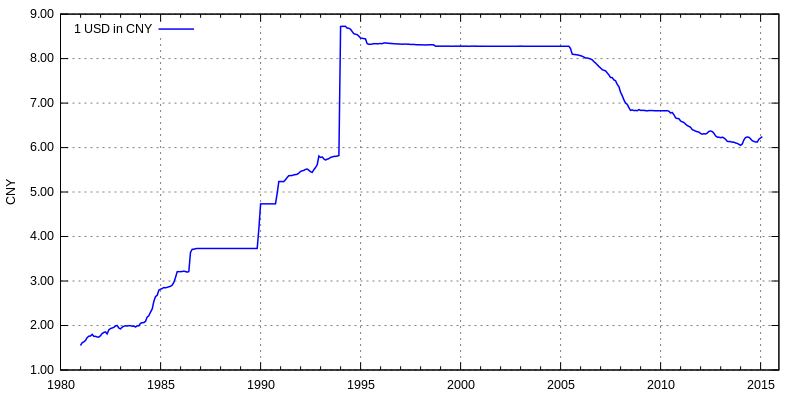

On Friday, following its week-long Golden Week (National Day) holiday, we noted that the onshore yuan (CNY) which had not traded since the previous Friday, soared the most since China's 2005 de-pegging - as it rushed to catch up to the recent gains in the offshore yuan (CNH) driven by a shift in market sentiment that a pro-China Biden administration may replace Trump, as well as the continued slide in the dollar.

This also resulted in the strongest Yuan print since since April 2019.

Well, it appears that Beijing also noticed the relentless - and deflationary - gains in the yuan since May, and on October 10th, the PBOC announced the reserve requirement ratio for FX derivative sales - which was introduced in late 2015 in order to stem fast FX outflows in the aftermath of China's devaluation - would be reduced from 20% currently to 0%, effective October 12th, in a which Bannockburn Global said was "an attempt to moderate the yuan's increase", and which Goldman said "likely signals the PBOC's discomfort with the recent rapid appreciation of CNY" as the relaxation of the reserve requirement itself would lower the cost for FX liabilities hedging and encourage FX derivative sales (which represents FX outflow).

To read more visit Zero Hedge.

Subscribe to our evening newsletter to stay informed during these challenging times!!