Please Follow us on Gab, Minds, Telegram, Rumble, Gab TV, GETTR, Truth Social

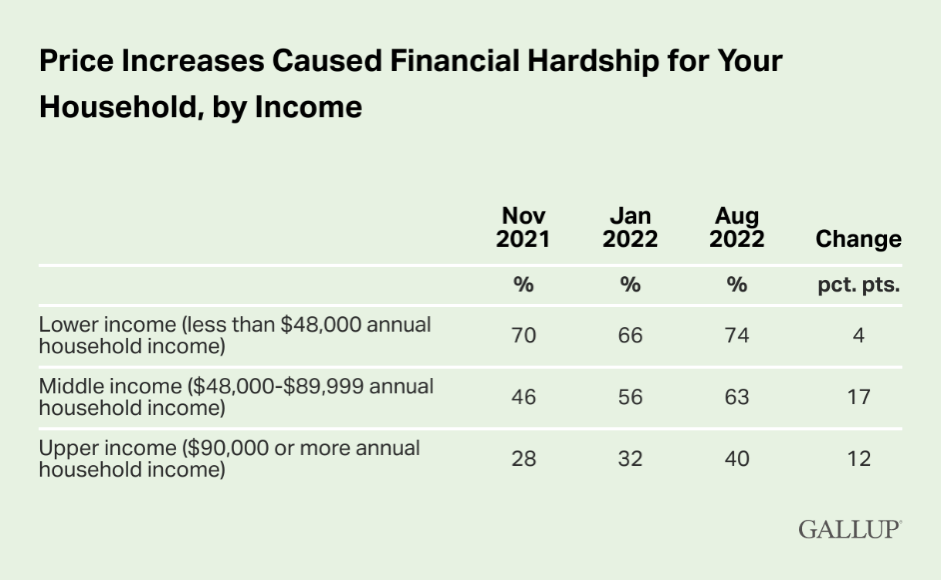

As inflation has continued to rise over the past year, it’s increasingly become the number one issue in the country. Almost 60% of those polled in an August Gallup poll said inflation was creating hardship for their household.

The Fed has taken interest rates from zero to soon to be 4% in order to combat it. So what’s next in the inflation cycle? We predict a slowing in inflation for the next few quarters before another large flare-up in 2023/4, which will again make this this the number one political issue.

We wrote about the politics of inflation in the past year. First, we noted that the government’s enormous stimulus in 2020 and 2021 would produce an inevitable wave of rising prices. Then we analyzed how this wave of cheap money was starting to shift psychology towards an inflationary mindset, which when entrenched, will make reversing inflation extremely difficult. The numerous supply side constraints have not been addressed, principally in energy. Without those solved, it will take a long time for inflation to sustainably return to the Fed’s goal of 2%.

The effects of inflation will produce a big shift in Congress in November 2022. The cooling inflation will see a burst of support for Biden and crew, but its reawakening in late 2023 and 2024 will likely further shift 2024 elections towards populist and anti-inflation candidates. The candidate for President who can best ride this wave will win.

Reviewing the Data

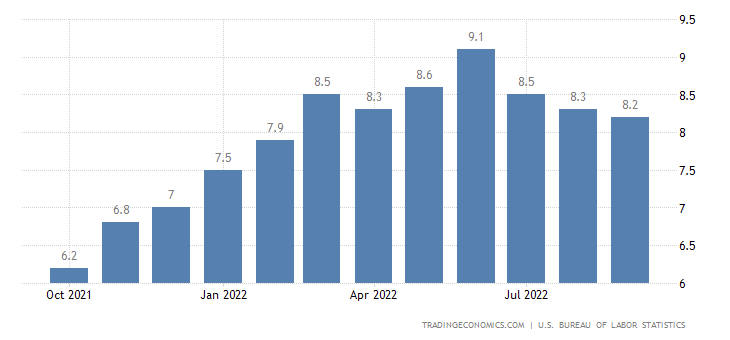

Consumer Price Inflation, that is, the rise in retail prices, reached over 9% in June of this year, before backing off to 8% by September. That is some progress, but still far from the Fed’s goal of 2%.

CPI %, Year over Year

Inflation has often been described as “too much money chasing too few good (and services)”. In 2020, the Fed was growing money at almost a 20% pace, so of course we saw high inflation later on. In 2021, they had slowed it down to a mere 10%, still enough to produce inflation. By September of this year, money supply growth has come down to 2.5%.

Ycharts.com

The Fed’s actions, and any central bank’s, always work with a lag. Money takes 6 to 18 months to either circulate or be withdrawn from the system to have the impact show up in data. This lower rate of money growth should show up as more moderate inflation was enter 2023. A quick rule of thumb would suggest 4 to 6% for the full year.

Succinctly put, year by year:

2020- A weak economy, despite lots of money printing, produced low inflation

2021 – A recovering economy and lots of money printing saw rapidly rising inflation

2022 – A recovering economy and slowing but high money printing produced still high inflation

In 2023, a weakening economy and slower money printing should produce somewhat lower inflation

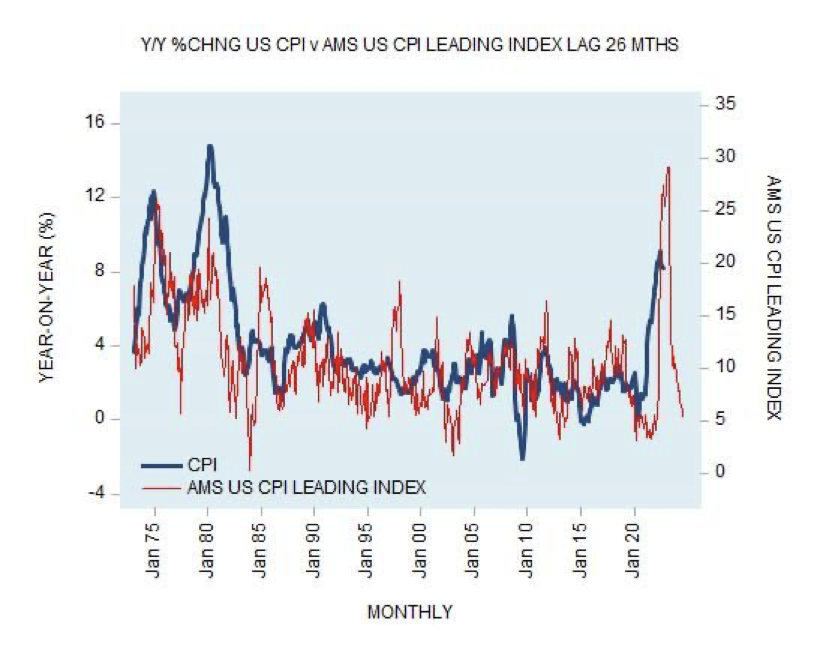

Economist Frank Shostak has produced a great chart showing how money growth leads inflation over a long period of time (the red line is a money supply linked index).

In early 2023, therefore, we should be getting a pause. Yet this is a pause in a longer term inflationary process. In prior articles we continually mentioned that inflation is a process. It’s a process by which government money printing enters the economy and circulates. Coupled with other factors, that can create feedback loops of either low inflation or sustained higher inflation rates. The feedback loops are all now suggesting high inflation for several years.

Let’s look at several longer-term shifts that suggest the era of rising prices is not over for the Biden administration. The administration is simply making all of the supply problems worse. The ongoing semiconductor industry issues with China will eventually cause large shortages and chaos for buyers. There has been no meaningful push to ease trade restrictions with China, Iran, Venezuela or Russia. Indeed, they seem to be pushing them further away. And they are threatening new sanctions and measures against several more countries such as Turkey.

But above all, its policy choices on energy will be largely to blame for the next wave of inflation.

Velocity Continues to Rise

The Fed has been increasing the amount of money in circulation ever since the 2008 financial crisis. Since January 2009, the Fed has increased the amount of money in circulation from $8.2 trillion to over $21 trillion currently. Yet we had never sustained inflation until 2021. Why now?

The metric to look is known as ‘velocity of money’. That is how quickly money circulates once it enters the economy. The velocity of money circulating fell like a stone for the past two decades- investors or companies received money, and either sat on it or used it to pay down debt.

Yet, if you look at little more closely, you can see that velocity has started to slowly rise. This says that people are no longer on sitting new money, but instead going out and spending it. They are either too cash-strapped to save, or are stocking up on essentials when they get money. Now we are seeing shortages and steady rising prices for things like consumer goods and food. This variable has flipped for the first time since the 1970’s and suggests that any money growth in future will go 1:1 into spending. An inflationary mindset produces more rapid spending produces more inflation until the link is broken.

Real Interest Rates

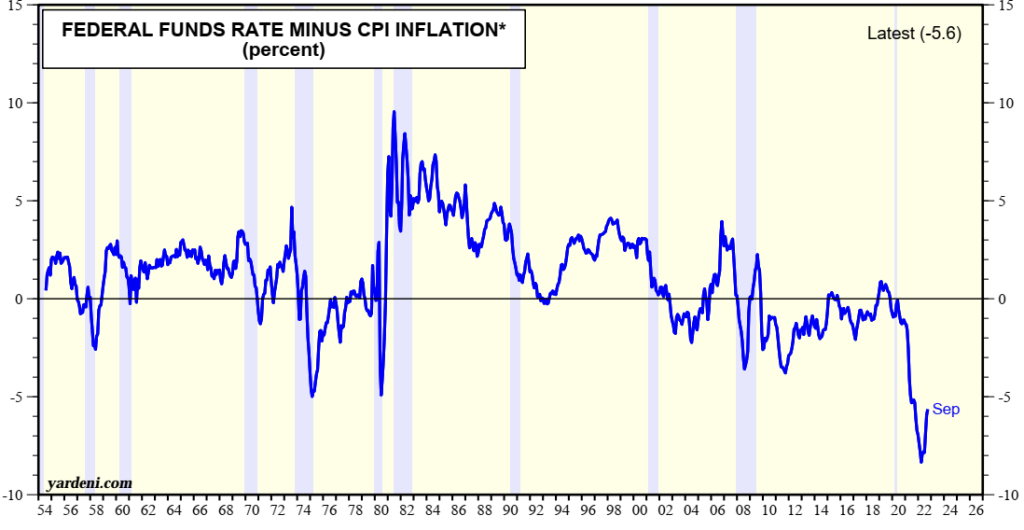

A big driver of spending is what are known as real interest rates. That is, the rate of interest you can get on money minus the rate of inflation. If you have debt far below the rate of rising prices, you are incentivized to borrow and spend money quickly. With positive real rates your savings yield twice the rate of inflation. You are inclined let the money grow and spend it later.

The combination of 2021’s low rates and high inflation produced the most negative real interest rates ever in the USA. It has since reverted, from -8% to roughly -5% now.

Federal Funds Interest Rate – Minus Inflation Rate

The situation has gone from hugely unbalanced to moderately unbalanced. Negative real interest rates stimulate inflation for a simple reason. The cost of money is cheaper than then return on real things. So why not borrow money cheaply and buy up a host of appreciating goods? Wait a bit, sell them that at a gain, and make a substantial profit with the bank’s money. As long as very negative rates exist, inflation won’t be contained. Only a period of sustained positive real rates will crack the inflation cycle- that’s what happened in the early 1980’s.

Consistently Strong Wages

Labor is the biggest input in most businesses. Employers have to pay a market wage to get laborers in the first place. In high inflation environments, they have to adjust them periodically higher to keep workers. Without a raise, their current employees will go somewhere else or drop out and work informally.

Apart from a spike and drop around stimulus payments, wages have been rising at about 5% the past three years. That’s below the rate of inflation, yes, but given the tremendous shortage of workers, this should persist for quite a while no matter what ‘headline’ inflation is doing.

Employers have to put up their prices to pass along those higher wages. That keeps the inflationary momentum going. Higher wages produce higher prices produce in turn higher wages down the road- the famous wage price spiral. Only a recession with sharply rising unemployment and layoffs would keep see these numbers down. We are simply not seeing that yet, when the unemployment rate is 3.5%.

The governments sponsored a host of generous stimulus and unemployment programs that left many people concluding it’s better to sit at home rather than work a job whose wage does not match inflation and commuting costs. Or, instead of being stuck at a fixed low wage, they are working jobs whose rates adjust quickly to inflation (Uber drivers).

The Oil Market Has Put Biden In a Corner

All of those factors we have cited are going to keep pressure on headline prices: higher velocity, negative real rates, and continually rising wages. But what’s going to send inflation shooting higher 18 months from now is the Biden administration’s myopic and idiotic treatment of the oil market.

Oil is the number one commodity by far. Oil eventually goes into almost every single price. Most people think oil matters because of the link to gasoline prices. While that is the biggest use of oil in the country, it’s not even 50% of the total. Much of the remaining oil goes into transportation for trucks, rails, ships, and airplanes. About a third of oil is used in industrial products and consumer products. Oil goes into everything: household cleaners, toothpaste, plastics, vinyl siding, you name it. The impact is understated in domestic energy data because so many of these consumer products are made overseas with foreign oil or chemicals and then imported. (https://www.eia.gov/energyexplained/oil-and-petroleum-products/use-of-oil.php)

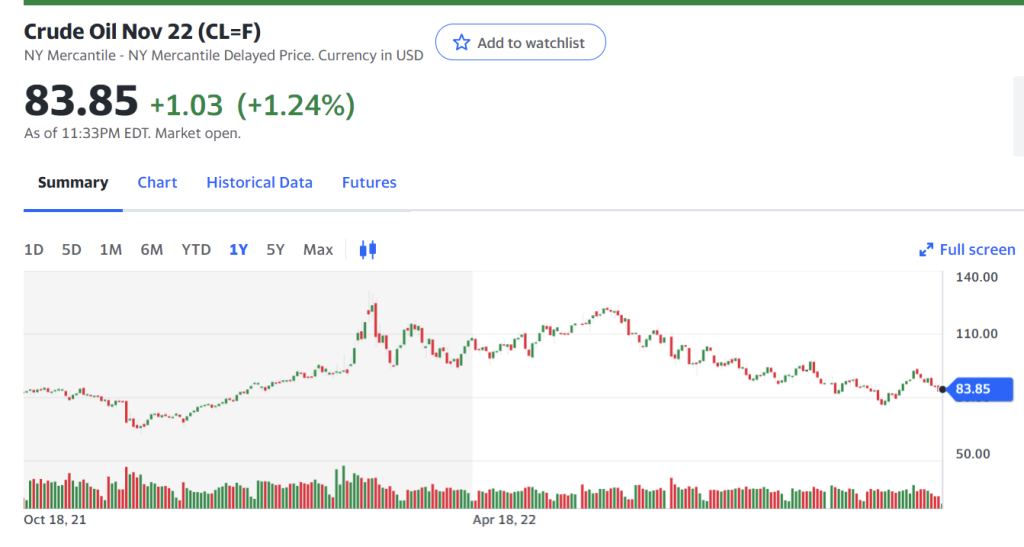

The oil price has declined for most of the year luckily, part of why we expect an easing in inflation for next year. It spiked to $120+ per barrel on the Ukraine war worries and has since come down to the $70-80 range.

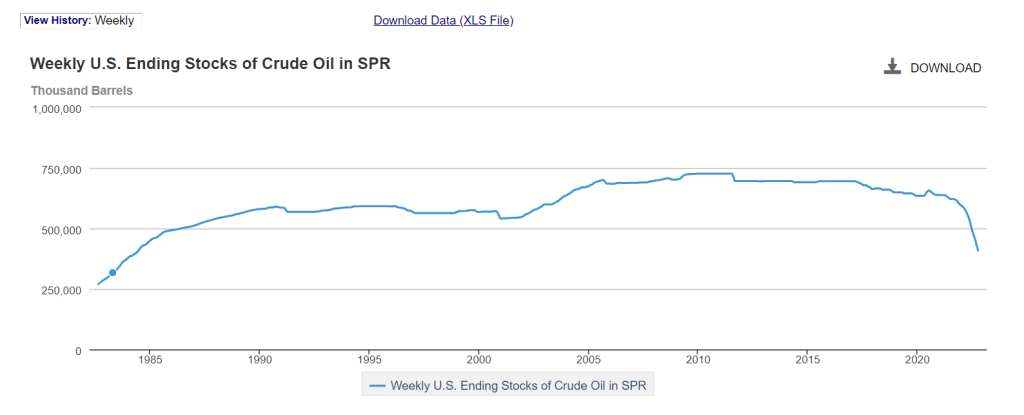

This was mostly driven by a cynical political decision though. The Biden administration saw the very high price of gasoline in the first half of the year and decided to sell down America’s Strategic Petroleum Reserve (SPR) to combat it. The SPR is the government’s emergency reserves, designed to be held and used in the case of emergencies. If there was another oil embargo, the idea goes, the US would not face a sudden stop of oil.

The administration has sold almost 200m barrels of oil since the start of the year, about 3% of the total used this year. That’s a huge number, because oil supply and demand typically move slowly, so a 3% move shifts prices dramatically. They should sell another 50m barrels by year end, and then likely stop post-election. That would leave inventories near their lowest level since the late 1980’s.

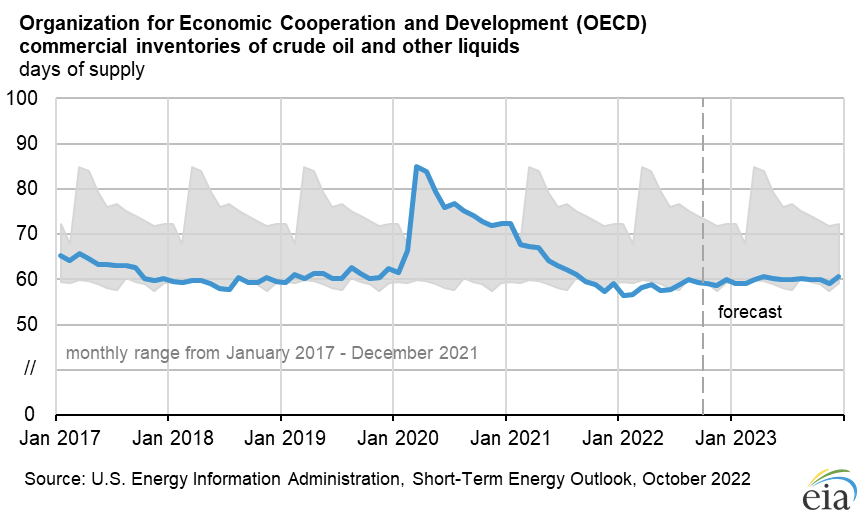

This produced a fall in gas prices and bought some political points. But all it has done set up a disastrous dynamic for next year. All of that oil was used up. Overall inventories across the developed world have reached the lowest levels in many years.

Oil Market, Days of Supply

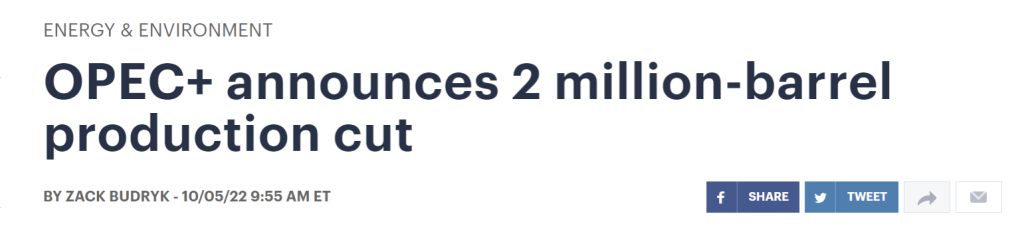

Oil is a global market and supplies can shift around swiftly to places facing the most acute pressure. But if inventories are low globally, then there’s simply not enough oil to go around. Despite these low inventories, there is no new production coming to balance it out. Big producers are cutting output. The US refuses to issue new drilling permits in an effort to push renewables. Russia and OPEC have formed an alliance called OPEC+ to influence the oil market. Together they control about half of global production. Saudi and Russia combined announced a 2m barrel per day cut in production, about 2% of global supply. With demand growing in most foreign countries, inventories will only become tighter and tighter.

In an explicit up yours to Biden, this was announced one month before midterms. Biden pleaded with them to wait until November and they refused. Clearly control over the oil market is shifting away from the US’s desires.

Shortages Coming

With no inventories, a stop in SPR selling, and production cuts, it’s not hard to see what is coming. At some point the inventories will get so low it will start to cause shortages and then price spikes. We have already seen this in countries with financial issues like Sri Lanka. Recently, France and the Netherlands ran into huge problems. The price of diesel skyrocketed. They were paying approximately 25% higher than the ‘market price’ to get supplies. Supply had to be rationed across France.

At one point this week, traders were paying premiums of as much as $160 a ton -- more than $20 a barrel -- to obtain a physical barge-load of the road fuel in Europe. That’s a sign of tight inventories. It compares with $24 a ton a month earlier.

https://www.rigzone.com/news/wire/diesel_hits_chaos_mode-17-oct-2022-170726-article/

We should start seeing similar stories develop in the US as the rolling shortages begin to come here. Diesel inventories are very low nationally and especially in the Northeast.

Some states in the Northeast are already rationing heating oil before winter begins.

Anyone who has tried to buy tickets to a hot concert or sporting event knows what will happen. When tickets are sold out, they don’t just go up by a few dollars on the after-market. They go up A LOT. They spiral much, much higher as people chase the limited supply. When you hit a chokepoint, it does not produce a slow moderate rise in prices. It produces a spike or a parabolic move. Diesel and heating oil will keep business energy costs high the next few months and prevent inflation from easing to levels the Fed wants. And once the oil price starts to move over $100/barrel, probably by next summer’s driving season, expect inflation to come roaring back.

Preparations

We suggest stocking up on energy products sooner rather than later. You may not like the prices now, but at least you won’t face rationing. As we have said before, don’t up and move to the woods of Montana or anything crazy. But just be much more cautious about day-to-day purchases to ensure a large stock of supplies. Businesses that are large consumers of oil products should be extra prudent in the coming months.

Investors will face tricky up and down cycle in the stock market. Stock investors will cheer an eventual fall in inflation. But that will be balanced out by a slowing economy and rising political tensions in Europe and Asia. Companies with pricing power will continue to do the best, and interest rate sensitive or cash burning businesses will do the worst.

We have repeatedly warned of the disaster that is investing in bonds in a high inflation environment, and hope that some readers heeded our warnings. Not only do your interest payments not keep up with inflation, but you face a substantial loss of principal too. The best broad measure of the bond market, The Barclays Aggregate, is down over 16% for the year. Longer term bonds in the US and other developed markets have fallen by a third or more. The UK pension system narrowly averted a crisis last month caused by falling bond prices.

The coming inflation pause should be the eye in the storm. Continue to allocate out of regular bonds and into things that pay income in line with inflation- dividend paying stocks or inflation linked bonds. Because after this pause, the risks would only grow larger for bonds. Oil could hit $150 or $200 a barrel in a shortage environment. Inflation could hit 10% as a result while business reprice everything. That level of inflation would produce another large loss in fixed income investments.

Subscribe to our evening newsletter to stay informed during these challenging times!!