Please Follow us on Gab, Minds, Telegram, Rumble, GETTR, Truth Social, Twitter

Reprinted with permission•Mises Wire•Jane L. Johnson

Conventional wisdom has it that the Federal Reserve system (the “Fed”) and the US Treasury Department are two separate entities. Congress created the Fed in 1913 as a legally and financially independent federal agency, privately owned by its member banks, with no funding from the federal budget. The US Treasury, on the other hand, is an Executive-branch cabinet-level department reporting directly to the President, with funding appropriated in the federal budget.

Conventional wisdom also tells us that the Fed’s monetary policy (managing the money supply and interest rates, directed by the Fed’s Chair and Board of Governors) is separate from Treasury’s fiscal policy (collecting taxes and implementing federal spending) at the behest of Congress and the Executive branch).

The modern-day separation of the Treasury and the Fed dates from the 1951 Treasury-Federal Reserve Accord, which established the Fed’s independence from the Treasury. During World War II, the Fed agreed to peg interest rates on short-term Treasury bills at 3/8 of 1%. The Accord clarified the separation between Fed monetary policy and Treasury’s debt-management powers, freeing the Fed to fulfill its dual mandates of price stability and maximum employment.

Yet as I discovered teaching senior citizens in the Osher Lifelong Learning Institute, many Americans remain unclear about the Fed’s and Treasury’s respective responsibilities, and how the two entities coordinate when the Fed supplies fresh bank credit to support Treasury’s need for spendable funds.

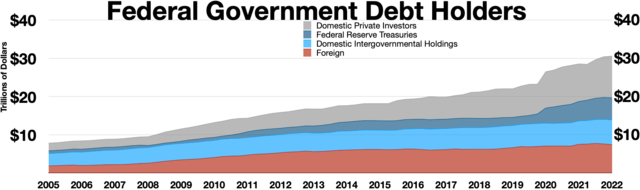

The Treasury sells bonds to both foreign and domestic investors when federal tax revenues fall short of its spending needs. Once bonds are in the open market, the Fed can then buy them for its own portfolio, creating new bank credit—spendable funds—literally out of “thin air,” sometimes referred to as “monetizing the debt.”

Such Fed credit creation occurred in massive amounts during the 2020-22 Covid era, when the federal government spent $5.2 trillion for congressionally-authorized programs such as enhanced unemployment benefits, employee retention credits, and consumer “stimulus” payments. To accomplish this spending, the Fed cooperatively expanded its balance sheet holdings of securities from $4 trillion to about $9 trillion, using its immense power to create spendable funds. Such massive credit creation arguably caused or exacerbated inflation to over 9% in mid-2022

This coordinated Fed-Treasury credit expansion reflects a novel approach to monetary and fiscal policies, as new strategies were developed to satisfy one-off federal spending needs. It began when Ben Bernanke, Fed Chair 2006-14, created Quantitative Easing (QE) during the 2008-09 financial crisis, purportedly to avoid another Great Depression. QE involves massive open-market purchases of Treasury debt—as well as mortgage-backed securities for the first time in the Fed’s history—to flood financial markets with newly-created bank credit in order to support the economy in what was then called the Great Recession.

QE might be considered traditional monetary policy on steroids. But another new policy tool might be considered a hybrid of monetary and fiscal policy. Milton Friedman in 1969 first proposed “helicopter money,” a colorful phrase describing a type of stimulus that injects cash into an economy as if it were thrown from a helicopter. Future Fed Chair Bernanke (“Helicopter Ben”) in 2002 referenced helicopter money as a strategy that could be used to avoid price deflation.

A variant of helicopter money was employed during the financial crisis of 2008-09 and again in 2020 during the early months of the Covid pandemic. After Congress authorized consumer “stimulus” payments in the Economic Stimulus Act of 2008, the IRS deposited prescribed amounts into the bank accounts of qualifying taxpayers. Thus, instead of having to scoop up paper currency dropped from helicopters, taxpayers effortlessly received the funds in their bank accounts. In 2008, the IRS deposited payments ranging from $600 per tax filer plus $300 for each qualifying child, for a total of $152 billion.

In 2020 and 2021, Congress authorized three tranches of pandemic stimulus payments, called “economic impact payments”: The CARES Act in March 2020 authorized $1200 per tax filer plus $500 per child; the Consolidated Appropriations Act in December 2020 authorized $600 per filer plus $600 per child; and the American Rescue Plan in March 2021 authorized $1400 per filer plus $1400 per child. All told, these three tranches distributed $814 billion in 476 million separate payments. Although about 40% of the stimulus payments were spent on consumption, 60% of Americans saved the funds or paid down personal debt.

QE involves an “asset swap” between the Fed and another economic entity. The Fed purchases Treasury bonds or other financial assets from private parties, adding them to its balance sheet and creating new bank credit. With new bank reserves, depository institutions can then increase their own lending activity to businesses and consumers, the intended result being new economic activity boosting GDP. This asset swap is reversible—as Quantitative Tightening (QT)—if the Fed sells financial assets to reduce the amount of credit outstanding.

But helicopter money is different from QE, and economists don’t all agree whether helicopter drops qualify as monetary policy or fiscal policy. Helicopter drops, unlike QE, do not involve an asset swap, since the Fed simply gives away the money created without increasing assets on its balance sheet.

John Cochrane of Stanford University’s Hoover Institution, considering the Fed to be a vital part of fiscal theory, refers to pandemic spending as “....a one-time $5 trillion fiscal blowout…”, adding that “....the Fed is still important in fiscal theory....[buying] about $3 trillion of the new debt and [converting] it to [bank] reserves.”

Stephen Miran of the Manhattan Institute warns that the Fed has allowed QE to remain in place far too long, engaging in large-scale asset purchases in eleven of the sixteen years since the 2008-09 financial crisis. And recent Fed policy of “run off”—allowing maturing Treasury bonds to leave its balance sheet, as a form of (QT), without replacement by new purchases of like duration—implies that the Fed is intervening in public debt maturity profile decisions that are traditionally left to fiscal authorities. He also describes how the Treasury can interfere in monetary policy, potentially forcing the Fed to sell at large mark-to-market losses on its securities portfolio, rendering QT moot as a monetary policy tool. He opines that, “Allowing Treasury to set monetary policy is extremely dangerous.”

Modern Monetary Theory (MMT)—a fringe movement within economics—claims that instead of creating credit to buy Treasury bonds, the Fed should create money to directly fund public expenditures or tax cuts. Further, MMT’s advocates consider helicopter drops a form of fiscal policy, not monetary policy. The Fed creates the helicopter money, but does not acquire any assets such as Treasury securities in exchange for creating new bank reserves. The Fed simply gives away the created funds, and the Fed’s capital declines. It appears that MMT fans might more accurately brand their cause Modern Fiscal Theory (MFT) rather than MMT. Note that the majority of economists do not accept MMT’s views.

The distinction today between monetary and fiscal policies is muddled. Some may view this as the Fed’s and Treasury’s interfering in each others’ traditional responsibilities, amidst the advent of new strategies and tools such as QE and helicopter money. Others may view this as overly-zealous cooperation between Fed and Treasury to flood credit markets with too much liquidity that can later result in price inflation and/or the inability to reverse the credit creation process as economic conditions change.

Perhaps it is time for a latter-day Treasury-Fed Accord to clarify the respective responsibilities and limits of the Fed and Treasury. Or, more aptly, it is time for Congress to step up its oversight of both the Fed—the independent agency that Congress created in 1913—and the US Treasury Department, which dates from the earliest days of our Republic.

Subscribe to our evening newsletter to stay informed during these challenging times!!