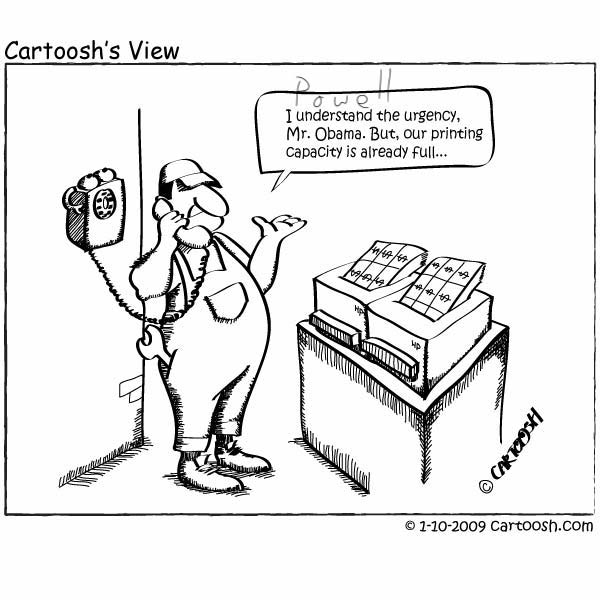

The US Fed is considering lifting its inflation target above 2 percent in order to revive the economy. Contrary to the accepted practice, the Fed is not expected to raise an alarm if the measured price inflation begins to rise. The US central bank is not expected to counter this increase with a tighter monetary stance as in the past. In fact, the idea is to continue robust monetary pumping until the economic data points toward a strong economy.

According to most experts, when an economy falls into a recession the central bank can pull it out of the slump by pumping money. This way of thinking implies that money pumping can somehow grow the economy. The question is, How is this possible? After all, if money pumping can grow the economy, then why not pump plenty of it to generate massive economic growth? By doing that central banks worldwide could have already created everlasting prosperity on the planet.

For most commentators the arrival of a recession is due to shocks such as the covid-19 that push the economy away from a trajectory of stable economic growth. Shocks weaken the economy, i.e. lower the economic growth, so it is held. As a rule, however, a recession or an economic bust emerges in response to a decline in the growth rate of money supply. Note that a decline in the monetary growth works with a time lag. This means that the effect of past declines in the growth rate of money supply could start asserting their influence after a prolonged period...

To read more visit Mises.org.

Subscribe to our evening newsletter to stay informed during these challenging times!!

[…] We’re Headed toward Stagnation—Unless The Fed Reins In Its Money Printing […]

[…] We’re Headed toward Stagnation—Unless The Fed Reins In Its Money Printing […]