and pro-business policies, as compared to Europe's socialist model and China's misallocation of capital, America looks to be the only game in town for responsible economic policy under the Trump administration.

The Trump administration's attempts to correct predatory Chinese trade policy is also weighing on investors.

A U.S. trade delegation, headed by Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin, will visit China for a two-day meeting at the end of next week. Chinese Vice Premier Liu He is then expected to travel to Washington in early April. President Donald Trump said in an interview that aired Friday that talks were going well. However, he also said tariffs on Chinese goods would only come off once China complied with the agreed upon trade deal, reported CNBC.

Subscribe to our evening newsletter to stay informed during these challenging times!!