The Trump administration continues to churn out incrementally better numbers as far as leading economic indicators are concerned. Today productivity came in strong for Q4 and compensation continued to rise. Initial jobless claims fell.

Markets have rebounded strongly in the last several days as traders overlook the coronavirus outbreak in favor of a reduction in uncertainty with POTUS being acquitted, Brexit being finalized, and the easing of trade tensions with China.

However, this frame of mind, and current valuations, require everything to go right going forward. In other words, the markets are pricing in perfection

The virus is still raging across mainland China and the chance of a world-wide pandemic is significant. If the market focuses on this fact in the near future, a significant correction could be in the offing, which as we have said repeatedly, would be very healthy.

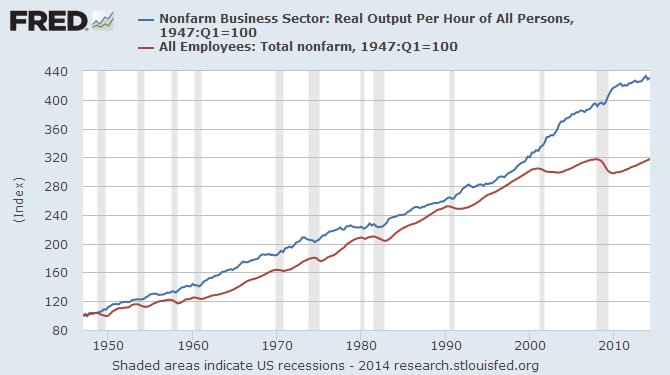

Non-Farm Productivity (Q4) PREL printed at 1.4%, below the estimate of 1.6%, but leaving the gain in YoY productivity for 2019 at 1.8%, the most since 2010.

Unit Labor Costs (Q4) PREL printed on the estimate of 1.4%.

Initial Jobless Claims (Jan 31) printed at 202k vs 215k consensus estimate.

Continuing Jobless Claims (Jan 24) printed at 1.751M vs 1.72M estimate.

The report showed inflation-adjusted hourly compensation averaged a 1.9% pace in 2019, the biggest gain since 2015, reported Zero Hedge.

As always, we are not giving investment advice, just our insights. Consult your investment advisor for your specific portfolio.

Subscribe to our evening newsletter to stay informed during these challenging times!!

[…] Economic Indicators Continue Their Positive March Forward…But…Be Careful Out There […]

[…] Economic Indicators Continue Their Positive March Forward…But…Be Careful Out There […]