Please Follow us on Gab, Minds, Telegram, Rumble, Gab TV, GETTR

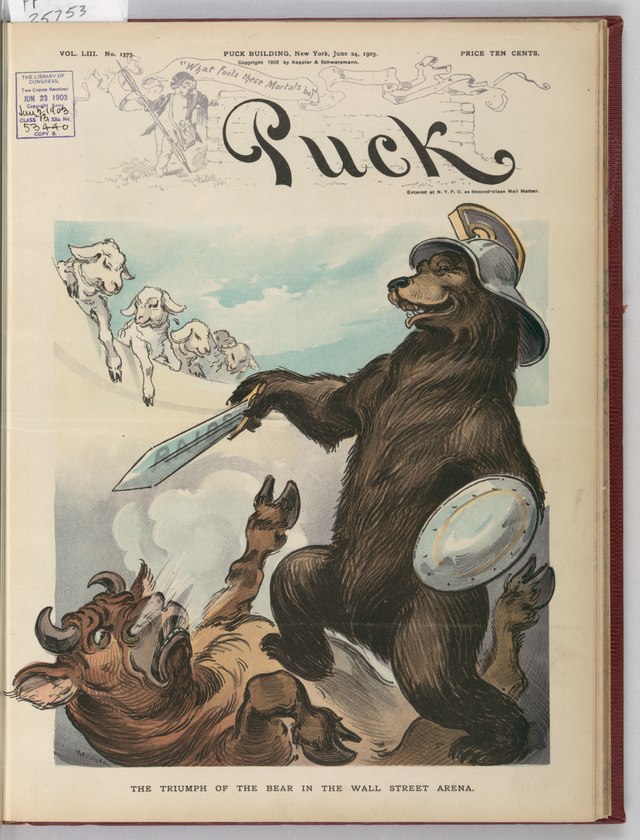

If you didn’t think the $70 trillion global bond market was a train-wreck waiting to happen, surely last week’s yield surge was a wake up call. From the 2.15% close one week earlier, the 10-year yield soared to a peak of 2.50% just after mid-day last Friday; and that 36 basis point gain was, in turn, the culmination of a stunning 200 basis point rise from the cyclical low point (0.51%) recorded during July 2020.

Needless to say, an economy staggering under the weight of $87 trillion in debt, representing a record 365% of GDP, can’t take much interest rate increase in any case. But when the Fed is drastically behind the curve and will be forced to hit the brakes hard (and unexpectedly) in coming months, you are talking about a recipe for financial carnage.

Of course, the knuckleheads in the Eccles Building are just beginning to faintly recognize the trap they have backed themselves into. As Bill King aptly noted,

….contributing to the bond carnage on Friday morning: NY Fed President Williams said the Fed will hike rates 50bps if needed, and inflation has been much stronger than the Fed expected. What dopes!!

To read more visit International Man.

Anyone claiming that ivermectin does not work against covid and flu like symptoms are either working for big pharma or doesn't know what he/she is talking about. It has been proven by so many scientists in universities that IVM works curing and preventing what is so called covid19 aka flu. I see people sometimes saying that they overcomed covid in 2-3 days with natural remedies and don't need any drug. While they are right about using natural remedies and healthy living style, we have elderly and immune deficient loved ones in our circle. That is when this drug accelerates the recovery process. I recommend everyone to get it because these big pharma shills have undertaken as a duty to kill us https://livingnatural.net