Please Follow us on Gab, Minds, Telegram, Rumble, Gab TV, GETTR

Reprinted with permission Mises Institute Frank Shostak

After closing at 0.53 percent in July 2020 the yield on the ten-year US T-bond moved relentlessly higher, closing on Tuesday, September 28, 2021, at 1.55 percent. There is a growing likelihood that the July 2020 figure of 0.53 percent might have been the lowest point.

How should we view this in the context of historical trends in bond yields?

First, it is important to consider the behavioral foundations of bond buying.

As a rule, people assign a higher valuation to present goods versus future goods. This means that present goods are valued at a premium to future goods. This stems from the fact that a lender or investor gives up some benefits at present. Hence, the essence of the phenomenon of interest is the cost that a lender or an investor endures.

An individual who has just enough resources to keep him alive is unlikely to lend or invest his paltry means. The cost of lending or investing to him is likely to be very high—it might even cost him his life if he were to consider lending part of his means. Therefore, he is unlikely to lend or invest even if offered a very high interest rate. Once his wealth starts to expand, the cost of lending or investing starts to diminish. Allocating some of his wealth toward lending or investment is going to undermine to a lesser extent our individual’s life and well-being at present.

From this we can infer, all other things being equal, that anything that leads to an expansion in the wealth of individuals gives rise to a decline in the interest rate, i.e., the lowering of the premium of present goods over future goods. Conversely, factors that undermine wealth expansion lead to a higher interest rate. Observe that while the increase in the pool of wealth is likely to be associated with a lowering in the interest rate, the converse is likely to take place with a decline in the pool of wealth.

People are likely to be less eager to increase their demand for various assets, thus raising their demand for money relative to the previous situation. All other things being equal, this will manifest in the lowering of the demand for assets, thus lowering their prices and raising their yields.

Note again, that increases in wealth tend to lower individuals’ time preferences whereas decreases in wealth tend to raise time preferences. The link between changes in wealth and changes in time preferences is not automatic, however. Every individual decides how to allocate his wealth in accordance with his priorities.

An increase in the supply of money, all other things being equal, means that those individuals whose money stock has increased are now much wealthier than before the increase in the money supply took place. Hence, this will likely give rise to a greater willingness in these individuals to purchase various assets. This leads to the lowering of the demand for money by these individuals, which in turn bids the prices of assets higher and lowers their yields.

At the same time, the increase in the money supply sets in motion an exchange of nothing for something, which amounts to the diversion of wealth from wealth generators to non–wealth generators. The consequent weakening in the wealth formation process sets in motion a general rise in interest rates. This implies that an increase in the growth rate of money supply, all other things being equal, sets in motion only a temporary fall in interest rates. This decline in interest rates cannot be sustainable because of the damage to the process of wealth generation.

Conversely, a decline in the growth rate of money supply, all other things being equal, sets in motion a temporary increase in interest rates. Over time, the fall in the money supply encourages a strengthening of the wealth formation process, which sets in motion a general fall in interest rates. We can thus see that the key to the determination of interest rates is individuals’ time preferences, which are manifested in the interaction of supply and demand for money. Also note that in this way of thinking the central bank has nothing to do with the determination of the underlying interest rates. The policies of the central bank only distort where interest rates should be in accordance with time preferences, thereby making it much harder for businesses to ascertain what is really going on.

From 1960 to 1979 the yields on the long-term US Treasury bond had been following a visible uptrend (see chart). From 1980 until now, the yields were following a downtrend (see chart).

From 1960 to 1979 we can also observe that the yearly growth rate of money supply (AMS) followed a visible uptrend (see chart). This caused a strong weakening in the wealth generation process on account of the exchange of nothing for something. The weakening of the process of wealth generation due to the uptrend in the growth momentum of money supply lifted individuals’ time preferences, and this placed the underlying long-term yields on a rising trend.

By contrast, the declining trend in the yearly growth rate of AMS that we can observe from 1980 to 2007 was instrumental in the strengthening of the process of wealth generation (see chart). This was an important factor in the declining trend in long-term yields during this period.

From 2008 to 2011, the yearly growth rate of AMS followed a visible rising trend (see chart). This most likely undermined the process of wealth generation again. The uptrend in the money supply growth rate enriched the early recipients of the newly pumped money, and as a result, their demand for various financial assets including Treasurys increased, in the process lifting the prices of these assets and lowering their yields. Despite large increases in money supply, the early recipients of the monetary increases benefited by being ahead timewise of the overall wealth erosion effect. This in turn also prevented the upward pressure on interest rates.

The massive increases in money supply from 2019 to February 2021 have likely severely undermined the process of wealth generation (see chart). Note that the yearly growth rate of AMS stood at 79 percent in February 2021. Also note that the yearly increase in dollar terms stood at an unprecedented figure of $4.2 trillion in February 2021. If one adds to this the reckless fiscal policy of the government this amounts to a severe weakening of the process of wealth generation and has likely placed long-term yields on a rising trend, which may have started in July 2020.

The erosion in wealth formation has already set in motion the weakening in economic activity and the decline in the momentum of inflationary bank lending. This type of lending is an important ingredient in the growth rate of money supply. The likely further decline in the pool of wealth raises the likelihood of a further decline in the growth rate of inflationary lending and the growth rate of money supply (see chart).

A fall in the growth rate of money supply will weaken the wealth increases of the early recipients of money. Consequently, they are probably going to reduce their demand for financial assets, exerting an upward pressure on yields. If the economic slump is of a severe nature, this will result in a prolonged decline in the momentum of inflationary credit. Consequently, a strong decline in the money supply growth rate will emerge. As a result, the uptrend in long-term rates could be of long duration.

This uptrend is likely to take place despite the positive influence of the expected decline in the momentum of money supply on the wealth generation process. Note that the likely Fed and government policies to counter the emerging economic slump will delay the liquidation of various nonproductive activities, thereby slowing down the revival of the pool of wealth.

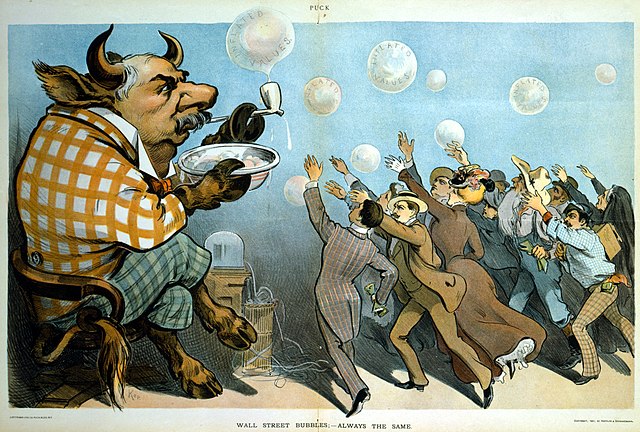

These activities, also known as bubble activities, have emerged on the back of loose monetary and fiscal policies. As a result, bubble activities are likely to continue to undermine the process of wealth generation with such policies in place. This in turn is going to prolong the bear market in Treasury bonds.

It is likely that the bull market in T-bonds ended around July 2020. On account of past strong increases in money supply, the process of wealth generation has probably been weakened significantly. This has set in motion the decline in the inflationary credit momentum and the consequent decline in the momentum of money supply.

As a result, this is expected to set in motion a visible rise in long-term interest rates. Attempts by the Fed and the government to counter the economic slump are likely to weaken further the pool of wealth and make the economic climate much more severe.

Note that once the pool of wealth starts to decline, aggressive monetary and fiscal policies can only weaken this pool, thereby weakening the heart of economic growth. If loose monetary and fiscal policies could strengthen the pool of wealth, then world poverty would have been eliminated a long time ago.Author:

Frank Shostak's consulting firm, Applied Austrian School Economics, provides in-depth assessments of financial markets and global economies. Contact: email.

Subscribe to our evening newsletter to stay informed during these challenging times!!