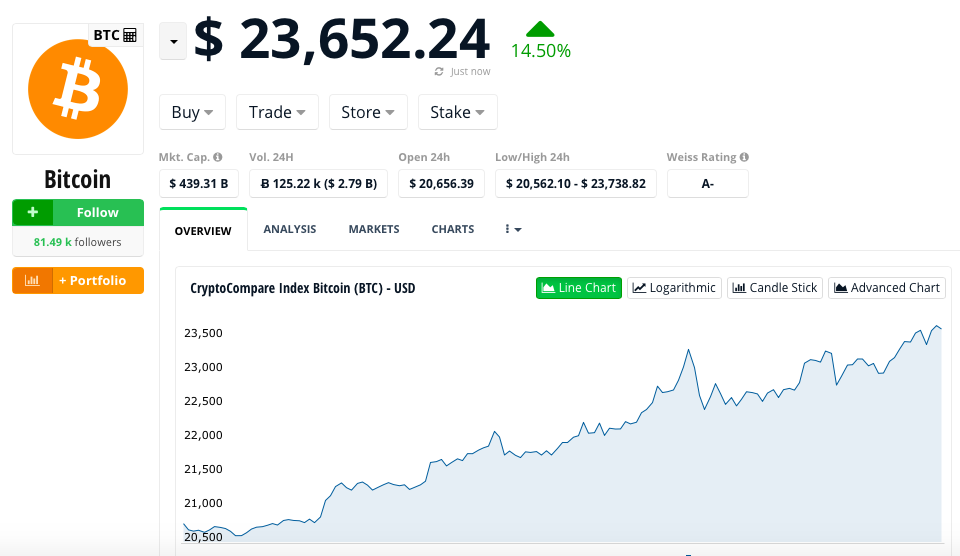

The first cryptocurrency, Bitcoin, has reached close to a high of $24,000 before backing off slightly in a stair-step trajectory to routine use in financial markets.

The previous high was approximately $20,000; the blockchain-based currency collapsed to under $5,000 before returning to these commanding heights.

Many analysts believe the financial medium will become a global reserve currency and its relentless rise is only just the beginning on its way to a price in the hundreds of thousands of dollars.

Election uncertainty in the United States, long seen as the place where the U.S. dollar is a 'risk-free' asset, has begun to destroy legacy world views. Investors and other institutional entities are looking for additional stores of value to diversity -- Bitcoin is one of these.

Reports are of large 'whale' players stepping up and buying hundreds of millions of Bitcoin.

The rise of communist China and its influence over the U.S. is also driving this reserve currency trend. Although the Chinese yuan is frequently bandied-about as a store of value -- the world doesn't trust the Chinese Communist Party with this responsibility.

So if the dollar is debased, where do you go? Bitcoin is one answer to that question.

Subscribe to our evening newsletter to stay informed during these challenging times!!

The problem is that you have Bitcoin this mega investors known as whales. A few of them can withdraw a big amount and the price of BTC will go drastically go down. They sit and wait and will buy BTC when is cheap. BTC has drastic manipulation.

Don't listen to the naysayers, the whole problem we see in the United States is caused by the US Federal Reserve System. They are debasing your dollars, bitcoin now is over 25k USD and is headed higher! You guys have to get in to prepare for the future, only together we can stop leftist nazi fascist marxists from changing the US for ever into a Marxist hell hole.