Equity markets are limit down once again in pre-market trading as futures sink after President Trump announced a travel ban from Europe and the NBA suspended its season for the foreseeable future.

POTUS also announced help for small businesses and employees impacted by the epidemic.

We believe the market wants news of a bigger stimulus package, or a break in the Chinese coronavirus outbreak, before a sustained rebound is possible.

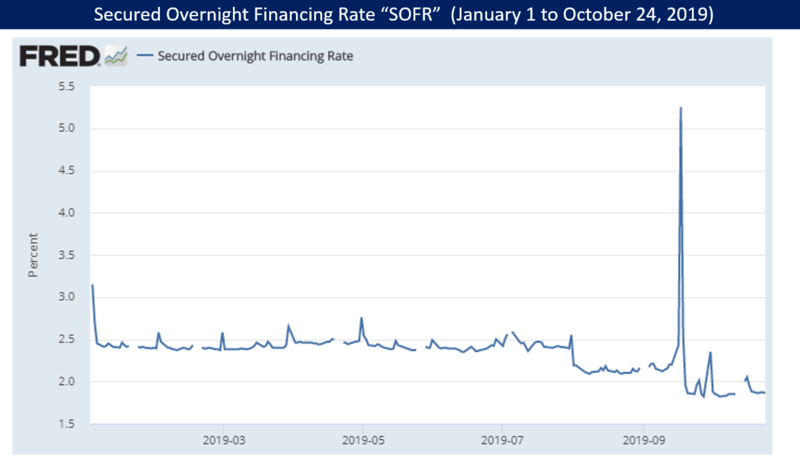

The Fed is also again opening the flood gates to support the overnight repo market which is drawing down tens of billions nightly.

The Chinese coronavirus is showing up in the pricing numbers this morning as PPIs came in below expected levels.

Producer Price Index (YoY) (Feb) printed at 1.3% vs 1.8% consensus estimate.

Producer Price Index ex Food & Energy (MoM) (Feb) printed at -0.3% vs 0.1% estimate.

Producer Price Index ex Food & Energy (YoY) (Feb) printed at 1.4% vs 1.7% estimate.

Continuing Jobless Claims (Feb 28) printed at 1.722M vs 1.723M estimate.

Producer Price Index (MoM) (Feb) printed at-0.6% vs -0.1% estimate.

Initial Jobless Claims (Mar 6) printed at 211k vs 218k estimate.

Initial Jobless Claims 4 Week Average (Mar 6) printed at 214k.

Subscribe to our evening newsletter to stay informed during these challenging times!!