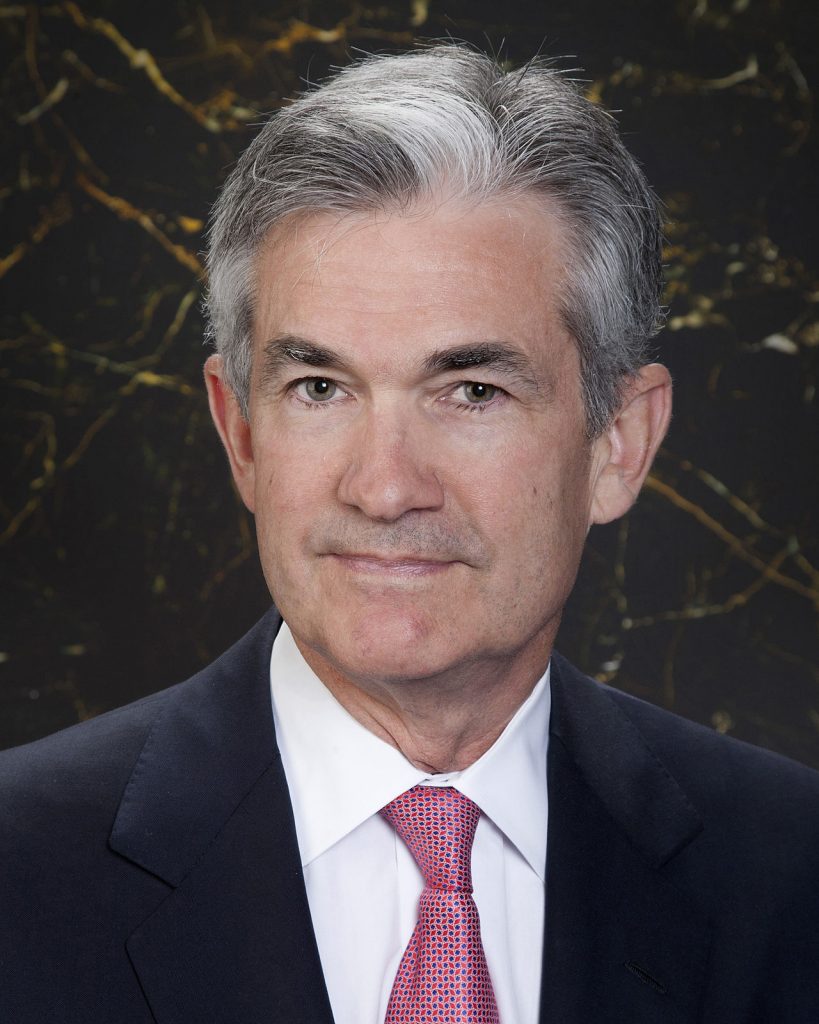

In remarks this morning, Federal Reserve Chairman Jerome Powell took a decidedly dovish tone, noting that "Uncertainties since the June FOMC meeting continue to dim the outlook" for the U.S. economy. He reiterated his pledge that the Fed would consider all relevant factors and "act as appropriate to sustain the expansion.”

Any outlying concerns that the Fed might skip a July rate cut were assuaged, and some optimistic investors may even take the comments as a signal that if global economic contraction worsens and U.S.-China trade tensions aren't resolved, a 50 basis point cut may still be in play, but the market has fully priced in a more prudent cut of 25.

Stocks moved modestly higher on Powell's comments.

Based on several factors, oil prices are up for a fifth consecutive trading session. September Brent (BRNU19) was up $1.53 to $65.69 a barrel.

The driving factors:

Subscribe to our evening newsletter to stay informed during these challenging times!!