Please Follow us on Gab, Minds, Telegram, Rumble, Gab TV, GETTR

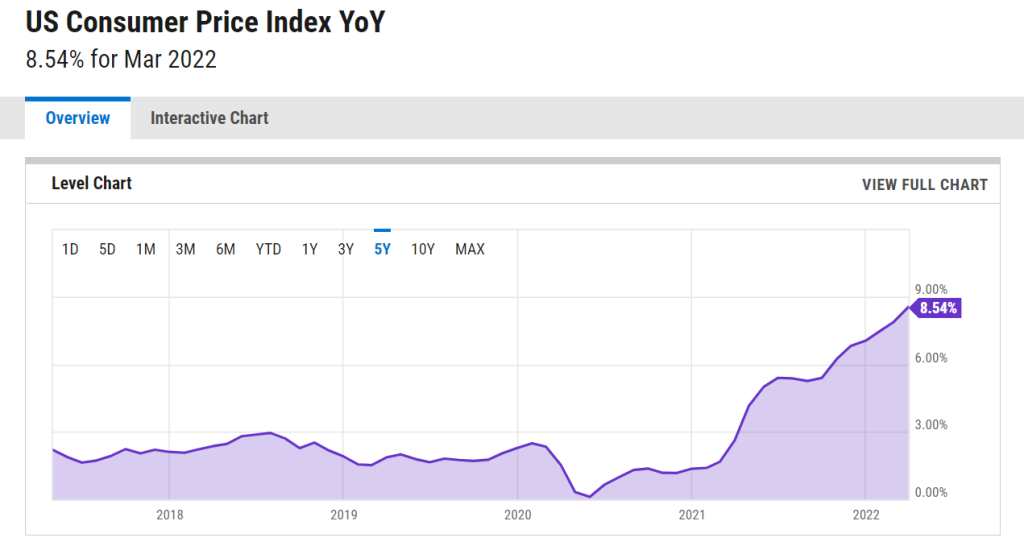

Decoding Politics highlighted six months ago that we were likely entering a period of permanently high, politically driven inflation. This is a recurring phenomenon for those in developing countries, but has not been seen in the US or other developed countries in the past forty years. The first phase really started in Q1 of 2020, with massive stimulus spending by the federal government and record-breaking money printing by global central banks. This propelled consumer price inflation from below 2%in 2020 to nearly 9% as of March 2022. Phase one was characterized by large amounts of money printing creating large amountsof sudden demand, which then rippled through the economy.

Now we are entering phase two of the inflationary episode, where people realize this is not a one-off event, but instead a new economic configuration. Money is still being printed at a rapid rate. As high inflation expectations set in, and shortages beget inflation, beget hoarding, beget shortages, this process will move of its own momentum. External events, led by the war in Ukraine, are adding pressure to the situation. Stay prepared, both personally and financially. The political impact on the 2022 midterms, let alone the 2024 presidential cycle, is going to be substantial. The highest inflation rate in 50 years is going to create a massive protest vote against anyone seen as being weak on inflation.

CPI Rate Hits 8.5%

US consumer price inflation (CPI) has reached rates of 8.5%, and rising. Readers remember that historically, the Federal Reserve’s target was 2% inflation. Nearly all of last year they were calling 4-6% inflation rates ‘transitory’. Now we sit over 8% and they have just raised interest rates ….to 0.25%.

The Fed’s Reaction

The Federal Reserve is the government appointed board overseeing interest rates, and indirectly, the amount of money in circulation. It seems to finally be reacting to inflation. They finally hiked interest rates at their last meeting. Recent communications reveal they want to finally shrink their balance sheet and hike interest rates multiple times in the next year. One may be under the impression that they are actually dedicated to slowing inflation. But this isn’t “closing the barn door after the horse has bolted” - this is closing the door and chasing the horse when it’s one mile down the road.

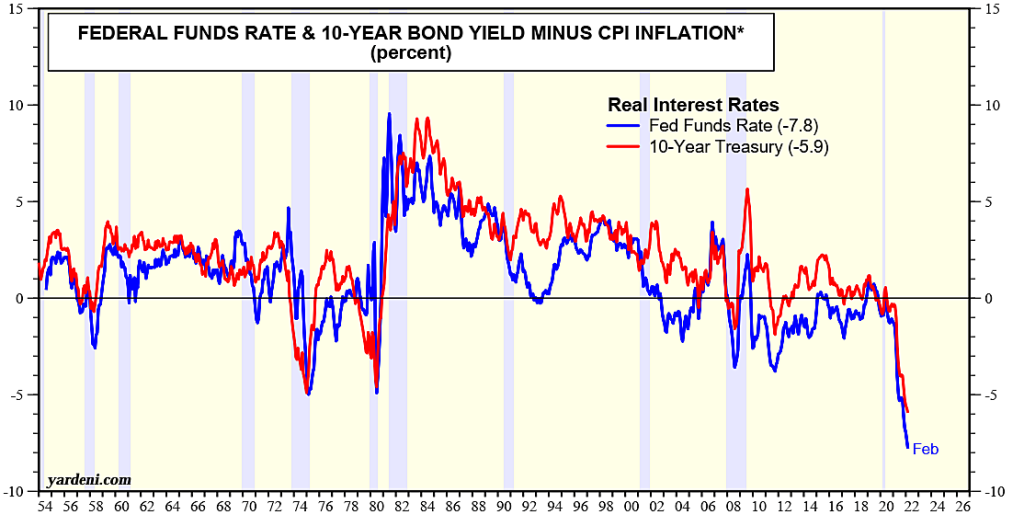

Looking at real rates, that is interest rates with inflation subtracted from them, tells the true story. Real rates are by far the lowest in seventy years. If you have a bond paying interest, your purchasing power is losing 5%+ per year.

Either measured by ten-year yields or the Federal Funds rate, monetary policy is incredibly easy. Hikes to 5%+ in Fed Funds or a move in the Treasury yield to 7% + are what are needed to make policy tight and to slow inflation. We are years away from that. We could safely call the end of this inflationary phase when real rates are in the 2-5% range.

Source: Yardeni.com

Money Supply Continues to Grow

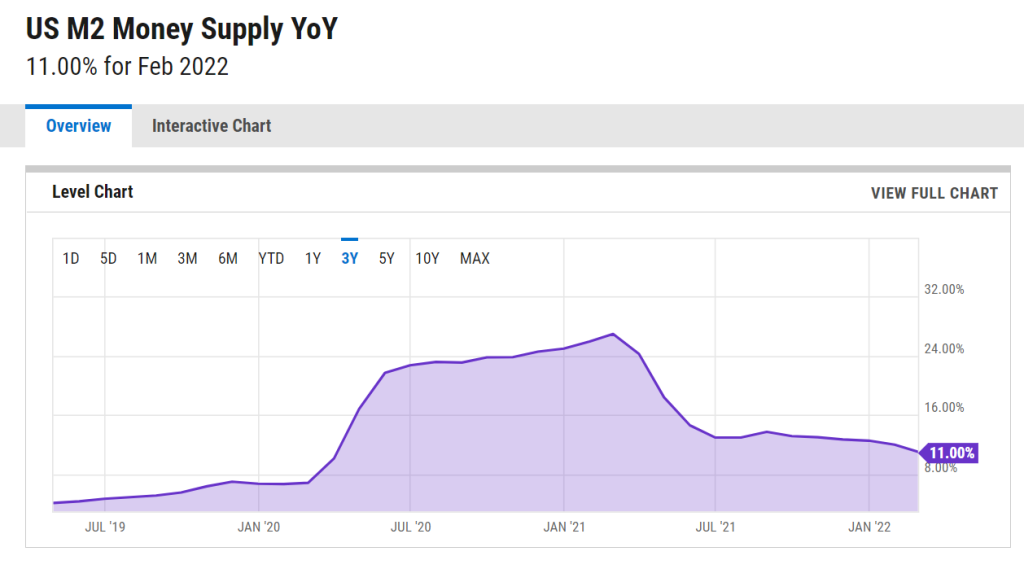

If the Federal Reserve were really serious about tackling inflation, then they would slow the rate of growth in money. The rate of inflation and amount of money tend to track each other closely over long periods of time. The best way to get inflation back to 2% is to limit the growth of money to 2% and wait for things to calm down over 24 months. As of now, the broadest measure of money, M2, is growing around 11% per year. That is still elevated, historically speaking, although it is down from the 20% rates after the pandemic. As we will break down later, this typically leads to 6-10% rates of inflation over time.

The Inflationary Mindset is Becoming Established

With this much money being printed, and a Federal Reserve this far behind the curve, it’s not a surprise that signs of an inflationary mindset are emerging in the nation. Consumers’ expectations of future prices continue to increase:

“US consumer inflation expectations for the year ahead increased again to 6% in February of 2022, the same as a record 6% in both December and November, and reversing some of January’s sharp declines. All the commodity price change expectations increased, namely for food (9.2%), gas (8.8%), medical care (9.6%), college education (9%) and rents (10.1%). Median home price expectations, on the other hand, declined (5.7%). Meanwhile, earnings growth expectations remained unchanged, while expectations about unemployment, perceived job loss, and job finding all improved and those for spending growth reached a new series high. Median three-year ahead inflation expectations also ticked up by 0.3 percentage point to 3.8%. less” [Trading Economics]

With inflation expectations this high, the highest in thirty years, people will start to embed this into future prices and services’ rates. Breaking the cycle will be difficult.

Monitoring Velocity

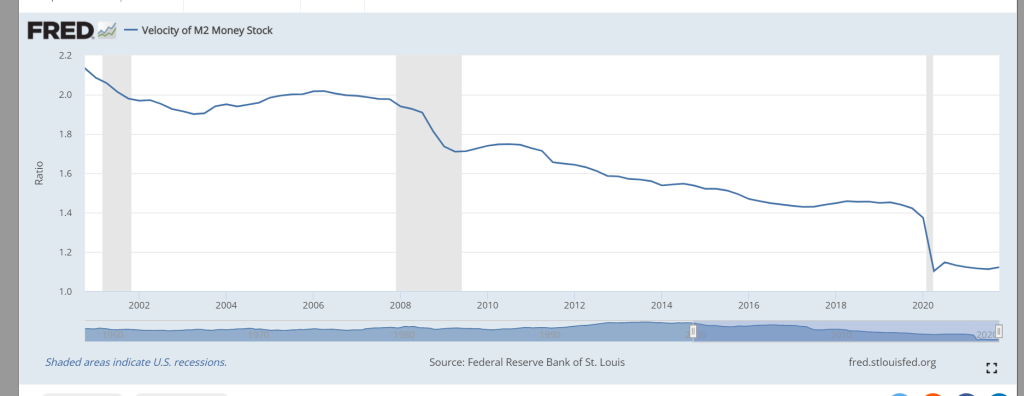

The metric that is best to show if we have flipped into an inflationary mindset is velocity, which is the rate at which money circulates. This has been falling since 2000, and it reached its lowest level ever in 2020. Since then, it has begun to stabilize. It is likely that by the end of 2022, it will have begun to rise. That would confirm what other anecdotals and data points are showing- that there is a shift to an inflationary mindset.

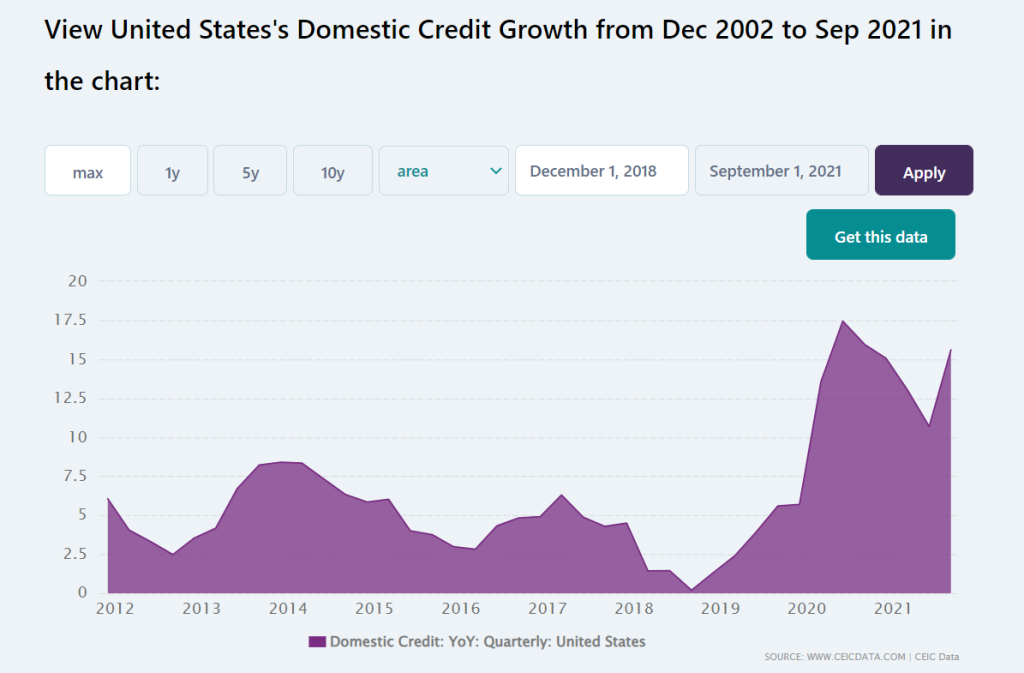

Credit Growth Remains Strong

The amount of credit being extended to the private sector continues to rise. This is important because credit ends for end use of goods of materials. Commercial credit is used for factories, commercial buildings or other business uses. Consumer credit is for buying a house, consumer goods, etc. Thus we know that credit growth will correlate to economic growth.

Credit growth is running at almost 16% in Q3 2021, and probably even higher in recent months. This will certainly keep the inflationary and velocity pressure high.

No Workers to Hire

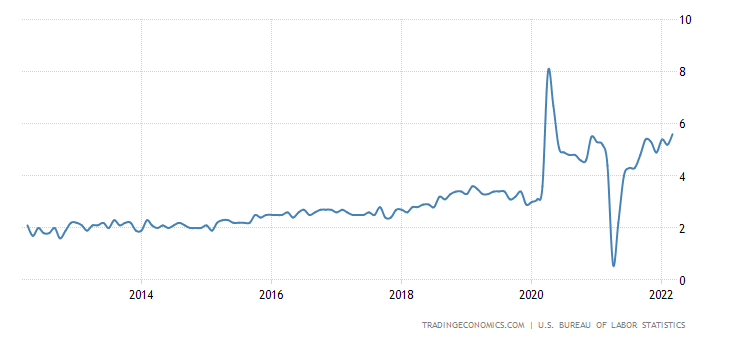

The labor market is very tight at the moment, and this is reflected in the rise in wages and the fall in unemployment. Hourly wages are growing at almost 6%, the highest on a sustained basis post pandemic. With all the potential workers now having a job, the only to get new workers for your business is to pay a high wage to get people out of the house, or bid away other employees with a raise.

Average Hourly Earnings, % YoY

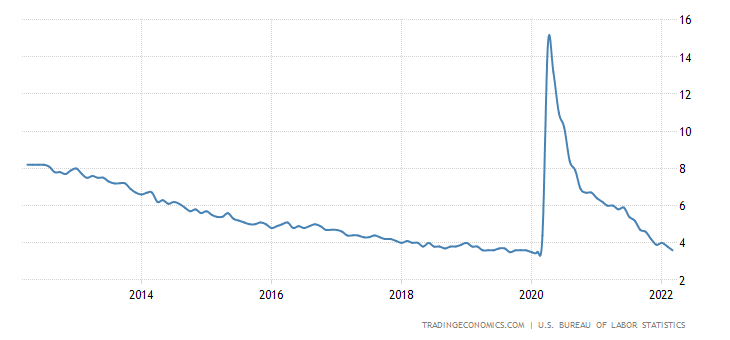

Wages should continue to keep growing, because the pool of workers continues to shrink. The unemployment rate is below 4%, the level at which the past two cycles stopped. As wags rise, it will feed into higher prices across the economy. Labor is the largest cost in most businesses, and when wages start to rise at high single digit rates, you can be sure prices will as well.

Unemployment Rate, %

The Quantity Theory of Money

This is an economic term that describes the dynamics of the amount of money in circulation and how it generates inflation. It’s an accounting equation, and therefore it has to balance out.

It says that the amount of money in circulation (M) and the speed with which it circulates (Velocity or V) is equal to the change in GDP or economic growth (Q) and the general level of prices (inflation rate or P).

Represented as an equation, that’s M*V=Q*P

Readers may be wondering – “Why Decoding is introducing such an egg-headed concept to a simple column on inflation?” Well, it’s because this equation can help us figure out where the future of inflation is. Let’s plug in the current economic situation to the formula:

M (+11%) * Velocity (steady) = GDP growth (2%) * Prices (unknown)

Solving for the price level gets you roughly 6% inflation, and, if velocity begins to rise, it could rapidly get to 8 or 10% for a sustained period of time. Restoring order and 2% inflation rates is not happening soon. That would require both slow money growth and a resolute government to force velocity to fall again.

The Impact of Russia and Ukraine

The major event of 2022, the invasion of Ukraine by Russia in February, is going to have further inflationary effects. There will be both immediate impacts and more subtle longer term impacts.

The immediate impact was a halt in both Russia and Ukraine’s exports of several commodities, namely wheat oil, and gas. The price of wheat exploded, and oil and natural gas had large spikes. Afterwards, Russia banned exports of numerous other commodities. Many other countries sanctioned and would not import Russian products such as oil, distorting the market globally. Ukraninan wheat plantings are down 30 to 50% and it’s almost impossible to get transport out of the country. These issues will continue shortages globally and keep pressure on prices.

In addition, Russia is one of the five countries in the world with no national debt. Its excess savings, to the tune of hundreds of billions of dollars, went into international banking systems and funded transactions in Europe, Asia and the Americas. The removal of Russia from the international banking system (SWIFT) and the barring of its central bank from dealing internationally effectively removed those reserves from the system. This will create financing pressures for many large commodity producers and importers around the world.

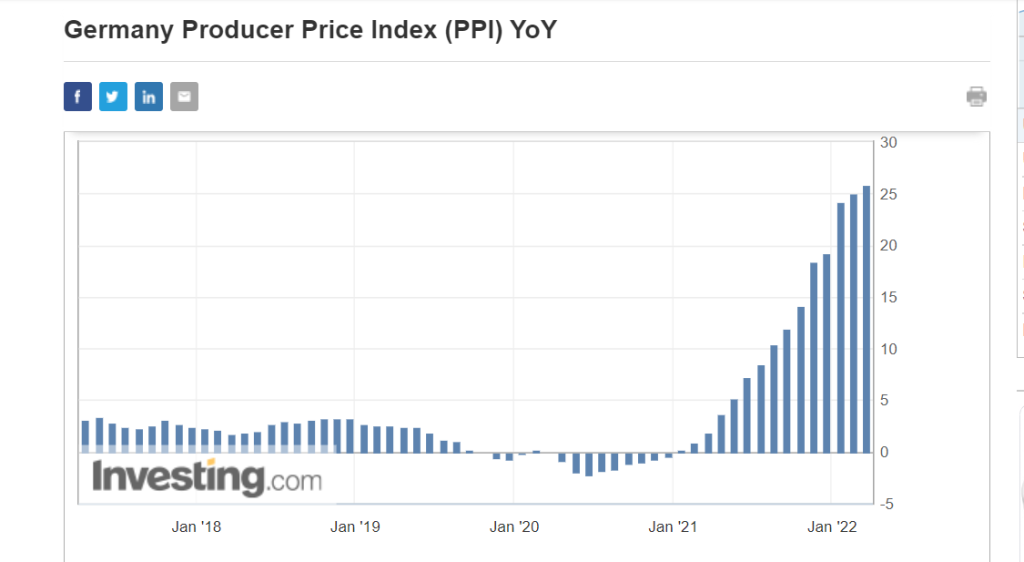

Taking this out of the theoretical, let’s look at one of the major casualties economically speaking, Germany. Producer prices, what companies pay for their inputs, had been rising at a 20%+ rate before the Ukraine invasion. Germany is a large energy and materials importer from Russia, and there is a potential for bans or limitations on many items. The squeeze on energy, commodities and other variables is sure to send this higher for the rest of 2022. Energy prices are already up 100%+ on the prior year, and it could get worse.

This means that your new German car is going to cost at least 25% if not 50% more versus last year. Similar stories are going to come from a host of industries and countries.

Also, we want to remind readers, that all of this is coming after what has been a minor two month war. If this war were to escalate in intensity or to involve multiple participants, then everything we are saying will be multiplied by five. Major wars have always involved huge shortages and supply chain disruptions. Furthermore, the military gets what is available first, and the civilian population gets the rest, leading to shortages of almost everything. The UK did not stop food rationing until nine years after the end of World War 2. If a major EurAsian war develops out of the Ukraine conflict, then you will not believe how high gas prices will go – if you can find it.

How to Manage This [Not Financial Advice]

Inevitably, a news story about shortages or price spikes will have a recommendation that you should not worry, this is temporary. Decoding Politics readers will understand that inflation and shortages are consequences of the inflationary wave rolling through the system, and it will be with us for several more years. Turbo-charged demand, consumers’ desire to frontload spending, and the gummed up financing for the system are going to keep creating shortages. To quote fund manager Hugh Hendry from a decade ago: “We recommend that you panic”.

In terms of financial moves, the inflationary playbook is still the same as six months ago. We had highlighted the poor risk reward in traditional bonds and fixed income before. Markets have begun to adjust, with the ETF which reflects long term Treasuries down 25% in the past five months. Yet even with that move lower, there is still a long way to go to reach the point at which interest rates reflect the true rate of inflation: 8 to 10%. Fixed income in a rising inflation and rising rate environment is the absolute worst place to be financially speaking. You are begging to lose money, both before and after inflation. Anything except perhaps cash is a better alternative.

Energy stocks, which we were positive on, have increased by 30-60% since December. This is keeping you well ahead of inflation. We continue to think that global energy majors are a major beneficiary of the squeeze in energy markets. On the other hand, certain metals have not yet participated in the rally. As the price of everything else goes up, gold and silver are sure to follow.

It’s remarkable to think that silver, currently $25/oz, reached $50/oz in 1980 and then again in 2011. Since 1980, the amount of dollars in circulation has increased at least 15 fold, so, at some point silver’s price has to catch up. Gold, now at $2000/oz, peaked over $800 in 1980, and so has done a slightly better job of reflecting the massive increase in money. But there is a long runway ahead of both metals as inflation picks up and fixed income globally turns into a black hole.

What many investors don’t know is that gold and silver can generate income too. Services like Monetary Metals allow you to invest in gold backed bonds, or lease your metals out, at rates around 3%- more than a ten year US Treasury. You get a higheryield and inflation protection. Why do people own bonds again?

We think research will show energy and mining are attractive industries at attractive valuations. International markets exposed to stronger commodity markets should continue to benefit, except for Canada, which we plan on discussing in a future piece.

Regular stock indices have traded in a range for the past nine months. Rising rates’ negative impact has offset higher earnings. We think that this pattern will largely continue in the major stock indices. And we think investors’ should tilt their portfolio away from interest rate sensitive assets to ones that have the power to increase rents/prices/commodity prices in this cycle.

On the personal front, stocking up six months’ supply or more of your favorites and essentials is a great move before prices spike further, or they are not there to buy. Gas, food and water are the obvious starting places. We are not saying to become preppers and go live in the woods in Montana, please don’t misunderstand this. But just ask yourself seriously – what is your plan if an item you need/rely on/purchase regularly were out of stock for a year or tripled in price due to shortages? Water filters? Diesel or propane? Baby Formula? Certain medicines? These items are not universally available in times of stress and shortages.

Follow Decoding Politics on Twitter: https://twitter.com/DecodingPoliti2

For Inquiries/Comments: [email protected]

Subscribe to our evening newsletter to stay informed during these challenging times!!

It's at the behest of the democrats, that the economy is terrible.

A lot of our points were echoed by Argentines themselves, in a recent WSJ article about how to fight inflation: https://www.wsj.com/articles/inflation-got-you-down-at-least-you-dont-live-in-argentina-11650898676