Please Follow us on Gab, Parler, Minds, Telegram

By Doug French

The Federal Reserve and the confederation of central banks which follow Chair Powell and his lieutenants at the Eccles Building have flooded the world with fiat script which is only limited by Keynesians' and modern monetary theorists' imaginations. In this flurry of metaphorical printing, one country, Russia, has loaded its central bank balance sheet not with the speculation de jour, bitcoin, but instead with the barbaric relic gold.

Tellingly, Russia’s stockpiling began in 2016, and on the eve of the president’s departure from the White House, Vladimir Putin and Elvira Nabiullina, president of Russia’s central bank, had more gold than US dollars stockpiled.

Bloomberg reports, “A multi-year drive to reduce exposure to US assets has pushed the share of gold in Russia’s $583 billion international reserves above dollars for the first time on record.”

It’s no secret Mr. Putin initiated the strategy to “dedollarize” Russia’s economy. The yellow metal is now the second-largest component of the central bank’s reserves after euros, which make up a third of its reserves. Chinese yuan reserves make up 12 percent.

Over two years ago Forbes compared the oil-producing state Texas to the oil-producing country. “Even though Russia has nearly five times as many residents as Texas, the Lone Star State's economy is more than $400 billion larger. Texans, therefore, enjoy a gross domestic product (GDP) per capita of around $58,000, whereas Russians have one closer to $8,700,” wrote Frank Holmes.

In the same article, Holmes pointed out, “The Russian Federation is the largest single producer of crude in the world, pumping out 10.95 million barrels per day (bpd) in January, according to the country’s energy minister.” Until there is an EV (electric vehicle) in every American garage, Russia is not to be taken lightly.

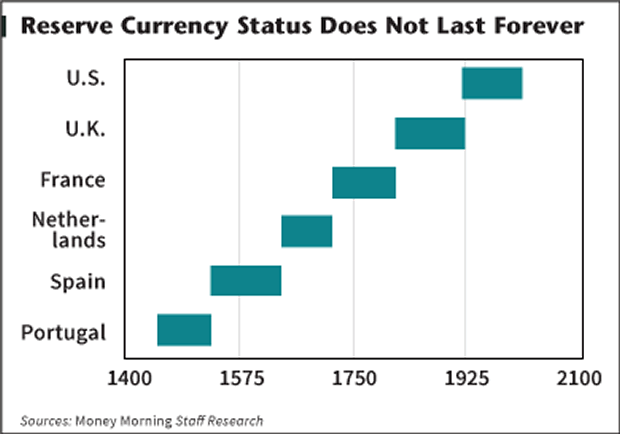

Americans have benefited mightily by holding and trading with the world’s reserve currency, though most people haven’t given it a thought. No one remembers when the pound sterling held this distinction a hundred years ago.

“Reserve currencies are typically issued by developed, stable countries,” Investopedia.com. Developed? If you insist. Stable? Not so much.

“Reserve currency issuing countries are not exposed to the same level of exchange rate risk, especially when it comes to commodities, which are often quoted and settled in dollars,” Investopedia explains. “Issuing countries are also able to borrow in their home currencies and are less worried about propping up their currencies to avoid default.”

Investopedia laughingly cites what it calls a drawback to reserve currency, “Low borrowing costs stemming from issuing a reserve currency may prompt loose spending by both the public and private sectors, which may result in asset bubbles and ballooning government debt.” Sounds familiar.

In 2015, Patrick Barron wrote on mises.org,

Because of this money-printing philosophy, the dollar is very susceptible to losing its vaunted reserve currency position to the first major trading country that stops inflating its currency. There is evidence that China understands what is at stake; it has increased its gold holdings and has instituted controls to prevent gold from leaving China.

Russia has joined China.

Barron concluded, “If we abolish, or even lessen, legal tender laws and allow the process of price discovery to reveal the best sound money, if we allow our US dollar to become the best money it can—a truly sound money—then the chances of our personal and collective prosperity are greatly enhanced.”

The Fed fiddles while the dollar burns.

Subscribe to our evening newsletter to stay informed during these challenging times!!