Economic data released today was basically in-line.

Continuing Jobless Claims (Dec 27) printed at 1.803M vs 1.72M consensus estimate.

Initial Jobless Claims (Jan 3) printed at 214k vs 220k consensus estimate.

Initial Jobless Claims Four Week Average (Jan 3) printed at 224M vs 236.641 estimate.

However, another bubble is growing in the financial markets...

From Zero Hedge...

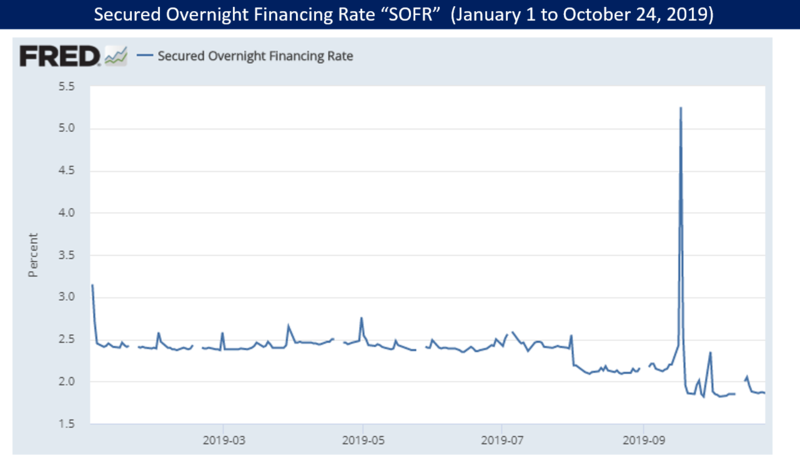

Yesterday we reported that with the Fed's first oversubscribed term repo in three weeks...

... coupled with a surge in amount of overnight repo submission, indicated that the funding situation in the repo market had again deteriorated sharply, which was odd since we are now two weeks into the new year and further away from the time when the repo market was supposedly in distress due to the year-end funding constraints.

Indeed, something appears amiss, because as Curvature Securities' Scott Skyrm writes in his daily Repo Market Commentary note, the total overnight and term Fed RP operations on Friday were greater than on year end! On year-end, the Fed had pumped a total of $255.95 billion into the market verses $258.9 billion on Friday...

To read more visit Zero Hedge.

Subscribe to our evening newsletter to stay informed during these challenging times!!

[…] Jobs Data Basically In-line But…Top Repo Expert Warns Fed Is Now Trapped: “It Will Take Pain To … […]