Financial markets seem to be ignoring Democratic governor's calls to stay locked down and are moving significantly higher this morning. Perhaps Trump is playing tricks with Cuomo and the others, who now have to justify their plans to continue their citizen's pain while the rest of the country moves forward.

The S&P is up approximately 2.5% as we write.

This market action comes on the heels of a new depressing global forecast from the IMF regarding this year's economic growth, which declared world economic activity will shrink by 3% in 2020.

Many countries face a multi-layered crisis comprising a health shock, domestic economic disruptions, plummeting external demand, capital-flow reversals and a collapse in commodity prices,” the IMF said.

Oil plummeted again on the news, along with reports of production cheating by Saudi Arabia.

In economic news, data showed a deflationary trend as a result of the world-wide quarantine. Not much demand? Prices drop.

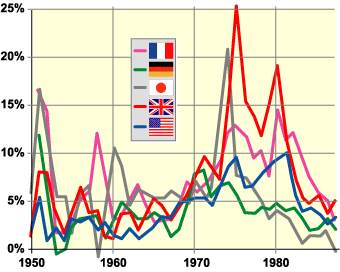

We at CDMedia feel that eventually the massive QE that is being implemented by the Fed (in Venezuela they call it printing money), along with massive Federal spending, will have an inflationary effect.

Import Price Index (MoM) (Mar) printed at -2.3% vs -1.7% consensus estimate.

Import Price Index (YoY) (Mar) printed at -4.1% vs -2.2% estimate.

Export Price Index (MoM) (Mar) printed at -1.6% vs -1.9% estimate.

Export Price Index (YoY) (Mar) printed at -3.6% vs -2.1% estimate.

Subscribe to our evening newsletter to stay informed during these challenging times!!